Key takeaways:

- International stocks have surged on multiple expansion, while S&P 500® Index gains remain grounded in earnings growth.

- Several tailwinds not only justify the U.S. equity rally—they also strengthen the bull market as it nears its third anniversary in October.

09/25/2025 – Global equity markets are undergoing a meaningful recalibration as investors weigh uncertainties around trade policy, the growing U.S. fiscal deficit, and questions about the long-term strength of the U.S. dollar’s reserve-currency status.

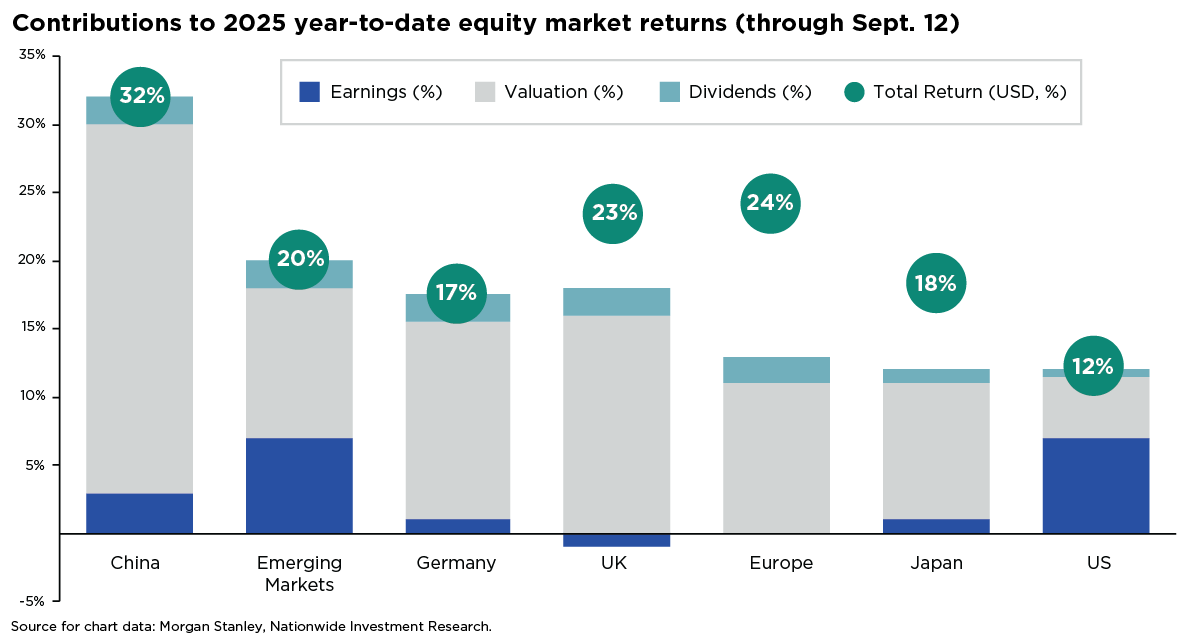

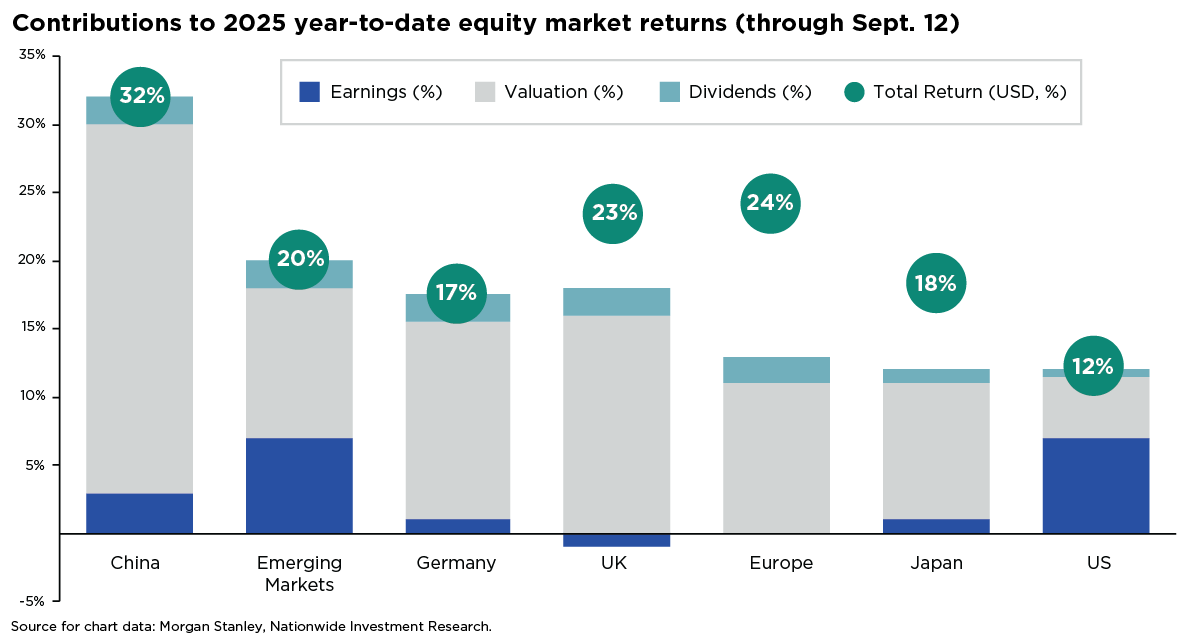

These dynamics have fueled a rotation into non-U.S. equities, with international stocks significantly outpacing their U.S. counterparts. As of September 12, the MSCI Emerging Markets® Index is up 20% year-to-date, compared to a 12% gain for the S&P 500® Index.

While returns outside the U.S. have been solid—and we continue to see merit in global diversification—financial professionals should stay focused on what’s driving those results. When discussing client portfolios, it’s especially important to distinguish between earnings growth and valuation expansion.

So why are global equity markets gaining? A closer look at the drivers of stock returns reveals that much of this year’s international outperformance has been fueled by multiple expansion—an increase in valuation driven more by sentiment or macro factors than by earnings growth.

In contrast, the S&P 500’s gains have been grounded in strong fundamentals—particularly earnings growth (see accompanying chart). Despite economic and political uncertainty, many companies have shown notable resilience, surprising some investors along the way.

We see several tailwinds that not only justify the U.S. equity rally off the April 8 low, but also reinforce the structural strength of the bull market as it nears its third anniversary in October. These forces could help U.S. equities not just catch up to international markets—but potentially take the lead heading into 2026.

First, positive corporate guidance and upward revisions to earnings estimates continue to support the S&P 500’s climb. Second, companies have held firm on margins despite tariff pressures—thanks in part to ongoing efficiency gains driven by AI. Looking ahead to 2026, consensus expectations point to broader sales growth and margin expansion, with margins projected to rise over 12%.

Third, the three-month earnings estimate revisions ratio shows that nearly every S&P 500 sector has seen more upward than downward revisions to earnings growth. That momentum could serve as a meaningful tailwind heading into the third-quarter earnings season.

Fourth, after a third straight quarter of double-digit earnings growth in Q2—paired with stronger-than-expected revenue and earnings beats—momentum continues to build heading into Q3. Analysts have raised earnings estimates for the quarter by 0.6%, a notable shift given that estimates are typically revised lower during the back half of the year.

All told, strong earnings momentum is likely to continue for U.S. equities, supported by resilient corporate profitability and the potential for easing financial conditions—both of which help justify the rally off the April low. While some volatility is to be expected, any short-term weakness may present buying opportunities for client portfolios.