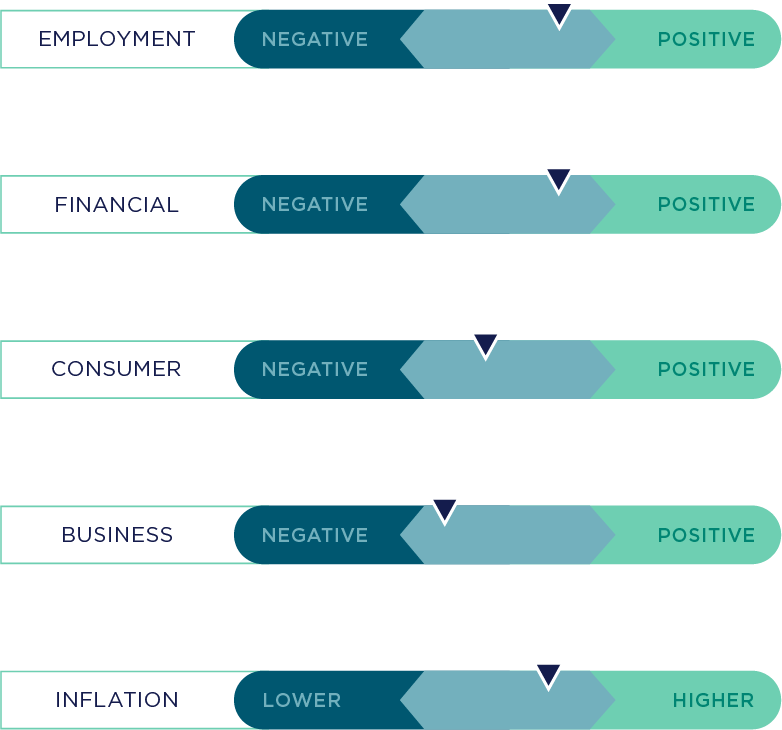

Economic review: Key indicators driving the economy

Employment: Recent job reports show the labor market is still vigorous. Growth was not particularly broad, and the unemployment rate ticked up to 4.0%, but wage growth was strong enough to support a solid level of consumer activity.

Financial: The S&P 500® Index rallied to a record high in mid-June and was up nearly 15% in the year’s first half. The yield curve is still solidly inverted and continues to signal a higher-than-normal recession risk.

Consumer: Retail sales growth was tepid in May, but solid growth at the core level suggests consumers remain willing to spend as long as income gains remain buoyant. Sentiment has also fallen to its lowest level since November.

Business: The ISM manufacturing index fell in May and signaled mild contraction, while the services index rebounded and climbed back into expansion territory. Price growth continues to be a concern in both sectors.

Inflation: The 3-month annualized rate for overall CPI inflation dropped to 2.8%, reversing the surge in Q1 and putting the inflation trend on the right track again. Price growth for rents was a surprise, climbing 0.4%.

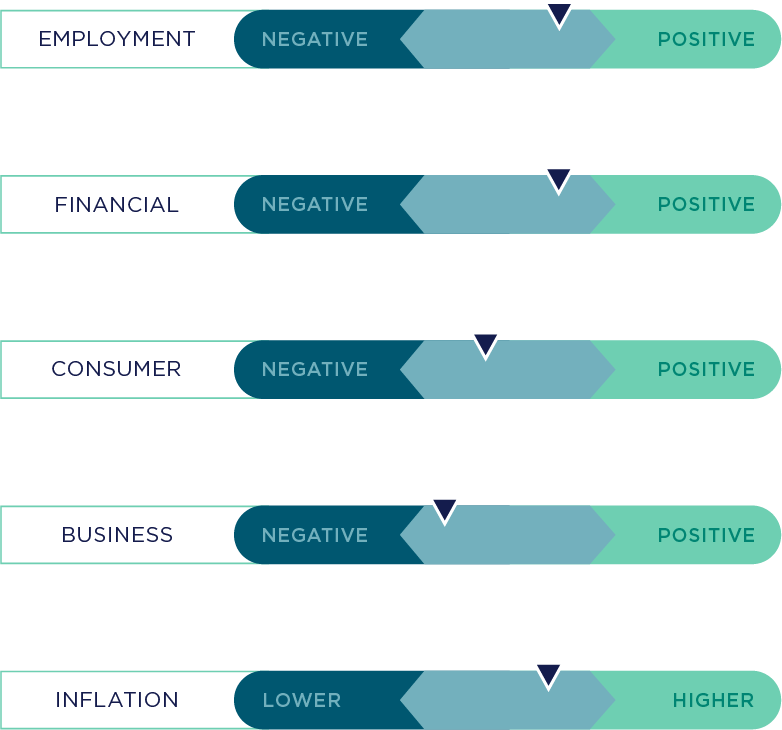

Financial review: Key indicators impacting the markets

Earnings: The percentage of S&P 500 companies with positive three-month percentage changes in forward earnings currently stands around 83%, supporting the equity market’s fundamental backdrop.

Valuations: The S&P 500’s forward price-to-earnings ratio (P/E) is currently at 20.8, above its 10-year average of 17.9x. The MSCI EAFE® Index is potentially more attractively valued at 13.8x forward earnings, slightly below its 10-year average of 14.6x.

Fiscal/Monetary: The labor market continues to cool, and recent inflation reports support a disinflationary trend. While the Fed held rates steady at its last meeting, a cut in September is plausible.

Credit: Although most credit spread measurements remain benign, high-yield credit spreads should be monitored if growth forecasts continue to be revised downward.

Technicals: Market breadth has improved, and sentiment remains bullish but not ebullient. Given the strong stock rally in the first half of 2024, market volatility should not surprise investors.

Cycle Watch offers valuable insights to enhance client conversations on market shifts and economic trends. By staying informed on critical indicators and providing context for investment decisions, financial professionals can offer guidance through volatile markets.