Key takeaways:

- The U.S. dollar typically strengthens during periods of equity market stress, but has diverged from that pattern so far in 2025.

- While the dollar’s decline may appear to signal a turning point, it more likely reflects a healthy retracement—not a structural shift.

06/04/2025 – The U.S. dollar has been steadily losing ground since the beginning of the year. As of the end of May, the U.S. Dollar Index (DXY)—which tracks the dollar’s value against a basket of major global currencies—is down over 8% year to date.

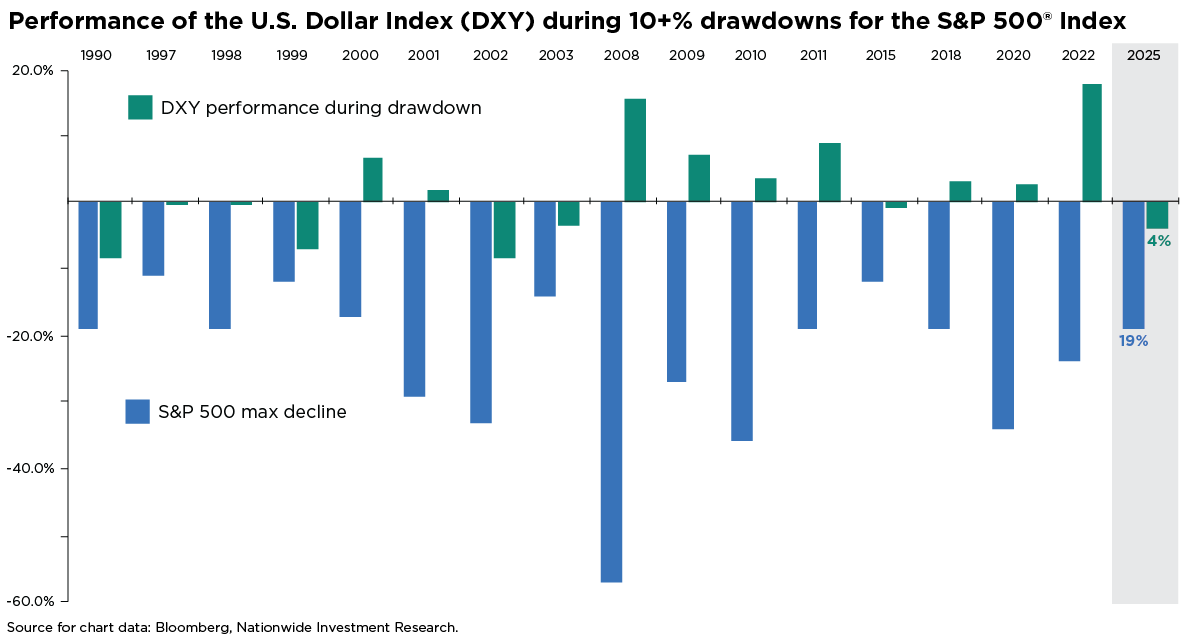

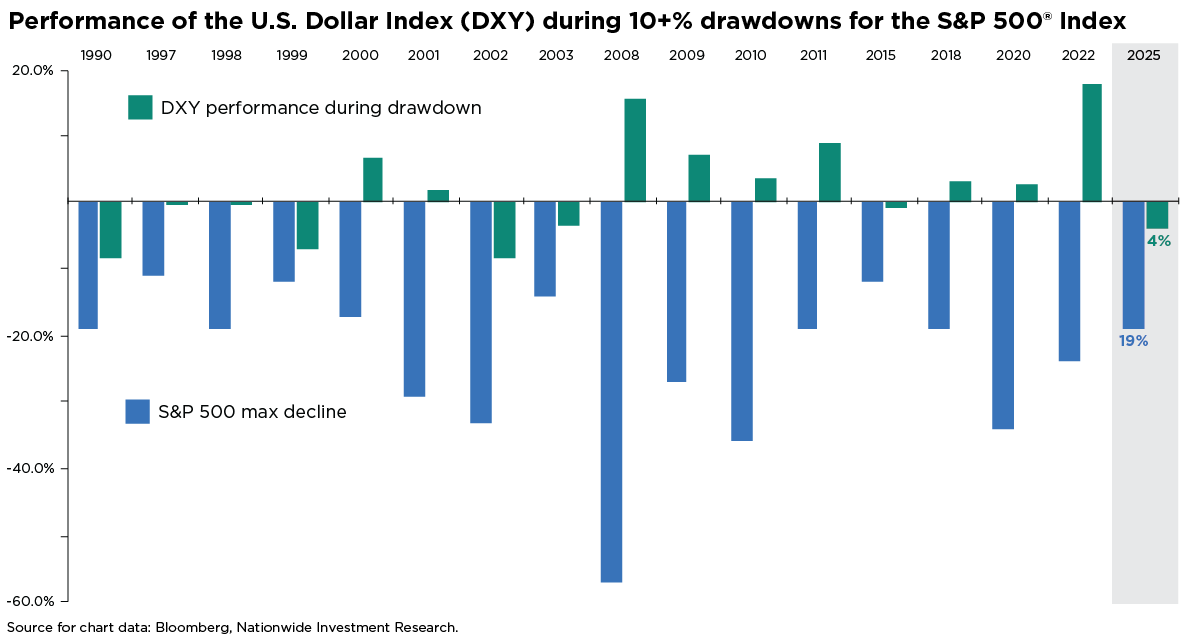

Historically, the dollar tends to strengthen during periods of significant equity market stress. Since 1990, the DXY has typically delivered positive returns in years when the S&P 500® Index experienced drawdowns of over 10%. While the S&P 500 briefly crossed that threshold earlier this year—before recovering—the dollar has moved in the opposite direction, defying the usual pattern.

Should investors be concerned about the U.S. dollar’s future? Some might view its recent weakness as a sign that the dollar’s role as the world’s reserve currency is fading. More likely, though, it reflects a mix of short-term factors currently putting pressure on the currency.

Before diving into recent developments, it’s worth stepping back for some historical perspective. The U.S. dollar has long cycled through periods of strength and weakness. In 2024, it rose 7%—despite two Fed rate cuts, recurring growth concerns, and election-related uncertainty. Looking further back, the DXY Index peaked in September 2022 at a level more than one standard deviation above its 30-year average, marking its most overvalued point since the 1980s (based on the Real Broad Effective Exchange Rate Index). What might feel like a turning point for the dollar could simply be a healthy pullback—not a structural shift.

It’s uncommon to see rising interest rates alongside a falling dollar, but in this case, no single factor seems to be driving the move. Instead, the dollar’s decline in 2025 appears to reflect a mix of market concerns: shifting global trade dynamics, downgraded growth forecasts, widening fiscal imbalances, diverging monetary and interest rate policies, and the repatriation of foreign capital as international valuations become increasingly attractive to investors seeking to hedge their dollar exposure.

The outlook for the U.S. dollar remains uncertain, but for now, it’s reasonable to view the trend as a period of normalization. So, what does a weaker dollar mean for investors? On one hand, it can weigh on domestic returns relative to international markets, as foreign assets gain value when converted back to dollars. On the other hand, a weaker dollar tends to support U.S. corporate earnings by boosting the value of overseas profits and improving the global competitiveness of American companies.

All things considered, the U.S. economy remains one of the most competitive and innovative globally—factors that continue to support the dollar’s role as the world’s reserve currency, even during times of stress. This resilience also helps sustain strong demand from foreign investors for U.S. capital markets.