Key takeaways:

- Shutdowns stir headlines and short-term volatility—but history shows markets often stay resilient and recover quickly.

- New risks like layoffs and delayed data could add pressure—but past patterns suggest shutdowns rarely derail long-term momentum.

10/03/2025 – The U.S. government officially shut down at midnight Wednesday after last-ditch efforts to reach a deal fell short—leaving an estimated 750,000 federal employees furloughed. Yet in a surprising show of market resilience, stocks closed at record highs, with the S&P 500® Index up 0.3%, surpassing the all-time high it set just last week.

The market’s resilience may seem counterintuitive, given the real-world impact on federal workers and the uncertainty a shutdown introduces. But investors appear to be taking cues from history. While shutdowns can stir volatility—especially when layered with other concerns like trade policy ambiguity and softening consumer confidence—historical data suggests their overall effect on markets and the broader economy tends to be modest, particularly when the disruption is short-lived.

In past budget battles, Congress often came close to a shutdown—only to reach a last-minute resolution. This time, negotiations failed to produce a deal, triggering a lapse in funding. Since 1990, there have been six shutdowns lasting more than a day due to political gridlock. While funding fights go back decades, earlier shutdowns were typically short-lived—four were resolved within a day during the Reagan era—and agencies often continued limited operations while negotiations played out.

Since 1976, the U.S. has seen roughly 22 government shutdowns—most of them short-lived, with furloughed employees typically receiving back pay. The longest, in late 2018 and early 2019, lasted 35 days and impacted around 800,000 federal workers. That episode briefly dented consumer spending, but activity rebounded quickly once the government reopened.

Based on historical precedent, there’s reason to believe this shutdown could be relatively short-lived. That said, President Trump’s stated plans for permanent federal layoffs and early retirements beginning October 1 introduce a new dynamic—one that sets this episode apart from prior shutdowns and could influence its duration and impact.

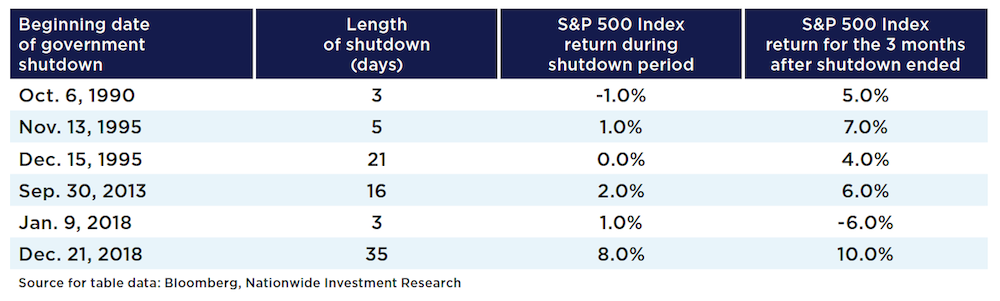

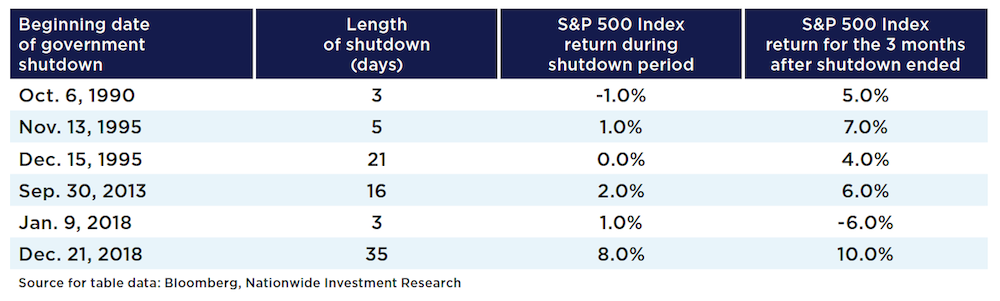

With the shutdown now underway, what should advisors keep in mind? Reviewing the six shutdowns since 1990 reveals useful patterns—offering context that can help advisors set expectations, maintain client confidence, and reinforce the importance of staying focused on long-term financial goals despite short-term disruptions.

Why history says don't overreact to shutdowns

First, shutdowns over the past 35 years have tended to be brief, with only one lasting longer than a month. This limited duration has often meant markets have had little time to fully price in the potential economic consequences. Second, while some short-term volatility has occurred during these periods, the longer-term impact on returns has generally been modest. As the accompanying data table shows, the S&P 500 was higher three months after the shutdown in all but one instance—the brief three-day episode in early 2018. On average, the index gained roughly 4% in the three months following a shutdown.

Looking further out, history suggests that shutdowns haven’t derailed the market’s longer-term momentum. In the 12 months following past episodes, the S&P 500 delivered positive returns in most cases, with an average gain of approximately 13%. While each situation is unique, this data can help advisors provide perspective and reinforce the value of staying invested through short-term uncertainty.

So, should investors be concerned about the impact of government shutdowns? While shutdowns can disrupt the private sector—affecting operations and household spending decisions—the broader market impact has historically been limited. Most economic activity tends to be delayed rather than permanently lost, with a rebound often occurring once the shutdown ends. For the $30 trillion U.S. economy, the temporary loss of income from furloughed federal workers represents a relatively small fraction. Historically, those wages have been repaid, though some short-term disruptions—particularly in consumer behavior—may not be fully recovered.

Why advisors should watch for new variables

While past shutdowns have often been short-lived, this one may carry more weight. The administration has directed federal agencies to prepare for potential layoffs and early retirements starting October 1—a shift from previous shutdowns, where furloughed employees were typically reinstated. If these measures are enacted, they could have longer-term implications for government operations and economic sentiment, introducing uncertainty that advisors may want to monitor in client conversations.

One of the most immediate ripple effects of the shutdown is the potential pause in key economic data releases. Without timely updates on employment, inflation, and other indicators, markets may feel like they’re flying blind—fueling uncertainty and near-term volatility. And if the shutdown stretches on, businesses could delay hiring and investment decisions, adding pressure to both equity markets and broader economic momentum.

Why historical patterns support client confidence

All told, shutdowns make headlines. They stir investor anxiety, rattle sentiment, and briefly hijack the narrative. But for equity markets, they rarely rewrite the fundamental script. Investors should remember that drivers of equity market performance are underpinned by economic growth, corporate earnings, and interest rates. Government shutdowns may jolt the tape, but they don’t steer it. In other words, advisors can help clients stay invested, stay diversified, and keep focused on the long arc of fundamentals. Shutdowns may rattle nerves and spike volatility, but history has a habit of proving them transitory.