Key takeaways:

- The recent dip in consumer sentiment has fueled concerns that weakness in soft data might foreshadow worse hard data to come.

- While investors should not disregard sentiment surveys, they can provide false signals and diverge from actual reports.

04/02/2025 – Recent uncertainty from tariffs, federal spending cuts, and economic growth concerns has captured investors’ attention. The result? A fracture in consumer sentiment, evident in The Conference Board’s Consumer Confidence Index and the University of Michigan Consumer Sentiment Index, both of which fell to two-and-a-half-year lows in March.

The recent dip in sentiment has raised concerns that soft data might predict weaker hard data, such as earnings, consumer spending, or capital expenditures. These concerns are valid. However, investors should not base their decisions solely on surveys; consumer reports often differ from actual behavior, necessitating a broader analysis of economic data.

Although considered soft data or survey-related data, these barometers gauge Americans’ financial confidence in the economy, personal finances, business conditions, and purchasing climate. The Michigan Index includes the Current Economic Conditions Index (CECI), while the Conference Board's Consumer Confidence Index comprises the Present Situation Index and the Consumer Expectations Index (CEI). The CECI reflects consumers’ perceptions of their current financial status and the broader economy, while the CEI—currently at its lowest level since the onset of the COVID-19 pandemic—gauges expectations for the future.

That said, investors can “peel back the onion” on these consumer surveys to look beyond the headline figures. Consider the current conditions component of the Consumer Confidence Index, which captures consumers’ perceptions—a notably fickle construct—of present business conditions and personal financial situations. These perceptions can vary significantly among different consumer groups.

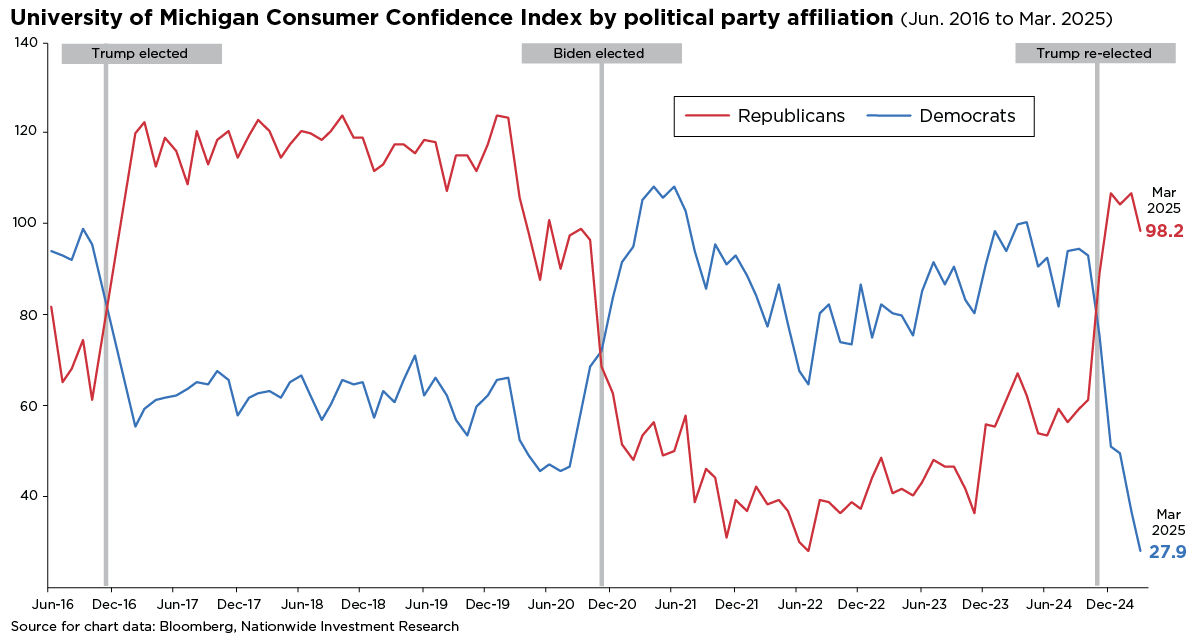

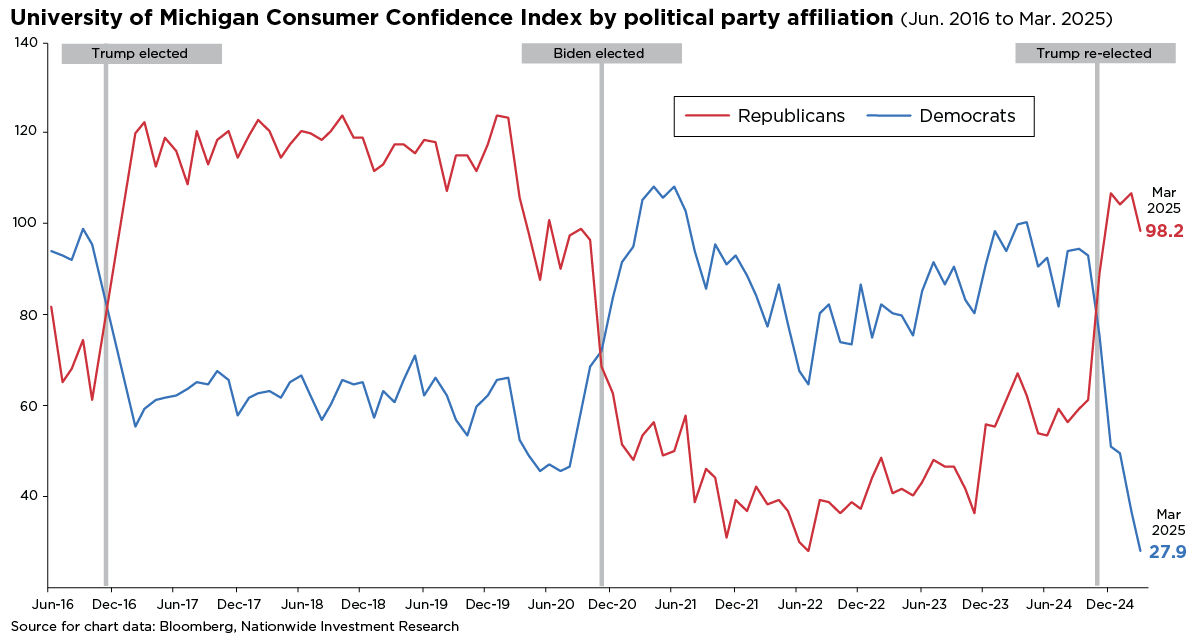

It’s also revealing to examine how different demographic groups, such as political affiliations, respond in these surveys. Over the past several months, a significant gap has emerged between Republicans, who are generally more optimistic about the economic outlook, and Democrats, who tend to show the opposite sentiment. (See the accompanying chart.)

The March University of Michigan survey results showed a clear consensus across all demographic and political affiliations: Republicans, independents, and Democrats alike have expressed worsening expectations since February regarding their personal finances, business conditions, unemployment, and inflation.

Conflicting data have been a recurring theme in recent years. Trusted indicators such as sentiment surveys and inverted yield curves have often signaled a recession that ultimately failed to materialize. While investors should not completely disregard soft data and sentiment surveys, these readings can sometimes provide false signals and diverge from hard data such as corporate earnings or low initial unemployment claims.

While policy uncertainty is likely to remain high and short-term weakness may persist, investors should remember that a long-term investment plan and a well-diversified portfolio can help them weather the souring sentiment around the economic outlook.