Key takeaways:

- The power of compounding is a force multiplier that emphasizes the importance of focusing on what investors can control: saving more and staying invested for the long term.

- By staying invested and tapping the power of compounding, investors can navigate market volatility without emotion and alleviate concerns about achieving retirement goals.

07/16/2025 – Many investors build their investment strategies for retirement around models that are assumed to be predictable and logically coherent. Yet, the financial markets often challenge these assumptions, much like we saw in the first half of 2025 when extreme volatility reminded investors that reality is far more intricate and unpredictable than any investment model can assume.

Volatility isn’t just noise; it can lead investors to make emotional investment decisions that may hobble their progress toward their retirement goals. For instance, the average retail investor underperforms the market by nearly 1.7% annually because of poor market timing decisions, often driven by fear.1 In a sense, fear becomes a tax on future returns.

Today, market volatility combined with economic uncertainty creates a stressful climate that for many investors makes them feel like their retirement goals are further from reach. This is especially true for those who are closest to retirement; pre-retirees (age 55-65) are largely resetting their retirement expectations to be more flexible in response to economic and market stress. For example, a recent The Nationwide Retirement Institute® survey of pre-retirees found that over half (52%) don’t believe in the concept of a “magic number” for their retirement savings.

Yet, amid this uncertainty, one principle remains constant: the power of compounding. Often revered as the “8th Wonder of the World”, compounding smooths out the variability of short-term investment returns so that over the long term investors’ savings can grow. By staying invested and allowing the power of compounding to work, investors can navigate market fluctuations without emotion and alleviate concerns about achieving retirement goals.

The power of compounding is a quiet, consistent and impartial force multiplier that emphasizes the importance of focusing on what investors can control. Instead of relying on various frameworks or advanced models, investors can concentrate on the fundamentals: saving more, reacting less and building a plan based on controllable factors.

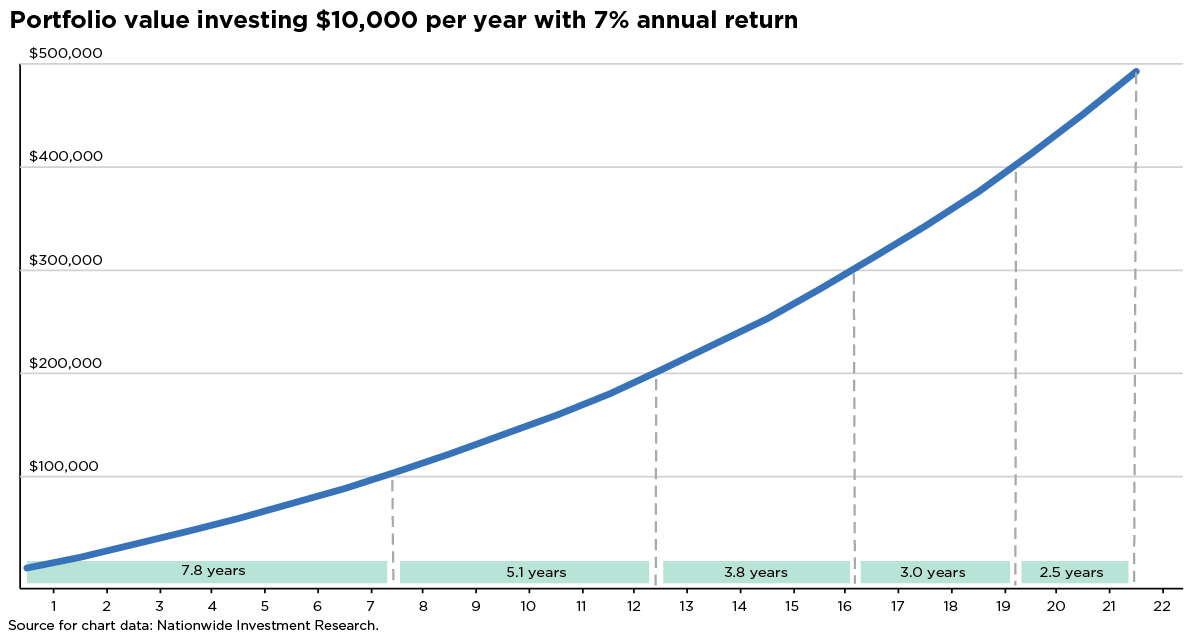

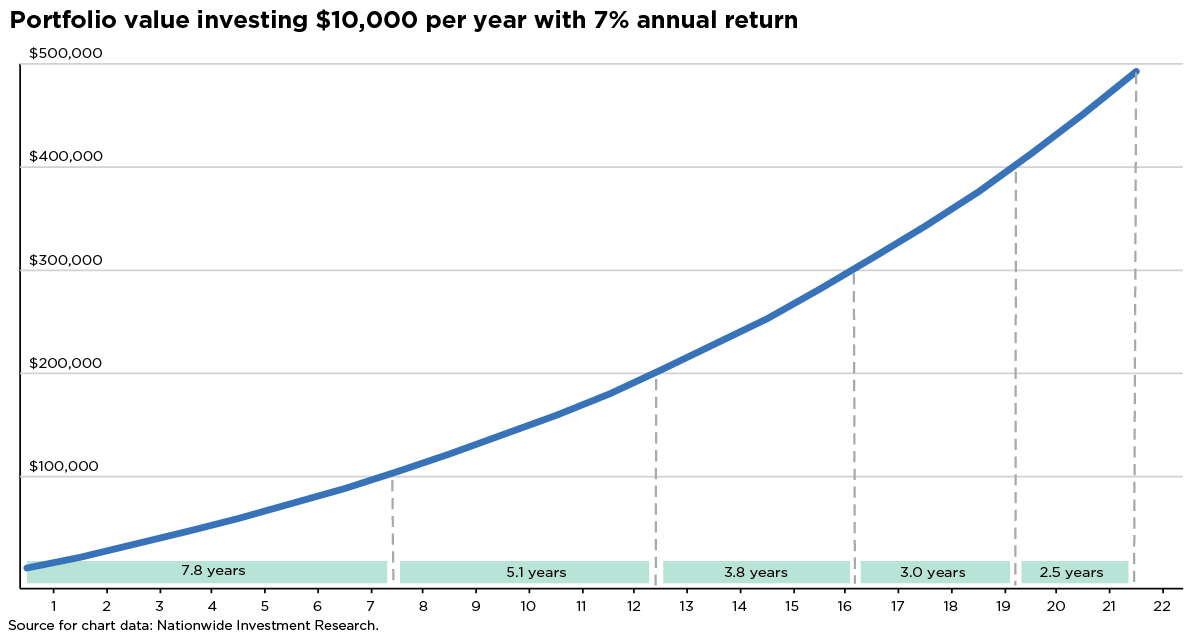

Consider a hypothetical investor who saves $10,000 annually. At a 7% annual growth rate (which is actually lower than the historical annual growth rate of the S&P 500® Index,) this portfolio will grow to $100,000 in around 8 years. (7 years and 10 months, to be exact.) If they continue to invest at the same rate and achieve their same growth rate, they accumulate the next $100,000 in just 5.1 years.

As time progresses, each additional $100,000 will be saved in increasingly shorter periods—a profoundly important insight that is often overlooked by the allure of market timing. As the accompanying chart illustrates, the third $100,000 is accumulated in 3.8 years, the fourth $100,000 in 3.0 years, and the fifth $100,000 in just 2½ years.

This insight highlights how the power of compounding accelerates wealth accumulation over time, by transforming a disciplined savings plan into a meaningful outcome. It also underscores why investors should avoid emotional decisions that could disrupt the powerful effect of compounding. Despite the challenging market and economic climate, the power of compounding remains a steadfast principle that can guide investors toward their financial goals and secure a stable retirement.