Drivers of market movement

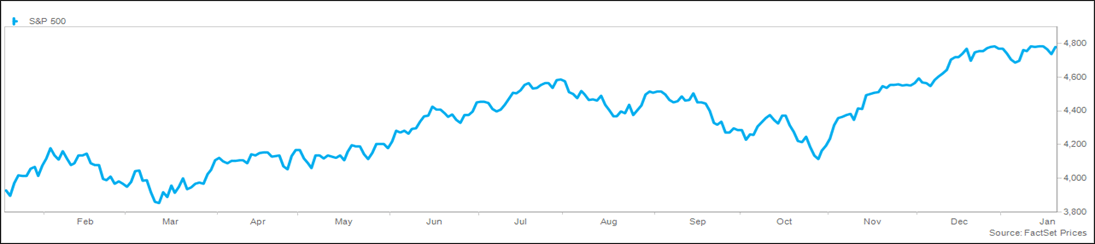

Equity markets managed a modest gain that drove the S&P 500® Index to a record high despite Fed hawkishness and mixed earnings results. The S&P 500 had been in a fairly tight trading range since mid-December, as the market consolidated the impressive gain since late October. The Index struggled to break through the record high from January 2022, managing to do so with a strong move on Friday. The week saw notable dispersion, with the Russell 1000® Growth Index gaining 1% while emerging market equities losing 3%. Interest rates were the lead story this week, with notably higher rates on shifting expectations for Fed rate cuts. The 10-year yield jumped 0.22% to 4.16%, while the 2-year yield surged 0.29% to 4.42%.

The strong market has swayed fund managers to an incrementally bullish stance per the Bank of America Global Fund Manager Survey, with the Bull & Bear Indicator at the highest level since November 2021 and the global profit outlook at a two-year high. Respondents are increasingly confident in the economy, with 79% expecting a soft or no landing, and 17% expecting a hard landing. As recently as October, the numbers were 64% and 30%, respectively. A record number expect lower short-term interest rates, greater than the previous peaks of March 2020 and November 2008. Not surprisingly, "long Magnificent 7" is the most crowded trade, followed by short China equities. Since 2017, long "big technology" has been the most crowded trade in nearly every monthly survey. Lastly, geopolitics is the largest tail risk while concern over a hard landing eased.

Investors have been largely unimpressed by the beginning of earnings season, with 58% of reporters seeing a negative share price reaction despite 92% beating estimates. This is despite the relatively low bar set by the 7% negative estimate revision for the quarter since September. To date, roughly 10% of the S&P 500 companies have reported earnings, with an expected drop of 2% from a year ago. Communication services, utilities, consumer discretionary, and technology are expected to generate double-digit growth, while energy, materials, health care, and financials could see double-digit declines. The bottom-up estimate for 2024 has eased modestly but still reflects 12% expected growth, which is well above the top-down estimate of strategists that suggests 6% growth.

Several members of the Federal Reserve, concerned about aggressive rate cut expectations being priced into markets, have made hawkish comments about the likely path. Atlanta Fed President Bostic recommends caution in cutting rates given the potential economic impact of domestic and foreign geopolitical events. Additionally, he wants to see more evidence that inflation has eased to the Fed’s 2% target, stating that he doesn’t expect to see a rate cut until the third quarter. Governor Waller commented similarly this week, saying, "When the time is right to begin lowering rates, I believe it can and should be lowered methodically and carefully." He does not see the urgency to cut rates at the same pace as previous cycles. This is a sharp contrast to the Fed Futures curve, which embeds more than six rate cuts over the next 12 months and greater than 50% odds that the first cut will come by March and 90% by May. The economy continues to be resilient despite the level of interest rates, with the Atlanta Fed’s GDPNow model forecasting 2.4% growth in the fourth quarter.

Congress passed a stop-gap spending deal to avoid a government shutdown, with bipartisan support in both the House and Senate. The continuing resolution keeps the government open until March, allowing focus on the 12 bills needed for the full-year budget. House Speaker Johnson and Senate Majority Schumer agreed earlier this month to a $1.6 trillion spending deal for the remainder of the fiscal year, but were unable to secure passage, setting the stage for the continuing resolution. Complicating the discussion is the surging budget deficit, with the $510 billion shortfall in the first quarter of the fiscal year foreshadowing $2 trillion for the year. Total federal debt has surpassed $34 trillion, resulting in a colossal burden on the federal budget when combined with higher interest rates. Further, financing costs were $659 billion in FY23 and could rise to over $1.5 trillion, given the current level of interest rates.

Details on performance

Equity markets finally broke out of their trading range, with the S&P 500® Index closing the week at a fresh record high. The S&P 500 gained over 1%, the NASDAQ added 2%, and the Dow added nearly 1%. Growth indexes outperformed value, while large caps beat small caps. Leading sectors for the week included technology, communication services, and financials, while utilities, energy, and real estate lagged. Volatility was elevated relative to the last several weeks, though at below 14, the VIX is below the long-term average. Trading volume was average.

Global markets were weak, with the MSCI EAFE and Emerging Market indexes both underperforming the S&P 500. In Asia, China led the decline with a 5% loss on disappointing GDP data, while South Korea lost 4% and Japan fell 1%. European markets were weak on hawkish ECB comments, driving Spain and the UK 3% lower, and Italy, France, and Germany down 2%. Latin America was weak in sympathy to the global weakness, with Brazil down 4% and Mexico down 3%. The trade-weighted dollar index gained 1% on the week due to higher rates and has now added 2% for the year.

Interest rates surged this week as hawkish Fed commentary and better-than-expected economic data shifted expectations. The 10-year yield jumped 0.22% to 4.16%, while the 2-year yield surged 0.29% to 4.42%, widening the inversion of the yield curve. Credit spreads remain well below average, while global rates surged. Commodity prices eased modestly, with the S&P Goldman Sachs Commodity Index down fractionally for the week and up less than 1% for the year. Crude prices gained 1% on strong macro data and continued uncertainty in the Middle East, while natural gas prices collapsed to the lowest level since April on the prospect of warmer weather across the US. Metals and agricultural commodity prices were mixed.

Money market funds had a rare week of outflows, losing $14 billion. This outflow was roughly equal to the inflows into bonds of $14 billion, including the largest inflow into investment grade since October 2021 ($61 billion). Equity funds lost $900 million, with outflows from mutual funds more than offsetting inflows into ETFs. Investor sentiment deteriorated modestly during the week, with the AAII Sentiment Survey showing bulls down to 40% from 49%, while bears rose from 24% to 27%, though these readings are more optimistic than the long-term averages. The CNN Fear & Greed Index was flat at 71 on a scale from 0 to 100.

What to watch

Earnings season ramps significantly next week, with 15% of the S&P 500 set to announce. Notable economic data include leading indicators on Monday, PMI data on Wednesday, the first look at fourth quarter GDP, durable goods, and new home sales on Friday, and the PCE deflator, and personal income and spending on Friday.

Trailing Twelve Month S&P 500 Chart