Key takeaways:

- Softer job growth, recession concerns, and dissent among central bankers have increased the likelihood of a Federal Reserve rate cut in September.

- Incoming data will likely shape the Fed’s final decision and influence the stock market’s tone heading into the year-end months.

08/28/2025 – Market expectations for a September rate cut have picked up speed over the past month. Just weeks ago, fed funds futures priced in slightly better than even odds of easing. But after Fed Chair Jerome Powell struck a dovish tone at this weekend’s global central banking summit in Jackson Hole, that probability jumped to roughly 85%, per the CME FedWatch Tool.

The likely catalyst behind the improving probabilities for a rate cut has been a confluence of softening labor data, internal dissent at the Federal Reserve and a growing sense that economic growth is quickly decelerating. On the jobs front, sizable revisions in the May and June nonfarm payroll numbers revealed weaker job creation than initially reported. That sparked debate about the appropriate level of monetary policy and if the Fed’s prolonged pause on rate cuts remains justifiable.

Adding to the intrigue, the July FOMC meeting saw a rare dissent among committee members, with two governors advocating for an immediate rate cut. That marked the first such split in over three decades, hinting at rising internal pressure to recalibrate monetary policy.

Yet, despite the market’s growing optimism, investors should understand that a September cut is not guaranteed as the Fed is tethered to its dual mandate of near-full employment and low inflation. Recent inflation data has remained stubborn, complicating the case for rate cuts in the current data-dependent framework.

The implications of Fed easing for equity markets aren’t written in stone either. Much depends on the why behind the move. Historically, when the Fed has cut rates as a form of “insurance”—think 1995, 1998 or 2019—the response from equity investors was constructive. These were periods when the central bank acted ahead of clear economic deterioration, injecting liquidity into a system that was still fundamentally sound. Markets tend to reward that kind of proactive policy.

Conversely, when rate cuts are reactive—as in the 2001 and 2007–2008 crises—the backdrop is often one of deteriorating fundamentals and rising risk aversion. In those cases, easing tends to coincide with falling earnings expectations and tighter financial conditions, which can weigh on equity performance.

Today’s backdrop arguably resembles the former. While labor demand is softening, jobless claims remain low, corporate earnings are resilient, and GDP growth is tracking near trend. That suggests the Fed may be leaning toward a precautionary stance in September. Still, persistent inflationary pressures continue to complicate their dual mandate, raising the risk that easing could be deferred.

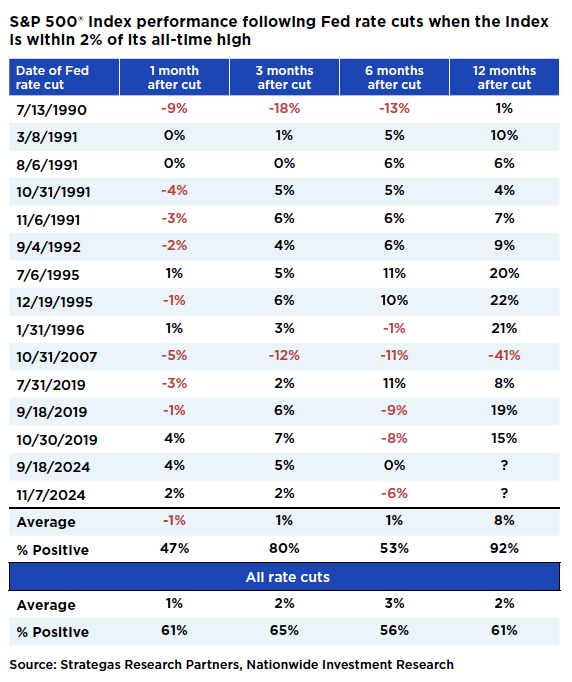

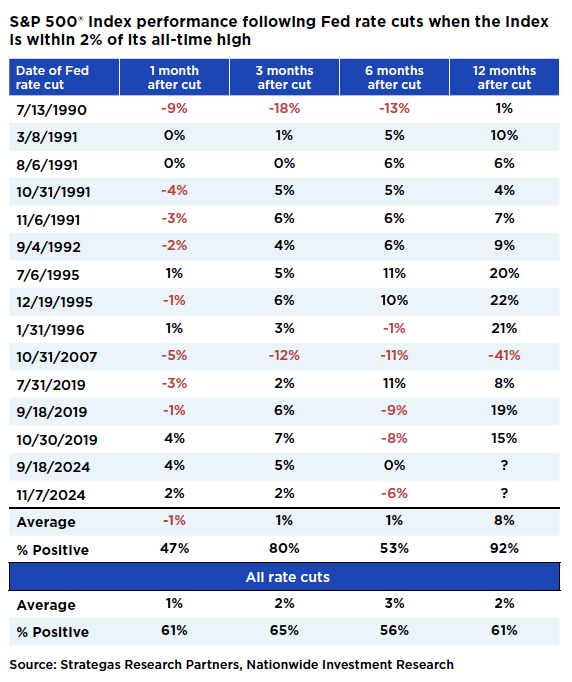

So, what might a rate cut mean for equities? The S&P 500® Index has already logged 18 all-time highs in 2025—a historically constructive signal for forward returns. Notably, when rate cuts occur near market peaks, the one-year performance has been positive 92% of the time, with the only exception during the Global Financial Crisis (see accompanying table). Similarly, since 1970, when cuts follow pauses of 5–12 months—September would mark month nine—the S&P 500 has been higher a year later in nearly every case.

That said, the Fed’s September decision will hinge on incoming data and evolving risks. Will inflation prove more persistent than hoped? Will labor market softness deepen? And perhaps most critically, will the Fed act preemptively to preserve momentum—or wait for clearer signs of strain?

The answers will shape not just the path of rates, but the tone of markets heading into Q4. For now, investors are betting on a pivot to lower rates—but history reminds us that the reason behind the cut often matters more than the cut itself.