Key Takeaways:

- The November-to-April period has historically been the most favorable six-month stretch for the stock market.

- The seasonal tailwinds that typically arrive during these months may provide a much-needed boost to investor sentiment.

- We expect the equity bull market to remain robust, underpinned by solid fundamentals and a resilient economy.

11/14/2024 – Investors faced significant uncertainty, emotion, and varying economic data in the weeks leading up to the presidential election. Different barometers of market volatility reflected this anxiety. For example, the CBOE put/call ratio surged to its highest level since the October 2023 correction, indicating significant demand for protective strategies. The CBOE Volatility Index (VIX), often referred to as the “fear gauge,” also rose sharply, signaling increased market anxiety.

Volatility wasn’t confined to the stock market. The MOVE Index, which measures volatility in the U.S. bond market, reached its highest point in a year, approximately 23% above its historical average.

This elevated volatility is expected to subside now that the election dust has settled, and there is potential for positive market performance as the year-end approaches. We are also entering the historically favorable November-to-April period, widely recognized as the best six-month stretch for equities. The seasonal tailwinds that typically arrive during these months may provide a much-needed boost to investor sentiment after several months of uncertainty and anxiety.

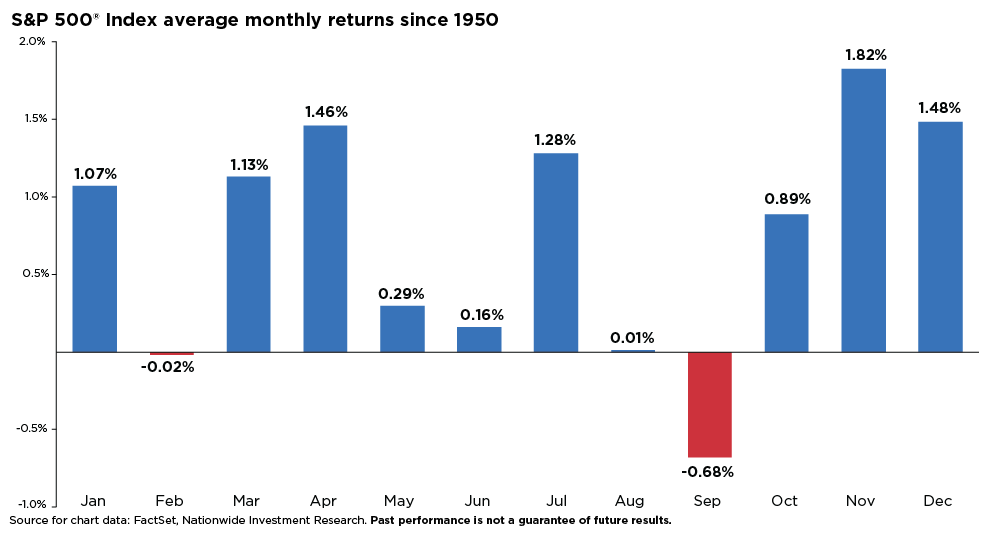

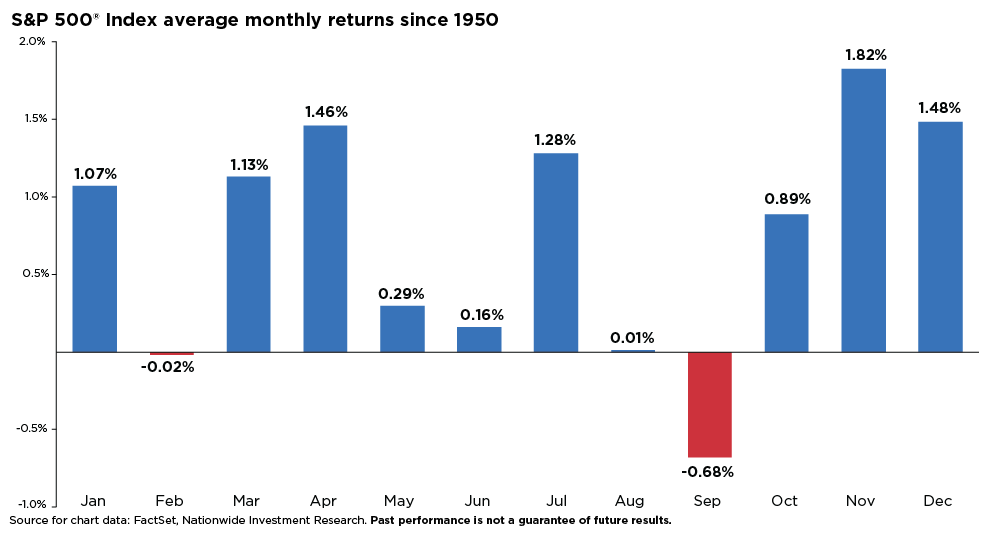

As the accompanying chart demonstrates, November and December have historically been the two most favorable months for stocks. Since 1950, the combined returns for the S&P 500® Index in these months have averaged around 3%. This trend is even more pronounced during presidential election years, with an average two-month gain of 5%. In presidential election years when the S&P 500 has already risen by at least 5% through August (as it has in 2024), the average gain for November and December has been an impressive 7%.

The interplay between heightened risk and favorable seasonal trends presents a unique opportunity for long-term investors. Any pockets of weakness in the coming weeks could offer a favorable entry point to increase risk exposure through stocks. We expect the bull market for equities to remain robust, supported by solid fundamentals and a surprisingly resilient economy.