Key takeaways:

- Market volatility occurred during past federal shutdowns but returns showed little change in the months after reopening.

- Future shutdowns are likely, so investors should ignore headlines to avoid emotional financial decisions.

03/20/2025 – A growing murmur among investors suggests that U.S. economic growth may be faltering. Occasionally, you can even hear a faint but persistent mention of the Members of Congress avoided a federal government shutdown last week by passing a continuing resolution to fund federal operations for the rest of the fiscal year. However, the drama leading up to this agreement added to market volatility. Concerns over trade policy ambiguities compounded this, eroding consumer confidence, and the potential for slowing economic growth.

The recent turbulence in stock prices pushed the S&P 500® Index into a correction last week, with the benchmark U.S. stock barometer dropping 10% from its last all-time high on February 19. This marks the fastest correction for the S&P 500 since the six-day slide at the start of the COVID-19 pandemic.

Past budget battles have seen Congressional leaders walk to the brink of a shutdown, only to step back at the last moment. Last week’s drama was a familiar scenario. However, since 1990, there have been six instances where they went over the edge, resulting in federal government shutdowns lasting more than one day. Political squabbles over funding the government existed long before that, but prior to 1990, shutdowns were either resolved within a day (as happened four times during the Reagan era) or government agencies maintained limited operations while budget disputes were settled.

Given that we will undoubtedly face this brink again, how should investors approach the next potential shutdown and prepare for the likely market volatility? Looking back at the six shutdowns since 1990 reveals a few insights that can help investors set expectations for future budget showdowns and keep their financial plans on course through the turbulence.

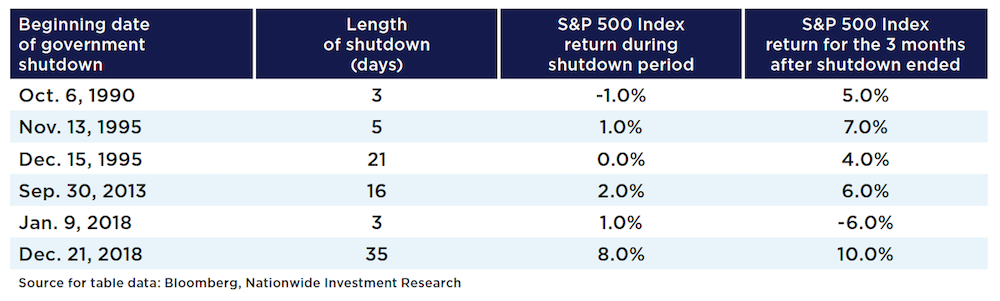

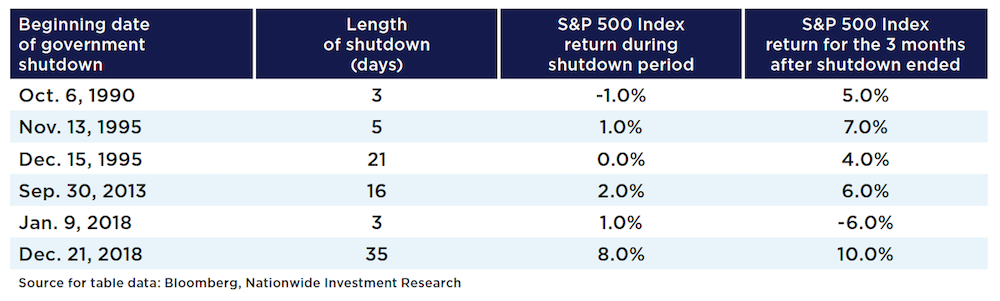

First, the shutdowns over the past 35 years have been relatively short, with only one lasting longer than a month. This limited duration has meant that the market has had little time to react to the consequences. Second, while there is some evidence of volatility during these shutdown periods, the impact on returns afterward has been minimal. In fact, as the accompanying data table shows, stocks were up three months later in all instances but one, during the three-day shutdown at the beginning of 2018. On average, the S&P 500 has gained around 4% in the three months following a shutdown.

Looking further out, past shutdowns didn’t derail the stock market’s upward trajectory. In the 12 months following these shutdowns, the S&P 500 rose by an average of 13%, with positive returns 80% of the time. So, should investors care about the impact of government shutdowns? While they can disrupt the private sector by affecting the operating environment and household spending plans, the broader market impact has been limited. Unpaid wages to furloughed federal workers have always been repaid once the shutdown ended, but the temporary uncertainty has historically led to some lost activity that can’t be recovered.

The takeaway from the recent drama and historical data is that investors must tune out the headlines around future government shutdowns—whether threatened or implemented—to resist making emotional financial decisions. Investors are best served by focusing on the real drivers of investment growth—namely, earnings—and staying focused on the long-term prospects of the financial markets.