Key takeaways:

- We see a generally favorable picture for the economy and markets in the year ahead, despite risks from persistent inflation and elevated stock valuations.

- The Federal Reserve should continue its easing cycle in 2025, but the pace of rate cuts will likely be slower than previously expected.

- Earnings will receive closer scrutiny in the coming quarters to determine if profits grow at a pace that justifies current valuations.

12/18/2024 — Both the U.S. economy and financial markets impressed investors with their resilience in 2024, despite uncertainty over Federal Reserve rate cuts and the outcome of the presidential election throughout the year. The eventual resolution of these uncertainties—first with the Fed effectively moving toward monetary policy easing in September, then with Donald Trump’s electoral victory in November—helped the year end on a relatively high note. The economy avoided recession in 2024 and stayed on its expansionary track, while the stock market recorded its second-consecutive year of greater than 20% gains for the S&P 500® Index—a rare feat that’s happened only five other times since 1950.

As we enter 2025, your clients are likely wondering if this momentum can continue. While there will be risks in the year ahead, we see a generally favorable picture for the economy and markets. From an economic standpoint, we think the U.S. economy should remain in growth mode, even though the early months may be weaker due to the lingering impacts of high inflation, elevated interest rates, and slower employment gains. The Federal Reserve’s easing cycle should continue in 2025. Still, the pace of rate cuts should be slower than expected, given the continued momentum for economic and inflation readings in the early months of the year.

For the financial markets, the climate is ideal for the bull market for stocks to continue; in addition to accommodative Fed policy, corporate earnings are healthy, and the incoming administration and Congress are likely to promote business-friendly initiatives, including lower corporate taxes and deregulation. However, the stock market’s recent run has also inflated valuations to lofty levels, near to those seen during the height of the tech stock bubble of the early 2000s and the peak of the COVID-19 pandemic in 2020. Earnings reports will be scrutinized in the coming quarters to see if companies can grow profits at a pace that justifies these current valuations.

Key factors for future stock performance

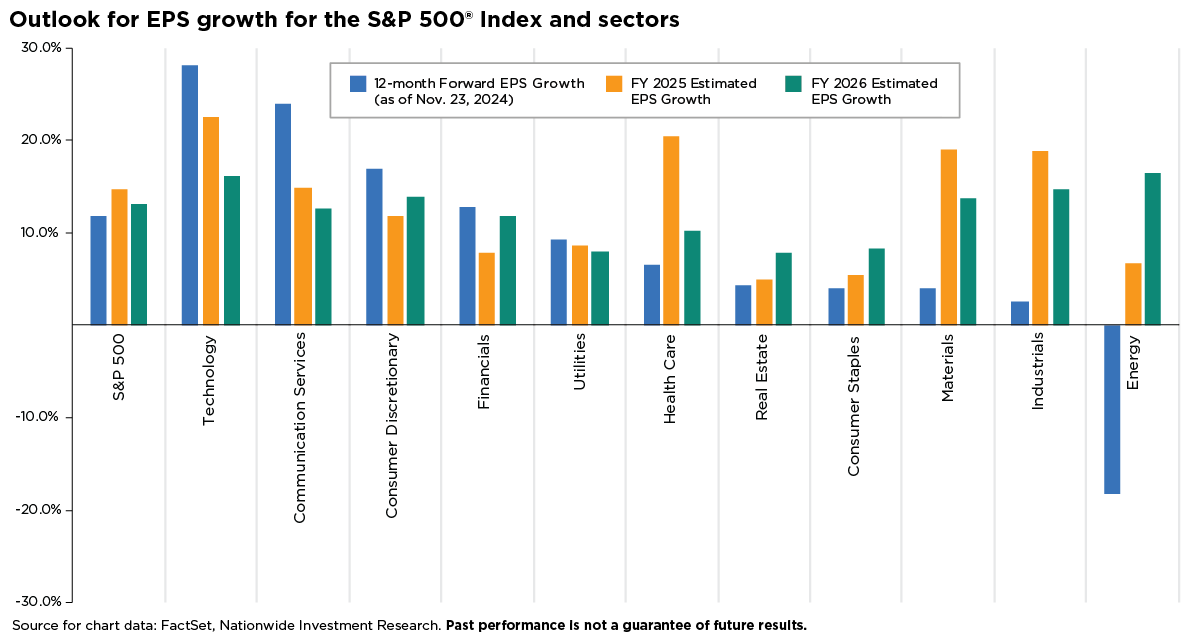

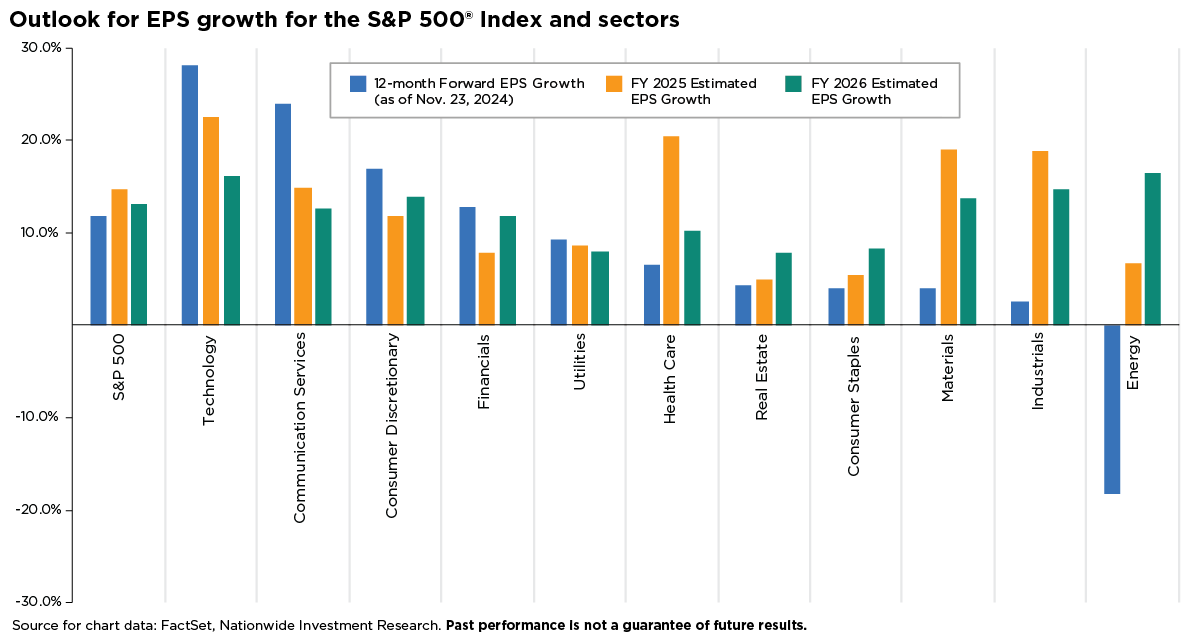

While uncertainty is ever present in the financial markets, clients can manage the risk of uncertainty by following a diversified approach in their portfolios, grounded in the belief that earnings growth will play a pivotal role in supporting the market through 2025. Earnings growth has been a key pillar in support of the current bull market, and the market is anticipating record corporate profit margins and approximately 15% earnings growth for the S&P 500 for 2025. Balanced against this forecast, however, are several factors that investors should monitor in the coming year.

Future earnings growth — Corporate earnings and guidance will likely be paramount in 2025 as the economy moderates toward average levels of GDP growth, as disinflation or economic policy uncertainty might temper lofty earnings projections. Future earnings growth will likely hinge on resilient economic data, revenue growth, and the results of the 493 S&P 500 companies of the S&P 500 outside of the “Magnificent 7”. Similar to 2022, profit margins are poised to be a critical factor next year as investors weigh the benefits of productivity growth against the declining pricing power of corporations.

Valuations — Much of the positive sentiment around stocks, including accommodative monetary policy, moderating inflation, positive earnings revisions, and the prospects of a “soft landing,” has likely been factored into current market valuations. The S&P 500’s current price-to-earnings multiple of around 22-times forward earnings is approaching rare territory, having surged by approximately 44% since the market low of October 2022. This multiple expansion has accounted for over two-thirds of the S&P 500’s impressive total price return of 72% throughout the bear market.

While valuations have been a tailwind for investors, future stock returns will likely need support from earnings growth in the coming year. Any earnings shocks or weak corporate guidance could pose headwinds for investors in 2025.

Market breadth — Over the past year, earnings breadth has gradually improved, and leadership has rotated from mega-cap technology stocks to more pro-cyclical market sectors. Given the economic and policy uncertainties looming on the horizon, stock investors will likely see fluctuations in sector and style leadership in 2025.

While rotation generally supports index-level performance, unresolved questions around the health of the labor market, the trajectory of economic growth, and policy changes from the incoming Trump administration may impact overall performance. Investors should watch the ongoing performance of the “average stock,” as represented by the S&P 500® Equal Weight Index. Out of the previous 11 bull markets, the current bull market is the only instance where the equal-weight index has failed to outperform the market-cap-weighted index.

Economic data will determine rate direction

It’s reasonable to assume that interest rate volatility will carry over into 2025 as the Federal Reserve remains dependent on future economic data. Nationwide Economics expects the economy to downshift moderately in 2025 as consumers cut back spending in the face of building household financial pressures. However, the expansion should continue, with GDP growth only slightly below the 2% trend in the year’s first half. The Fed’s continued easing of interest rates should boost activity in the second half of 2025, which should support hiring and consumer spending and set the stage for faster growth in 2026.

Hiring within cyclically sensitive industries like manufacturing, retail, and restaurants should weaken in 2025, dragging down overall job gains despite solid hiring for education and healthcare services. We expect the unemployment rate to drift higher in 2025, but it should top out at around 4.5%— still low by historical standards. Lower interest rates later in 2025 should cause more businesses to expand operations, driving an expected boost in labor demand and hiring activity into 2026.

After several years of rapidly rising prices, consumer inflation is expected to settle slower, around 2.5% in 2025, a welcomed reprieve. Housing and services costs may continue to rise faster than usual, keeping inflation figures from reaching the Fed’s desired goal of 2.0%, but the broader trend for inflation should be more stable in the future.

Following several rate declines in late 2024, the Fed’s easing cycle should continue in 2025. Still, the pace of rate cuts should be slower, given the continued momentum for economic and inflation readings into early 2025. Even with more cautious Fed easing, the yield curve (the spread between short- and long-term rates) should fully normalize in the first half of 2025. Long-term interest rates should edge lower over the coming year, but lingering inflation and rising concerns about the fiscal deficit and debt may maintain yields at current levels.

These factors will create a complex landscape for investors to consider when evaluating fixed-income opportunities next year. Assuming no unexpected shocks or significant economic and labor market declines, a baseline assumption of moderating growth and easing inflation suggests that investors holding excess cash should consider allocating further along the yield curve. Economic and market fundamentals should provide a supportive backdrop for investors—one likely to offer attractive yields, tight credit spreads, and a yield curve that continues normalizing.

Volatile markets call for long-term focus

As we transition into a new year, it’s a good time to reinforce to clients the importance of maintaining a long-term perspective and avoiding short-term thinking and emotional decision-making. Following the strong performance of stocks over the last two years, some clients may find their portfolios are exposed to more risk than they are comfortable with. They may not realize this until the inevitable selloff, correction or bear market occurs.

At the start of year, take this opportunity to reassess goals and risk tolerance with your clients, making adjustments to portfolio allocations where appropriate. Also, help keep your clients on track to their long-term goals with a disciplined strategy to manage market volatility and build lasting wealth.