The downside of faster-than-expected economic activity has been a renewed acceleration in inflation. The Consumer Price Index posted substantial gains in Q1, particularly for services and housing. Inflation trends were more encouraging in Q2, with price increases for goods turning deflationary, but the overall rate remains above the Fed’s 2.0% target. Still, inflation remains the most significant drag on the economy and the focus of both the Federal Reserve and consumers. However, we are cautiously optimistic that the encouraging trends will continue, and prices should come down in the second half of the year, eventually creating room for a reprieve on interest rates.

Interest rates: Anticipating the shift to rate cuts

The stronger-than-expected start to 2024 pushed out the timing of Federal Reserve interest rate cuts. At the beginning of the year, most estimates showed 5-6 rate cuts in 2024, but as we know, the Fed has stood pat so far this year. At this midpoint, consensus expectations project the Fed to cut rates only once or twice by year-end. As of this writing, inflation will likely cool enough in the coming months to allow for a quarter-point cut in September and another in December.

This interest-rate cycle is much different than previous cycles when the Fed acted slowly to hike rates and then quickly to cut rates. The central bank has taken the opposite tack this time; rates were swiftly hiked—at the fastest pace of tightening since the early 1980s—and we expect cuts to happen slowly. The risks are pointed to a later start to the easing cycle, which could even be delayed into 2025. We expect monetary policy to remain restrictive into next year and for the Fed to be more cautious than usual when gradually lowering the federal funds rate to ensure that inflation returns to trend.

Global interest rates have likely reached their zenith in this economic cycle and are expected to gradually decline as various central banks shift towards implementing rate cuts this year. While there is no immediate urgency for the Federal Reserve to cut rates, the Federal Reserve won’t be far behind in initiating policy normalization. As a result, both short—and long-term bond yields are likely to see a gradual decrease over the next 12 months. We believe investors should understand that rate cuts will not result in the low interest rates of the past 15 years when the Federal Reserve implemented unprecedented monetary policy easing. Instead, we think the rate-cutting cycle will be slow and methodic, as Fed Chair Powell noted at the June FOMC meeting, stating that the risks are now two-sided when considering an adjustment to the target fed funds rate. From our perspective, as the Fed begins to cut rates, investors sitting in cash will face reinvestment risk. If short-term yields fall when the Fed starts to lower rates, then the 5% yields enjoyed by investors over the past year will not be available when it’s time to reinvest. Therefore, reinvestment risk at lower rates in the future is a risk that investors must consider in their short and long-term planning.

Stocks: Earnings growth powers gains

After last year’s 26% rise in the S&P 500® Index, many market analysts anticipated 2024 would be a weak year for stocks with heightened volatility. Neither of those projections came to fruition, at least through the year’s first half. The S&P 500 delivered an impressive return of 15.3%, making it one of the top three first-half returns of the last 25 years. Further, there hasn’t been a move of more than 2% for the S&P 500 in 18 months, the longest such streak since the pandemic, and sentiment indicators show that many stock investors feel bullish but not to extreme levels. All these factors have created a constructive backdrop for stock market gains.

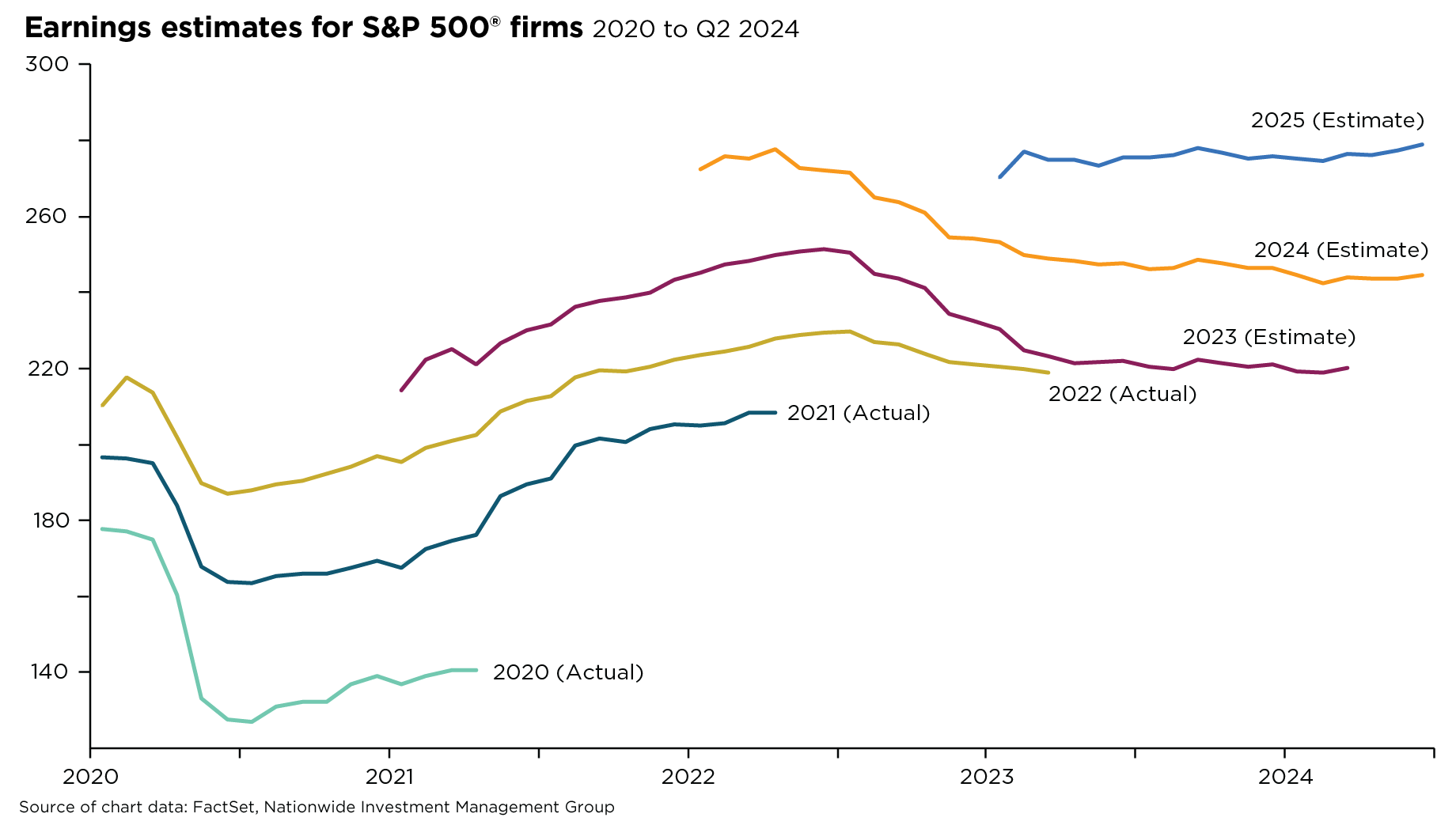

We view any period of equity market weakness as an excellent opportunity for investors to add risk, given our favorable outlook for earnings into 2025. Two favorable trends support this outlook. First, S&P 500 net margins improved across eight of the Index’s 11 sectors in the first quarter of 2024 compared to the first quarter of 2023, a positive indicator of the bull market’s potential longevity. Moreover, first-quarter earnings have laid the foundation for what we believe will likely be respectable growth in every subsequent quarter for 2024, with all 11 S&P 500 sectors on pace to deliver earnings growth year-over-year by the end of 2024. Second, aggregate S&P 500 EPS estimates have remained unchanged year-to-date (see chart below), which is typically unusual. Generally, as of June of the previous year, consensus estimates normally decreased by an average of 7%.