For example, the second estimate of Gross Domestic Product (GDP) growth for Q1, which was revised downward to 1.3% from 1.6%, shined a light on the challenge that higher interest rates present to the economy overall. The quarterly GDP report revealed consumer spending rose at a 2.0% annual rate, down from 2.5% in the first estimate. Moreover, the year-over-year rate was down more than 3% from the growth rate in the previous two quarters.

In addition, the Personal Income and Spending report for April echoed the tempered tenor of the quarterly GDP report, suggesting that consumers may pull back on spending as inflation and higher rates quell consumer confidence. For example, real and inflation-adjusted income in April declined by 0.1% from the previous month. Spending on discretionary services fell too, suggesting consumers may be turning more discerning in their spending habits. That’s a sentiment echoed by commentaries in Q1 earnings reports and in the readout from the Federal Reserve’s most recent Beige Book release. These are factors that could weigh on corporate earnings growth.

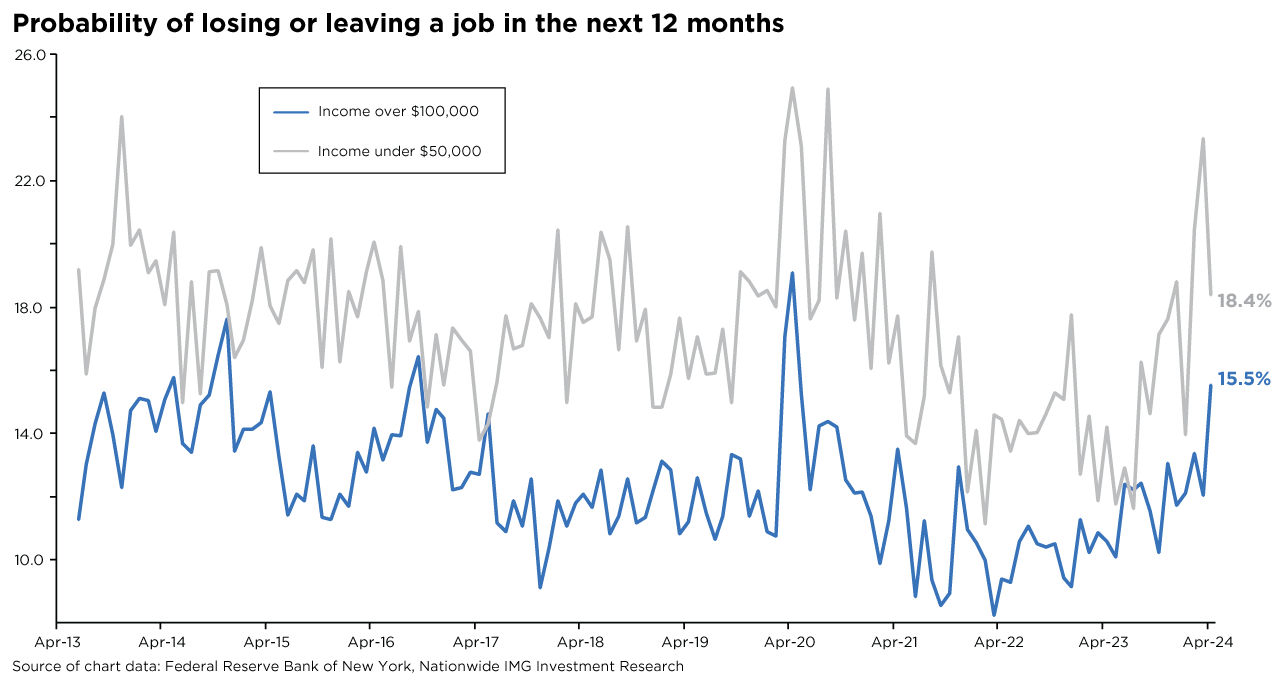

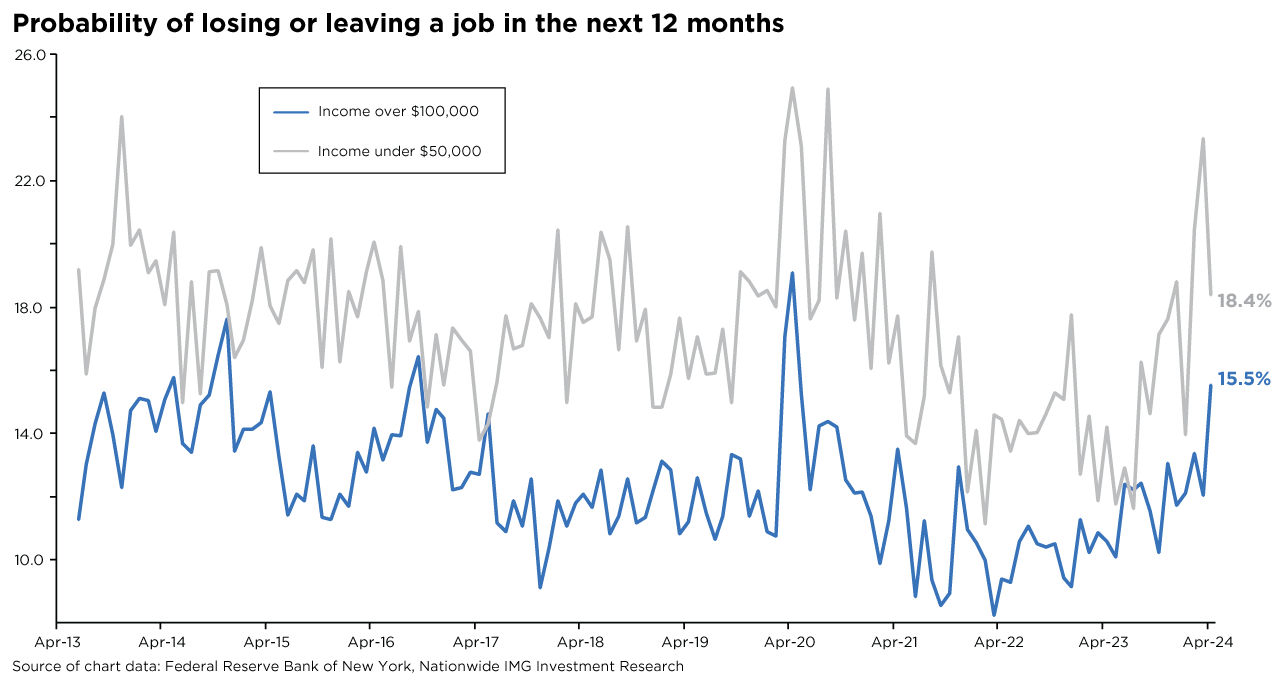

An examination of Q1 earnings reports from retailers reveals a nuanced but significant divergence among shoppers and highlights the discordant nature of the current economic cycle. Lower- to middle-income consumers are showing an increasing preference for value, while spending on goods and services among higher-income groups remains strong. For the latter group, buoyant stock prices and elevated house prices continue to support the wealth effect. However, recent data from the Federal Reserve shows high-income earners are increasingly concerned about losing their jobs, as the accompanying chart illustrates.

Similarly, when looking at consumers by income percentiles, higher interest rates are starting to impact lower income groups. The most recent survey by the Federal Reserve Bank of New York shows that credit card delinquencies of 90 days or more have started to accelerate, a trend worth monitoring. Although consumers show some signs of stress, investors should consider if the recent slowdown indicates a rapid deterioration of spending strength or a moderation in recent economic momentum.

It’s important to remember that household income is the best forward indictor of consumer spending. Income, in turn, is powered primarily by the labor market and supports consumer spending. Barring a potential exogenous shock, cooling consumption and a normalizing labor market should bode well for the soft-landing narrative.