Loading...

Renters insurance

Renters insurance coverage

What does renters insurance cover?

Renters insurance is an insurance policy that can cover theft, water backup damage, certain natural disasters, bodily injuries and more in a rented property. If you rent an apartment, home or even a dorm, renters insurance is recommended for protecting your space and belongings in the event of a covered accident. Get a free renters insurance quote in minutes.

Can you afford not to have it?

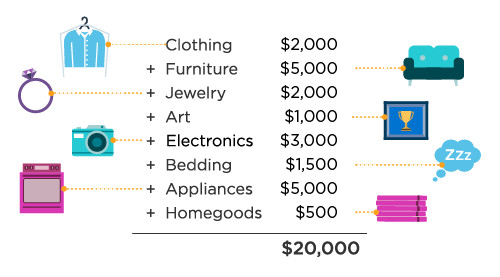

No matter how modest your lifestyle, replacing all your belongings can add up.

Replacing the basics could look something like this:

This is a hypothetical illustration. Actual coverage amounts and limits vary based on individual needs and policy.

Renters insurance coverage can help you replace these items and more.

Basic renters insurance coverages

Contents

Helps protect your furniture, clothing & other items from covered losses.

Loss of use

Provides reimbursement for additional living expenses when a covered loss prevents you from living in your home.

Personal liability

Get help paying for covered damage or bodily injury caused by an accident that occurs in your home.

Medical payments to others

May help pay for medical or funeral expenses for someone who is injured on your property.

Building additions & alterations

Pays for covered damages to additions, alterations, fixtures, improvements or installations that you make to your home.

Credit card coverage

Pays up to your selected limit for unauthorized transactions on your credit cards and bank debit/ATM card. Also applies to forged checks and counterfeit money.

Brand New Belongings®

When the things inside your home are damaged or stolen, we’ll help you pay to have them fixed or replaced.

First, you’ll get money for the depreciated value of your covered items. Then, after you buy replacement items or have them repaired, send us the receipt and we’ll pay you the difference.1

Optional renters insurance coverages

Valuables Plus®

Provides additional coverage for high-value items such as jewelry, watches, antiques and fine art.

Water backup

Protects you against loss caused by backed up sewers or drains.

Theft extension

Provides extended protection for your personal belongings stored in or on any motor vehicle, trailer or watercraft.

Earthquake

Pays up to your selected limits for covered losses to your property caused by earthquakes or volcanoes.

Insurance terms, definitions and explanations are intended for informational purposes only and do not in any way replace or modify the definitions and information contained in individual insurance contracts, policies or declaration pages, which control coverage determinations. Such terms may vary by state, and exclusions may apply.

1Brand New Belongings is an optional feature. Exclusions and limits apply. Damaged items may be repaired in some cases. Details vary by state and policy language. Please consult your policy for the specifics of your selected coverages. Subject to underwriting guidelines, review, and approval.