03/21/2024 — With the Federal Reserve (Fed) signaling potential interest rate cuts as inflation heads toward the Fed’s 2% inflation target, the fixed income backdrop offers a compelling opportunity for investors. The question is: how significant will the decline in interest rates actually be and how will it change the shape of the yield curve?

As we write in our latest paper, there are still risks for surprises to the upside that could stall the need to cut rates. Despite these uncertainties, there should be strong relative value opportunities in high-quality segments of the bond market.

While 2023 remained volatile for fixed income markets, much of it can be attributed to wild swings in sentiment as market participants looked to the news for answers about economic data on inflation to understand the Fed’s reaction. Bearish sentiment led many investors to seek relief from further losses in the bond market by shifting to money market funds. But after the Fed signaled three potential rate cuts for 2024, it helped the Bloomberg U.S. Aggregate Bond Index deliver a positive return in 2023.

Higher yields could be an opportunity in 2024

As we look to 2024, the backdrop of higher yields could be an opportunity for investors to generate income and diversify their portfolios. Since the start of the year, we’ve already witnessed a significant issuance of investment-grade bonds for U.S. companies since the start of the year largely due to narrow credit spreads, which have been below long-run medians and coupled with low volatility.

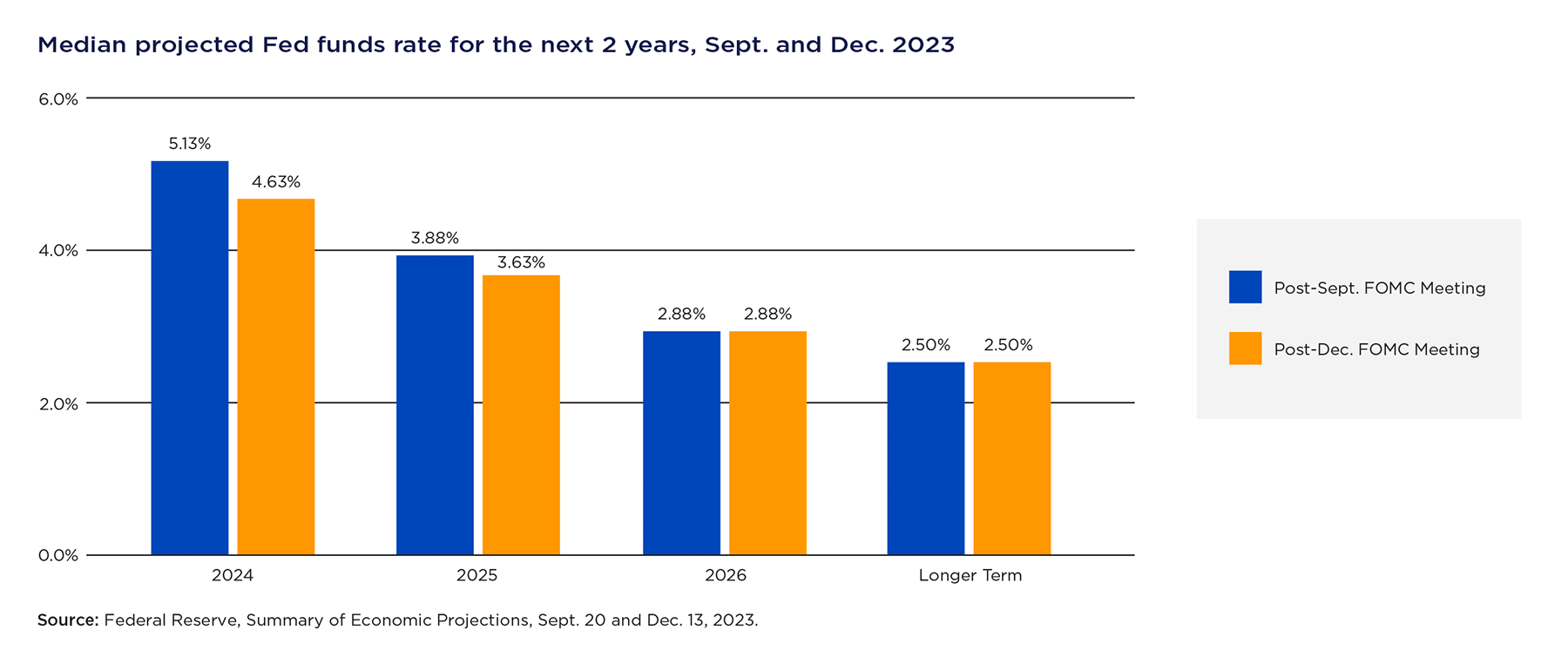

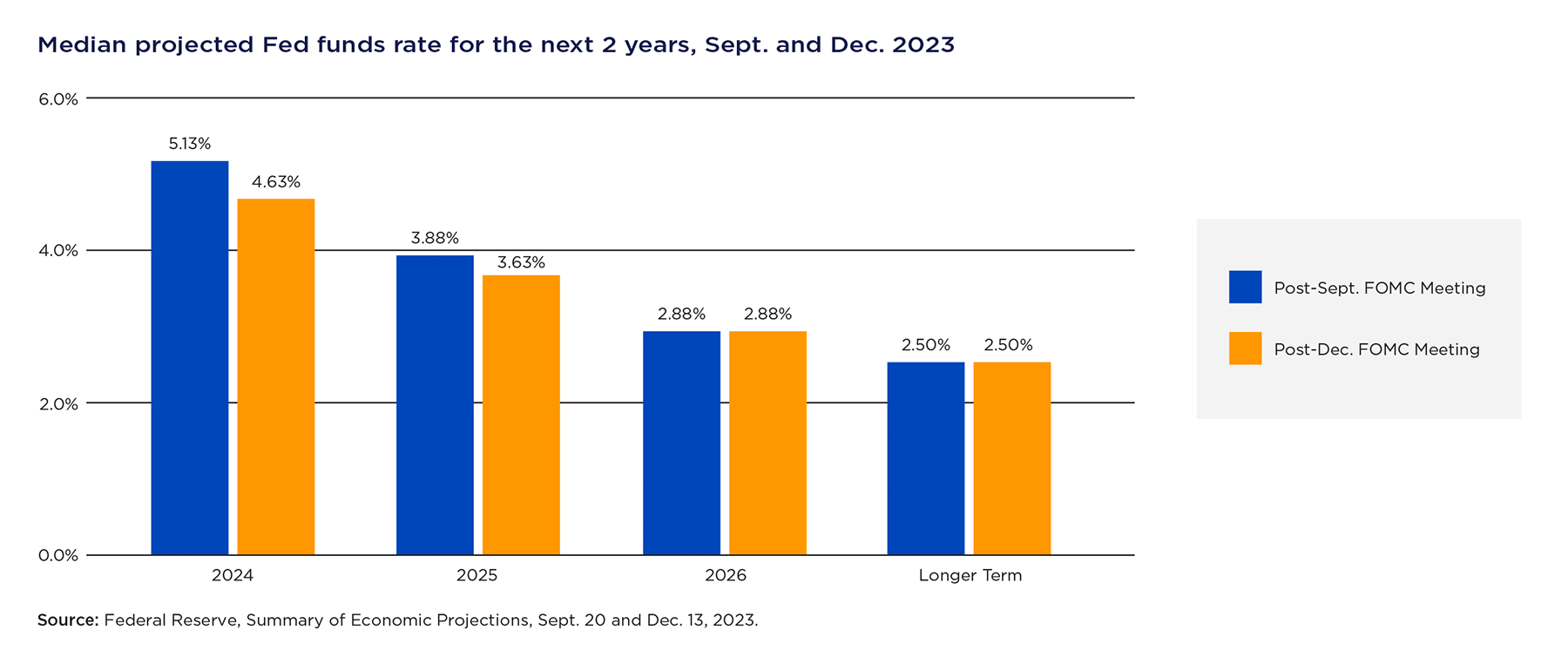

As shown in the chart, the Fed has signaled that it will take a more balanced approach to its policy stance in 2024, especially if economic data begins to moderate. As such, the backdrop for bonds appears to be favorable since fixed income assets usually perform well after the Fed pauses its rate-hiking cycle. Nonetheless, volatility will likely remain a key characteristic of the bond market as investors confront resilient economic data.

Strategies for investors

In our view, investor expectations for rate cuts versus what the Fed has signaled via their Summary of Economic Projections will likely be a source of volatility for investors. As the market continues to reprice its expectations for rate cuts, investors should capitalize on higher yields to generate income and diversify their portfolios since we ultimately believe that the path of least resistance for interest rates will be lower as we enter the latter half of 2024. As such, we believe that money market funds have a place as part of a balanced portfolio, but investors should consider the reinvestment risk as money market yields are likely to decrease as the Fed embarks on its rate-cutting cycle.

Looking ahead, the path from high to low and stable inflation may not be straightforward, we think active managers will be well-positioned to identify strong relative value opportunities.