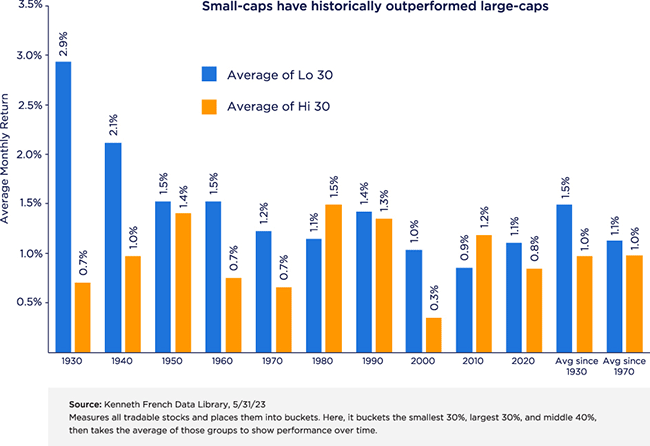

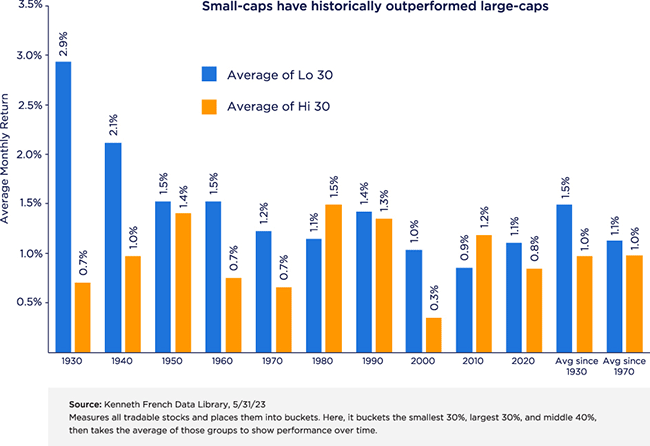

In fact, small-caps are the only asset class to outperform inflation in every decade. One reason for that consistent performance year after year is that smaller companies are usually more nimble and able to react more quickly to increases in the cost of doing business. This allows them to remain profitable in the face of inflation and rising rates by reducing their operating expenses and increasing their prices if necessary.

It’s also worth noting that the agility and often domestic focus of these small-cap companies allows them to benefit from other current market trends as well—including reshoring of manufacturing and capital expenditure cycles. Plus, thanks to their "local focus" and less-complex tax structure as compared to larger corporations, they are less impacted by increasing wage levels in traditionally low-cost countries and tend to be more insulated from tax-related margin risks.

There are also some significant diversification benefits to investing in small-caps. With different risk-reward profiles and varying sector weightings compared to their large-cap counterparts, small-cap stocks offer investors broader market exposure and enhanced portfolio resilience. With that in mind, there’s certainly a case to be made for a balanced portfolio consisting of both large-cap and small-cap stocks.

As you know, timing is everything. And right now, small-caps remain relatively attractive. How attractive? The current dynamics of today’s market have brought small-cap stocks to valuations that are not only historically low relative to large-cap stocks, but also attractive purely on an absolute basis.

And yes, while it’s true that small-caps have underperformed large-caps so far this year, when valuations are this low, history shows that small-caps could be poised for big things.

That’s why it’s important for investors to continue to maintain a long-term perspective. Although it’s easy to be swayed by some of these short-term trends and react accordingly, it’s far more important to remember that these are often short-lived.

Small-cap equities offer potential for growth and should not be dismissed outright based on the latest trend. Their attractive valuations, coupled with the dispersion benefits they bring to a well-balanced and diversified portfolio in a variety of market conditions, provide a compelling argument for long-term investors to consider an increased allocation to small-cap equities.

Bottom line? Small-caps offer the potential for solid returns in the long run.