Key Takeaways:

- Fixed income investors find themselves at a pivotal juncture, contending with elevated policy uncertainty, persistent inflationary pressures, and the unpredictable nature of interest rate fluctuations.

- Investors should rethink their core fixed-income holdings to be more adaptable.

- High-quality fixed income presents a compelling investment opportunity.

Looking back at the first quarter

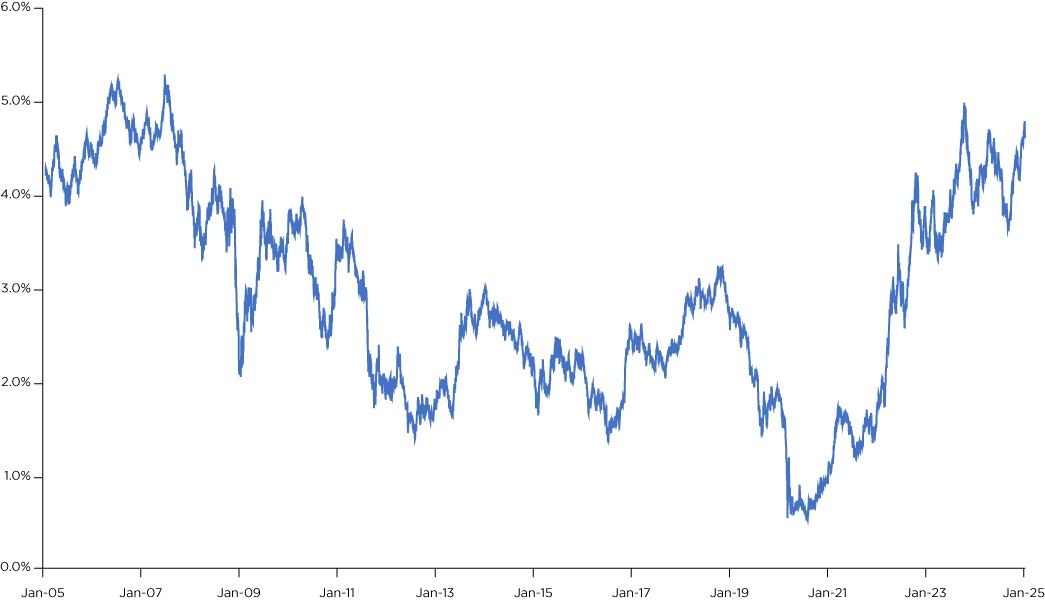

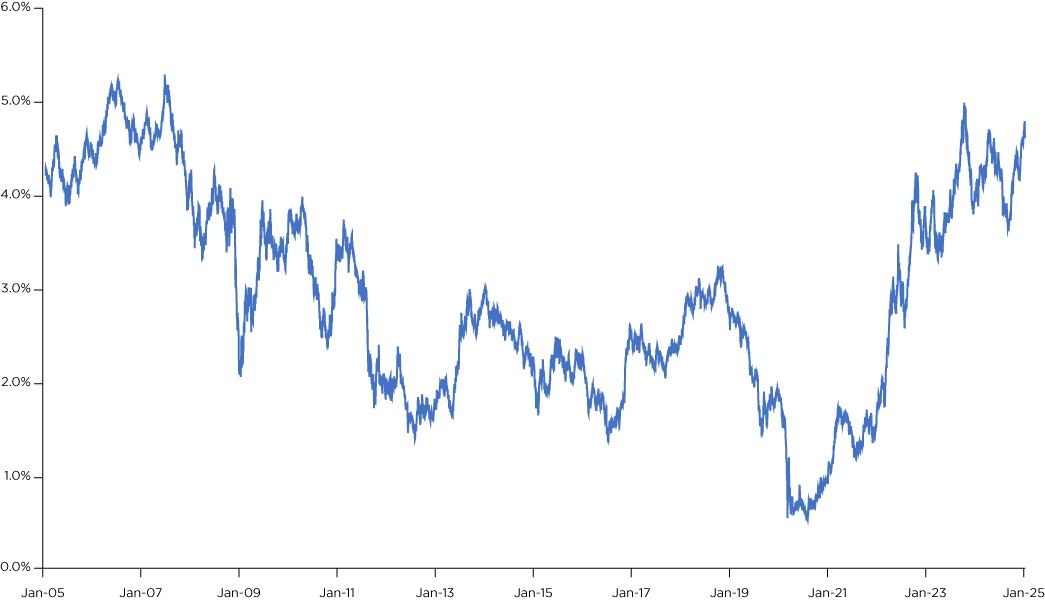

03/18/2025 – As the first quarter of 2025 draws to a close, fixed income investors find themselves at a pivotal juncture, contending with elevated policy uncertainty, persistent inflationary pressures, and the unpredictable nature of interest rate fluctuations. Underscoring this pivotal juncture of uncertainty is volatility, which is likely poised to remain a prevailing motif throughout 2025. Yet, hidden opportunities for discerning bond investors may reside within its turbulence. Our latest white paper takes a closer look at how the prospect of higher yields from fixed income investments offers the potential for increased income and enhanced returns over time.

What do today’s higher yields mean for bonds?

A prospective pro-inflationary paradigm shift, potentially accompanied by a higher neutral rate of interest, raises important questions about how to build enduring portfolios. In essence, investors should rethink their core fixed-income holdings to be more adaptable, combining different active investment solutions to target specific investment objectives.

10-year U.S. Treasury yield, 2005-2025

In the wake of the bond market’s dramatic downturn in 2022, with some investors questioning the reliability of fixed income, our outlook for 2025 strikes a note of cautious optimism. This outlook is underpinned by the prospects of above-average growth in corporate earnings and an enhanced corporate landscape, bolstered by productivity gains and potential deregulation. Furthermore, regarding fixed income, we interpret relatively tight credit spreads as current evidence of a resilient economy. While we continue to closely monitor these developments, we think that the economy is navigating bouts of policy uncertainty and transitioning from a period of above-trend growth to normalized economic growth, rather than heading toward a downturn.

A new era for bonds

Given the anticipated rate volatility this year, we recommend a more tactical approach to fixed income. We view corporate credit as a potentially valuable component of investor portfolios, supported by our expectation of its likelihood to outperform government bonds. And while corporate high-yield bonds may be offering attractive absolute yields currently, we think they should be approached with caution due to their abnormally tight spreads and inherent risks.

When it comes to concerns about allocating capital to fixed income this year, the recent rout in the stock market should remind investors of the benefits of bonds. In other words, the value of diversification, along with attractive yields and higher income potential, should help alleviate concerns as 2025 unfolds.

A compelling time for fixed income

Despite headwinds from ongoing fluctuations in rate cut projections and broader interest rate volatility, the current environment may actually present excellent entry points for long-term fixed income investors. Against a market backdrop of lofty equity valuations and credit spreads at historic lows, bond yields can be particularly enticing. That’s why high-quality fixed income presents a compelling investment opportunity. Rather than focusing on the timing, pace and eventual endpoint of rate-easing cycles, investors should instead focus on optimizing their risk-adjusted returns in fixed income.