Key takeaways:

- Credit spreads often provide a more reliable signal of investment risk than stock market movements.

- High-yield bond spreads have remained unusually narrow in 2025, despite persistent economic stressors.

10/29/2025 – While the stock market often grabs headlines as a measure of risk, credit markets tend to offer a more grounded—and often more telling—signal. Movements in credit spreads between bond categories typically reflect real shifts in underlying risk, not just sentiment. Unlike equity markets, which can be swayed by headlines or hype, credit spreads are more likely to move with purpose.

How do credit spreads signal market risk?

Credit spreads represent the additional yield—or risk premium—investors demand for taking on credit risk beyond what’s associated with U.S. Treasuries. The spread is calculated by subtracting the yield on a “risk-free” Treasury bond (backed by the full faith and credit of the U.S. government) from the average yield on corporate bonds, whether investment-grade or high yield. For this discussion, we’re focusing on the high yield segment.

When credit spreads widen, it signals that investors are demanding more yield to compensate for rising credit risk—typically concerns about a bond issuer’s ability to meet interest and principal payments. Slowing economic growth tends to amplify those concerns, pushing spreads wider. On the flip side, spreads narrow when investors grow more confident in repayment, often in response to improving economic conditions.

What’s driving tight credit spreads in today’s market?

That relationship has been put to the test in 2025. Despite a steady stream of economic stressors—persistent inflation, political uncertainty, shifting trade policies, and renewed pressure on regional banks—high-yield spreads have remained relatively tight.

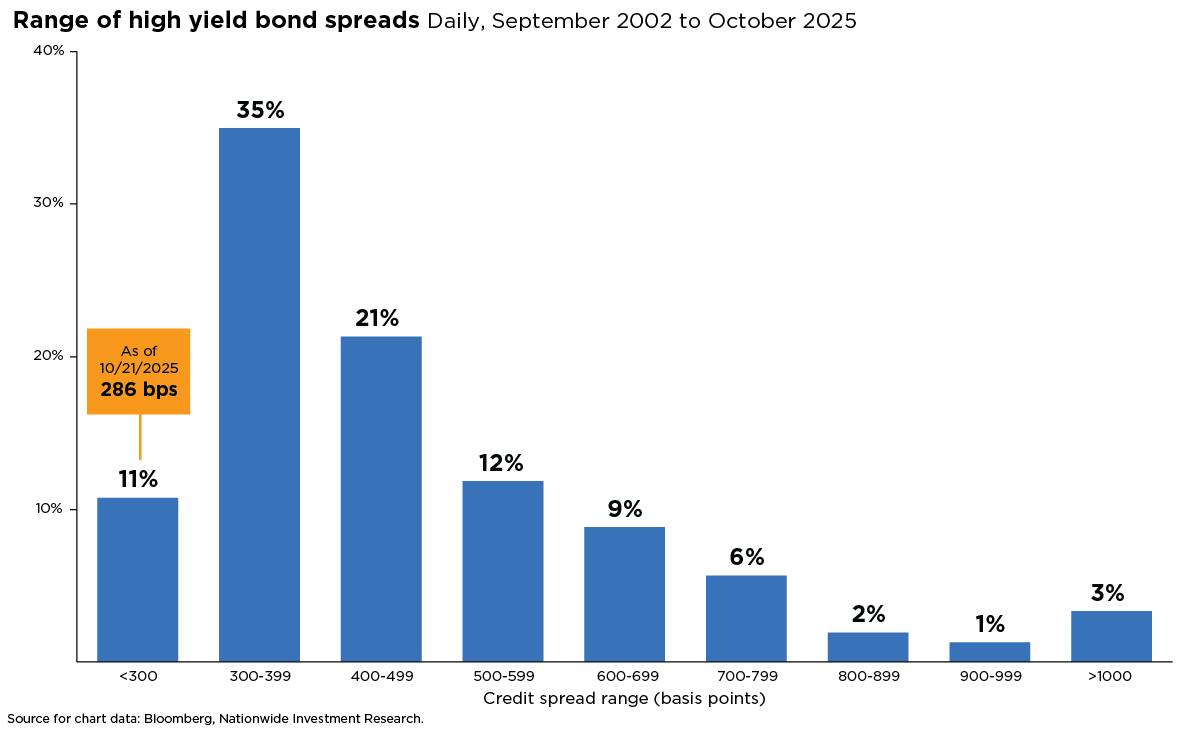

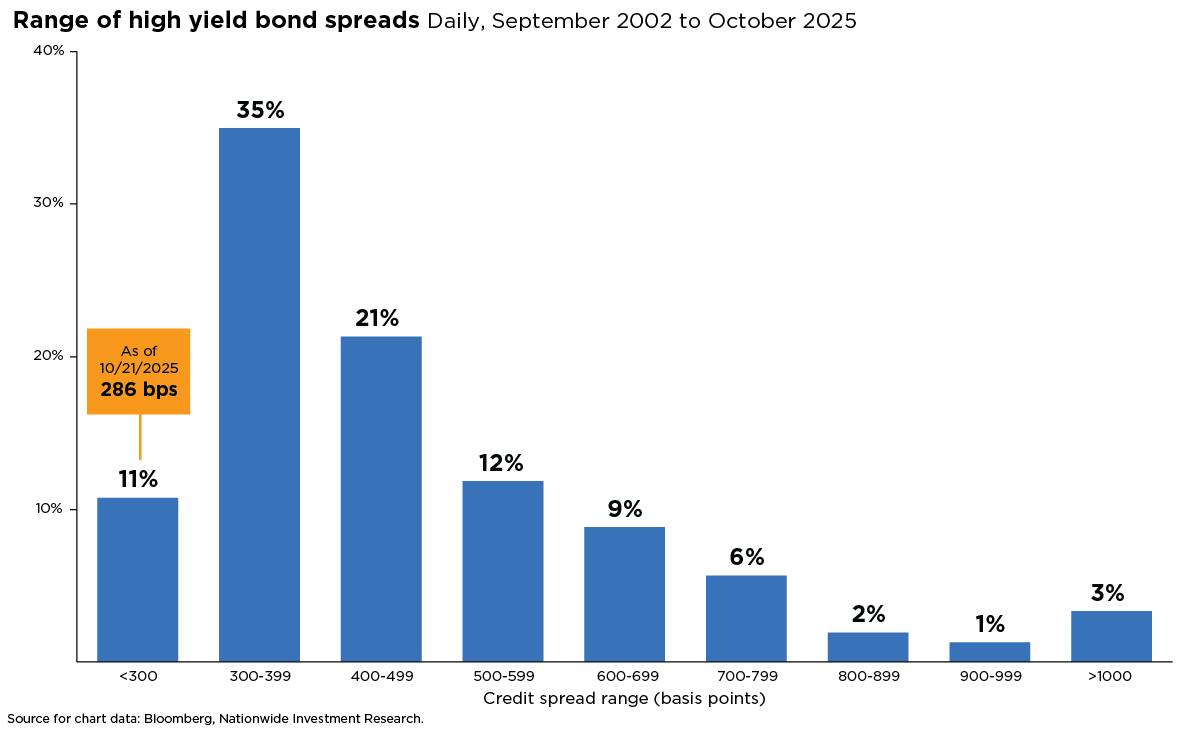

Currently, high-yield bond spreads are hovering between 200 and 299 basis points—a relatively tight range that’s also historically uncommon. As the chart shows, spreads have fallen into this zone only about 10% of the time since 2002. More often, they’ve landed in the 300–500 basis point range over the past two decades.

What risks should advisors monitor despite narrow spreads?

Advisors may be asking what could disrupt the calm currently reflected in these historically tight spreads. To answer that, it helps to first understand what’s been keeping spreads in check. Contributing factors include strong technical tailwinds, resilient corporate earnings, improved credit fundamentals, steady economic growth, and favorable tax conditions. Together, these forces have created a constructive backdrop for bond issuers—and helped attract investors to the asset class, as reflected in continued positive flows into fixed income.

Still, it’s important to caution clients against complacency. Despite the relatively calm signals from credit spreads, bond investors should continue to assess whether the additional yield is truly enough to compensate for the risks they’re taking on. Key risks to monitor include softening labor market data, shrinking profit margins, rising corporate leverage, and weakening coverage ratios.

While not an exhaustive list, these potential headwinds could challenge the current stability in credit spreads. For advisors, maintaining a disciplined approach to fixed income—and staying vigilant as risks evolve—will be key to navigating what’s ahead and supporting sound, risk-adjusted portfolio construction.