08/28/2024 — Amid the market volatility that dominated headlines in the financial press, many investors may have missed some good news for the ongoing bull market for stocks—the continued strength and resilience of company earnings.

With some of the volatility calming down more recently, it’s a good time to review several key themes that emerged during the Q2 earnings season. The results show that the fundamental and macroeconomic backdrop remains broadly supportive for stocks while also providing a good reason for investors to tune out the noise of market volatility.

For the most part, Q2 earnings season was solid; 79% of S&P 500® Index companies exceeded analyst estimates by 3.5% on average. Overall earnings for S&P 500 firms grew a solid 11% year over year—the best quarter for earnings growth since Q4 of 2021—while revenue rose 5.2% year over year, its best quarter since Q2 2022.

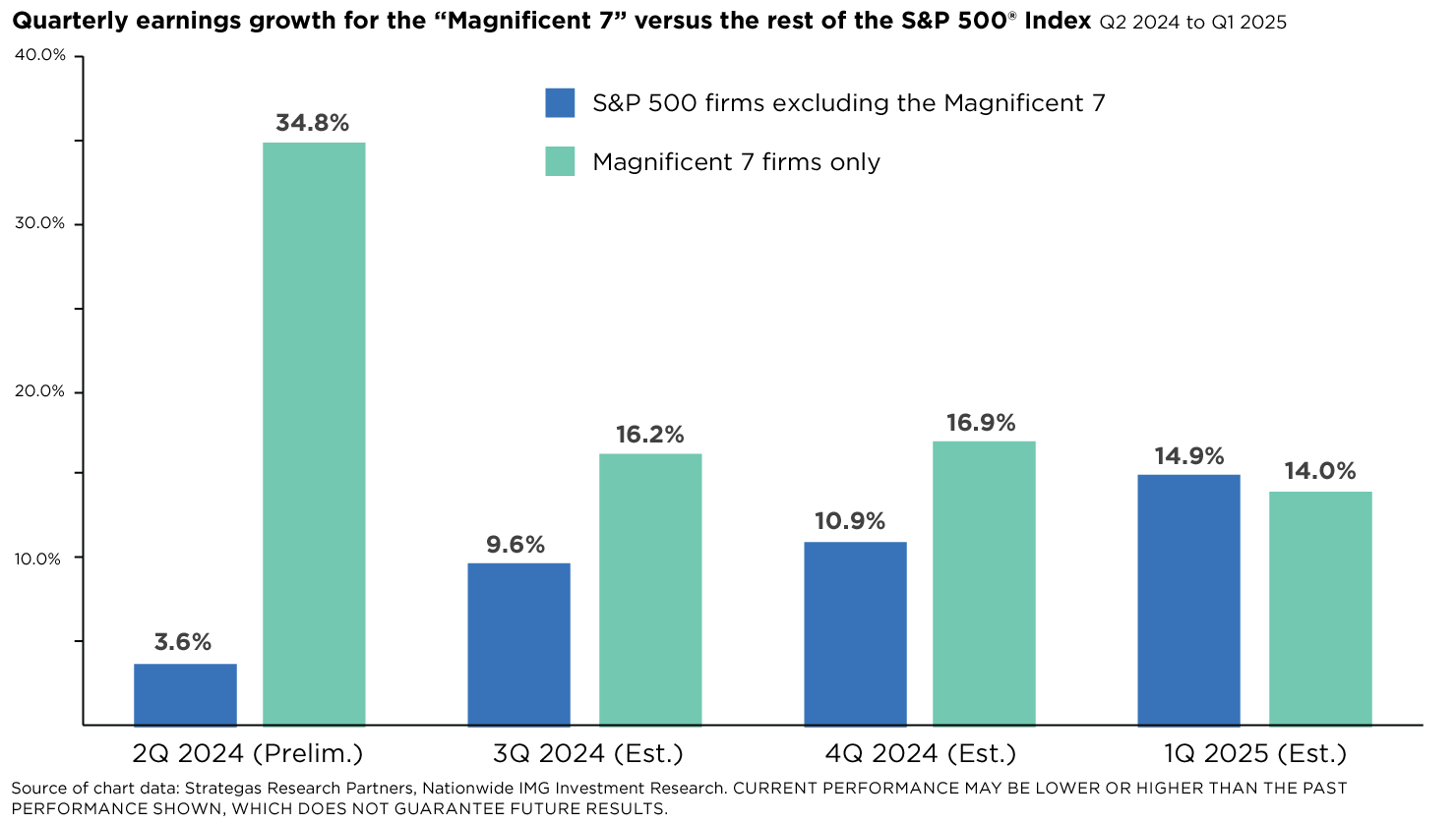

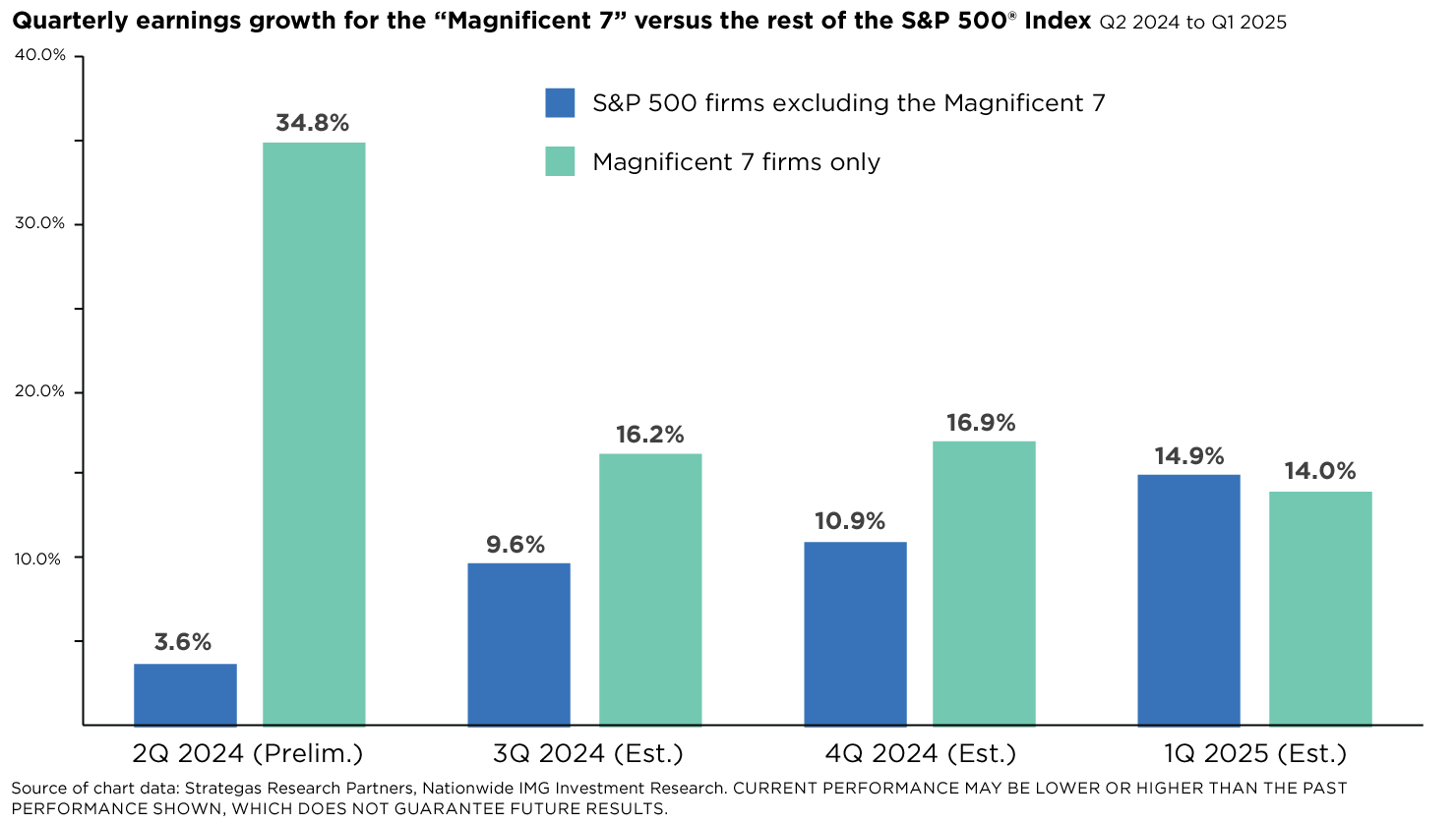

Earnings for the “Magnificent 7” companies grew earnings by around 35%, while the other 493 S&P 500 stocks advanced by 3.6%, recording their first year-over-year earnings growth since Q4 of 2022. (See the accompanying chart.) These results show the theme of broadening market leadership beyond the “Mag 7” continues to hold.

Nine of 11 S&P 500 sectors reported positive earnings growth for the second quarter, with five sectors scoring double-digit earnings growth. The biggest upside surprises to earnings came from financials, health care, and utilities, supporting the view that “green shoots” are starting to emerge in the more cyclical areas of the market. The earnings data might signal that a new profit cycle is underway, with guidance remaining decently strong.

Consensus earnings estimates for 2024 and 2025 continue to hold, calling for the S&P 500 to deliver earnings-per-share (EPS) growth of $242 this calendar year and $278 EPS growth next year. This suggests estimates are tracking a non-recessionary revision trend. Additionally, according to FactSet, the frequency of companies referencing recession during conference calls has dropped to its lowest point since 2006.

There are pockets of weakness that deserve monitoring. For example, in numerous company earnings calls, executives report a highly bifurcated consumer environment; lower-income consumers continue to feel the squeeze from inflation, while higher-income consumers remain in spending mode. Furthermore, a cooling labor market combined with restrictive interest rates continuing to hamper economic activity in several sectors such as housing and manufacturing. Many companies face dwindling pricing power, a threat to top-line revenue growth and potentially to margins as well.

As a result, estimates for 2025 may be overly optimistic and subject to revisions, potentially leading to increased market volatility. All things considered, the conclusion of Q2 earnings season suggests that corporate profits remain supportive of the current bull market. With nominal GDP remaining constructive and the Federal Reserve likely to ease interest rates starting in September, the financial backdrop for the equity bull market remains intact.