Key takeaways:

- With interest rates falling, industry sectors that had been affected by Federal Reserve tightening may soon see decent returns.

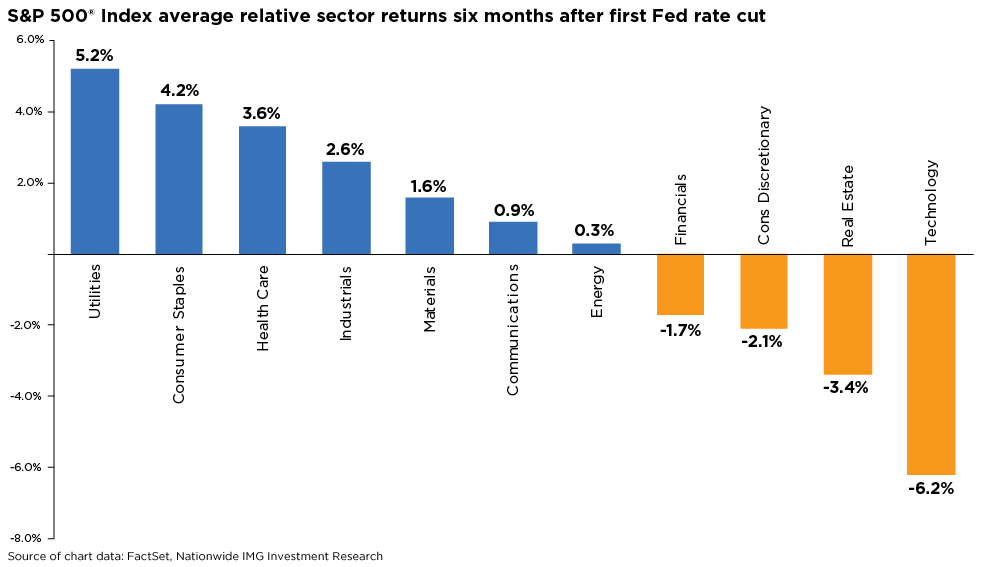

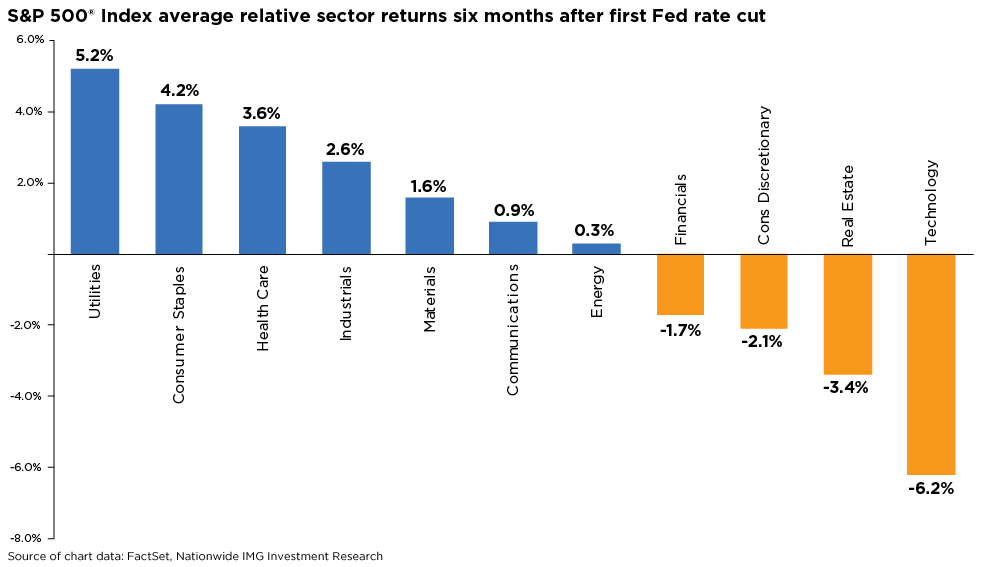

- Defensive sectors often outperform the market in the six months following the first Fed rate cut.

10/02/2024 – The Federal Reserve’s 50 basis point rate cut on September 18 increased the likelihood of a “soft landing” for the U.S. economy. However, it can also be seen as a regime change for the Fed following its earlier campaign of aggressive interest rate hikes and a long spell of restrictive monetary policy. Now that interest rates are on their way down, industry sectors that have been adversely affected by Fed tightening may be poised to see decent returns in the coming quarters.

With investors keenly focused on the direction of interest rates and their potential impact on the economy, a subtle change in market leadership over the past several months may signal how different segments of the stock market might perform after the first rate cut. The market’s anticipation of an outsized rate cut by the Fed has likely contributed to this shift.

For example, the change in Fed policy has broadly lifted stocks. Defensive and cyclical sectors such as real estate, utilities, financials, and industrials have led the charge, rather than the sectors investors have grown accustomed to, such as technology, communication, and consumer discretionary. This rotation into more defensive sectors makes sense considering market expectations for accommodative monetary policy and may highlight how investors are gauging the potential performance of various equity sectors in a climate of lower interest rates.

An analysis of previous rate-cutting cycles suggests that defensive sectors tend to outperform (relative to the S&P 500® Index) in the six months following the first rate cut, particularly in cases where the U.S. economy avoided recession. Surprisingly, technology has historically underperformed the S&P 500 during these past six-month periods. Financial stocks, on the other hand, could benefit from a steeper yield curve and a soft-landing backdrop, while consumer discretionary sectors have typically underperformed compared to consumer staples in past cycles.

While investors may be keen to understand how different stocks or sectors perform during Fed easing cycles, they should remember not to use past performance to project future returns. Every easing cycle is different, although avoiding recession bodes well for equities. Rather than basing investment decisions on historical patterns, investors should focus on building a diversified portfolio designed to achieve their goals through different economic cycles.