Key takeaways:

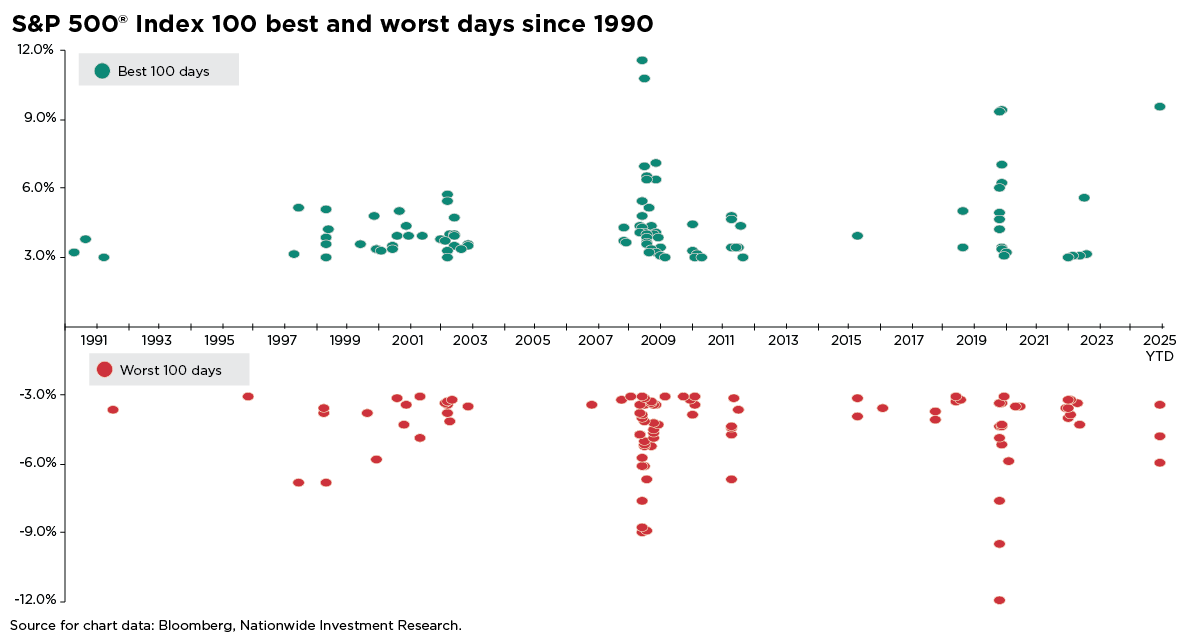

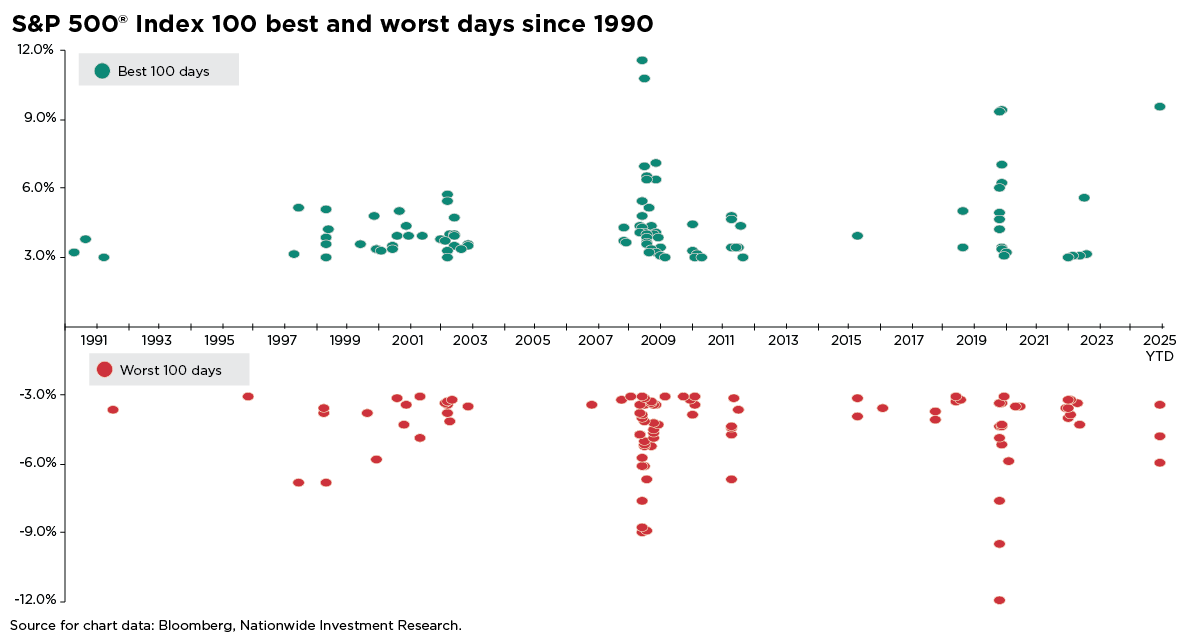

- Short-term market volatility often masks the fact that some of the worst days for stocks are closely followed by the best.

- Reacting emotionally to market downturns can lead to missing rapid recoveries—crucial moments for building long-term returns.

05/14/2025 – Monday’s strong stock market rally (May 11) following a 90-day tariff reprieve between the U.S. and China is a reminder that market volatility is still very much in play. The CBOE Volatility Index (VIX)—often seen as Wall Street’s “fear gauge”—has dropped below 20, down from last month’s peak of 52 and April’s average of 32. While that’s a notable decline, it remains above the long-term average, signaling that investor uncertainty hasn’t fully subsided.

Investor sentiment and portfolio positioning have been heavily influenced by tariff-related announcements from the White House—especially since President Trump’s second inauguration. But anxiety peaked following the April 2 “Liberation Day” announcement, when the S&P 500® Index fell roughly 11% over just four trading days (April 3–8), pushing fear levels to new highs.

After President Trump paused the “reciprocal” tariffs for 90 days, stocks staged a dramatic rebound. The S&P 500 delivered one of the sharpest turnarounds in recent memory, ending the month down just 0.7% on a total return basis. This kind of sharp, short-term volatility offers an important reminder: some of the market’s worst days are often closely followed by its best. Missing those rebounds can significantly affect long-term returns.

It also underscored a timeless investing principle: emotional reactions during market turbulence can be costly. Selling amid a sharp downturn often means missing the rapid recoveries that are critical to long-term compounding. Consider this: the post–Liberation Day drop marked the 12th largest four-day decline for the S&P 500 since 1950. By April 8, the Index was nearing bear market territory—defined as a 20% drop from its recent peak, and investor sentiment had turned decidedly pessimistic.

What happened next was extraordinary. On April 9, the S&P 500 jumped 9.5%—one of its biggest single-day gains in 35 years—wiping out the entire tariff-driven decline. This pattern aligns with historical trends: nearly half of the S&P 500’s 100 best days since 1950 occurred within just five trading days of the worst ones. An even larger share—79%—took place within 20 trading days.

The takeaway is straightforward: long-term performance hinges on time in the market, not market timing. During periods of heightened volatility—when sentiment is most fragile—maintaining discipline and adhering to core investment principles is critical to capturing recovery and compounding returns.