Key takeaways:

- There's a growing divergence in the stock market, where momentum is fueled less by fundamentals and more by behavioral dynamics.

- In a market increasingly driven by sharp swings in sentiment, staying grounded in investing fundamentals is more important than ever.

09/03/2025 – Secular tailwinds and solid corporate earnings have helped lift the stock market off its April lows. But under the surface, a growing disconnect is emerging—momentum is being fueled less by fundamentals and more by behavioral forces that can skew price discovery.

In some corners of the market—think microcaps, meme stocks, and short-dated options—the chase for quick gains and momentum has started to feed on itself. It's creating pockets of froth that challenge traditional valuation models. Momentum trading, once a tactical play for navigating cyclical shifts, now seems to be driven more by psychology than strategy.

Behavioral finance offers a compelling lens to view the recent market shift. Investors influenced by cognitive biases like overconfidence and herding aren't just reacting to price trends—they may amplify them. The AI stock surge in 2024 is a textbook example. Some investors, confident in their ability to pick winners regardless of fundamentals, flooded into tech names, driving valuations well beyond reasonable levels.

This wasn't just optimism reaching exuberant heights, as we've seen during the recent stock rally. Instead, the euphoria in some corners of the market likely reflects a timeless impulse among investors to chase quick gains—often untethered from a disciplined strategy.

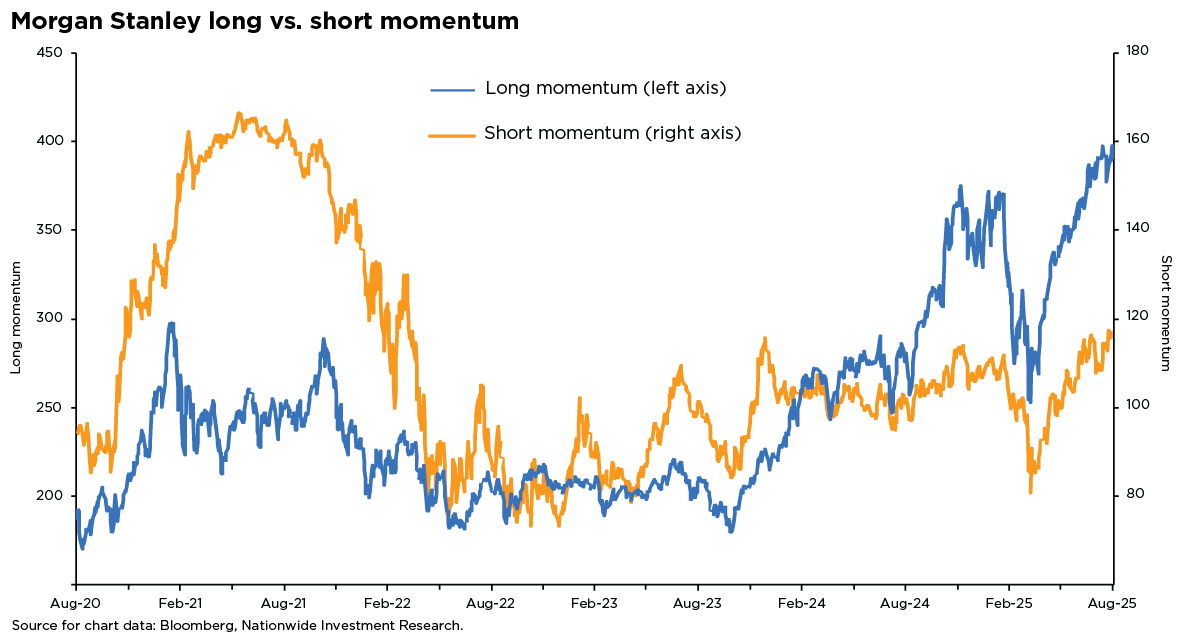

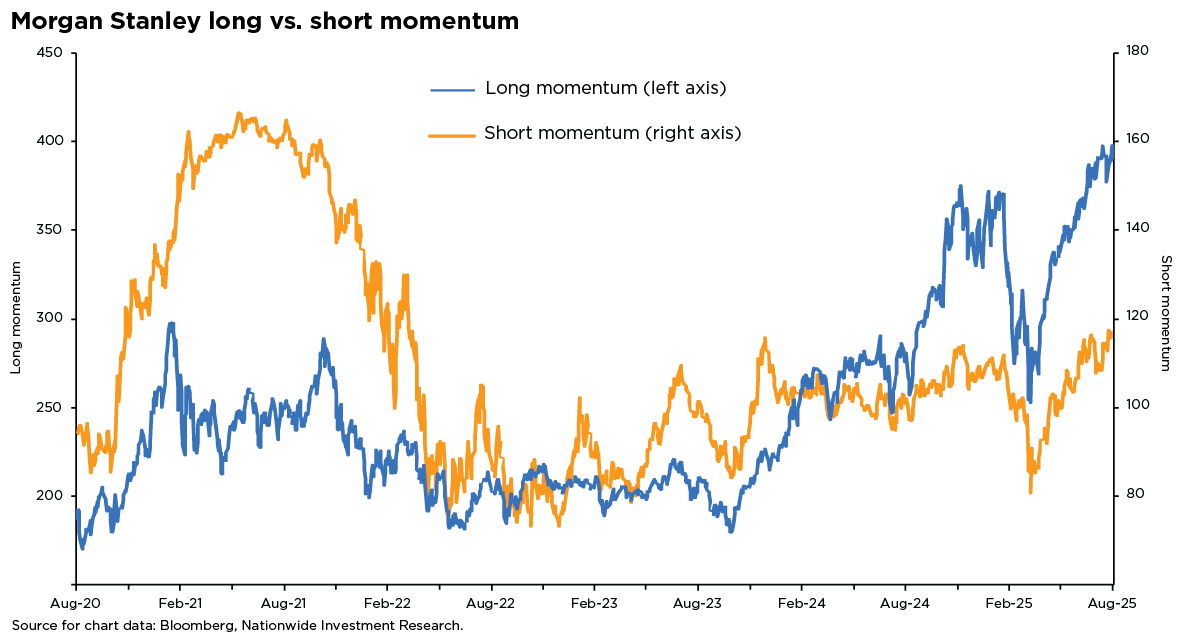

When evaluating the recent rally, these euphoric signals deserve close attention. While the rally is supported by a solid foundation of resilient fundamentals, the accompanying chart tells a more nuanced story. A basket of momentum stocks has staged an outsized rebound from the April 8 low—likely driven more by sentiment than substance, with gains outpacing the underlying fundamentals.

In essence, investors seem to be operating under the assumption that recent market winners will keep outperforming, while laggards will continue to trail. These patterns can persist—but they also tend to reverse abruptly. Timing those shifts is notoriously difficult, and when misjudged, can pose a real risk to long-term wealth creation.

Other signs of emotionally driven momentum trading include accelerating IPO activity and renewed investor interest in special purpose acquisition companies, or SPACs. These are highly speculative, publicly traded firms with no business operations of their own—created solely to raise capital and acquire privately held companies to take them public. Additionally, data from the Chicago Board Options Exchange shows that short-dated options trading is booming, another signal that speculative behavior is coursing through the recent rally.

In a market increasingly shaped by sharp swings in sentiment, staying grounded in fundamentals matters more than ever. Momentum may bring excitement, but lasting success comes from patience, discipline, and a clear investment plan rooted in long-term principles. By focusing on diversification, cost efficiency, and time-tested strategies, investors can navigate uncertainty with confidence—and avoid the pitfalls of chasing short-lived trends.