This material is not a recommendation to buy or sell a financial product or to adopt an investment strategy. Investors should discuss their specific situation with their financial professional.

Except where otherwise indicated, the views and opinions expressed are those of Nationwide as of the date noted, are subject to change at any time and may not come to pass.

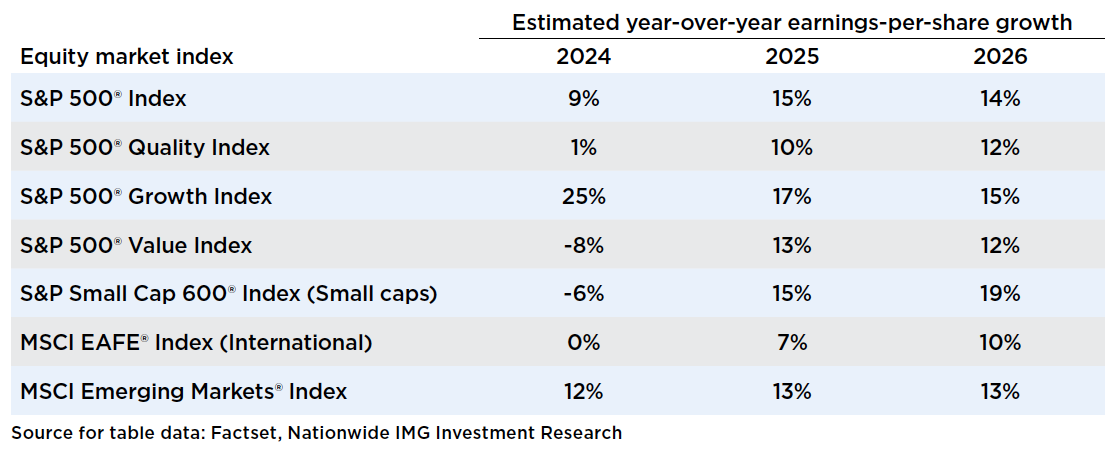

MSCI EAFE® Index: An unmanaged, free float-adjusted, market capitalization-weighted index that is designed to measure the performance of large-cap and mid-cap stocks in developed markets as determined by MSCI; excludes the United States and Canada.

MSCI Emerging Markets® Index: An unmanaged, free float-adjusted, market capitalization-weighted index that is designed to measure the performance of large-cap and mid-cap stocks in emerging-country markets as determined by MSCI.

The Fund is not sponsored, endorsed, or promoted by MSCI, and MSCI bears no liability with respect to any such funds or securities or any index on which such funds or securities are based.

S&P 500® Index: An unmanaged, market capitalization-weighted index of 500 stocks of leading large-cap U.S. companies in leading industries; it gives a broad look at the U.S. equities market and those companies’ stock price performance.

S&P SmallCap 600® Index (S&P 600): a stock market index established by Standard & Poor's that covers roughly the small-cap range of American stocks, using a capitalization-weighted index.

S&P 500® Quality Index: A stock index that tracks the performance of the highest quality stocks in the S&P 500. It's based on a quality score that considers a company's return on equity, accruals ratio, and financial leverage ratio.

S&P 500® Growth Index: An index consisting of those stocks in the S&P 500 Index exhibiting the strongest growth characteristics based on: (i) sales growth; (ii) earnings change to price; and (iii) momentum.

S&P 500® Value Index: A style-concentrated index designed to track the performance of the S&P 500 stocks that exhibit the strongest value characteristics by using a style attractiveness weighting scheme.

S&P Indexes are trademarks of Standard & Poor’s and have been licensed for use by Nationwide Fund Advisors. The Products are not sponsored, endorsed, sold or promoted by Standard & Poor’s and Standard & Poor’s does not make any representation regarding the advisability of investing in the Product.