Key takeaways:

- Some investors may see the expansion of stock market valuations to historically lofty levels as a sign of trouble ahead.

- Valuations, as measured by forward price/earnings ratios, are often poor predictors of short-term market returns.

- Both declining earnings growth expectations and rising yields could challenge valuations in the coming quarters.

October 30, 2024 – The S&P 500® Index has recorded 47 new all-time highs so far in 2024, an impressive run that many investors view as a positive signal for future stock returns. However, some investors take a more contrarian view of this record-setting rally, seeing stocks climb a “wall of worry” as they reach new heights. The S&P 500’s lofty price/earnings (P/E) multiple, currently at 22 times forward earnings, is another brick in this wall.

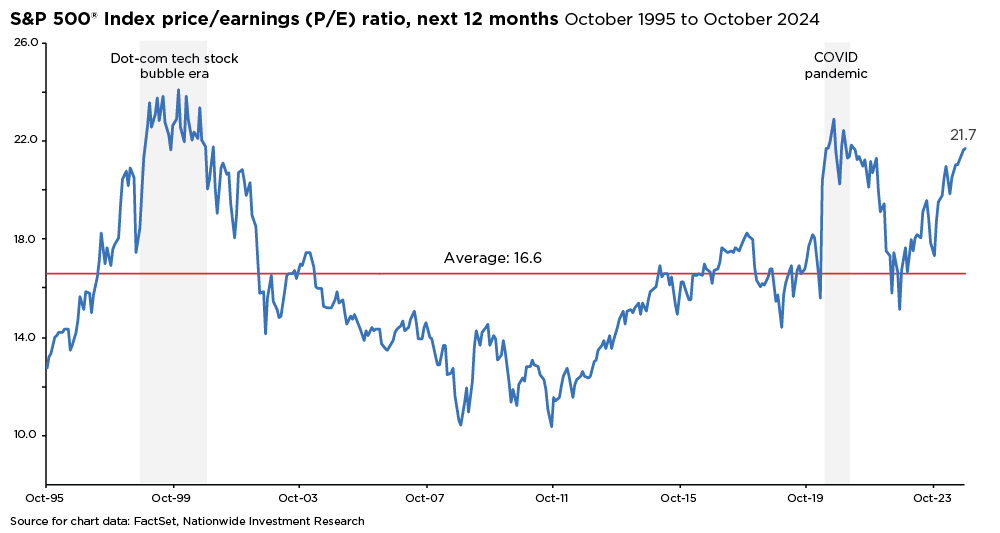

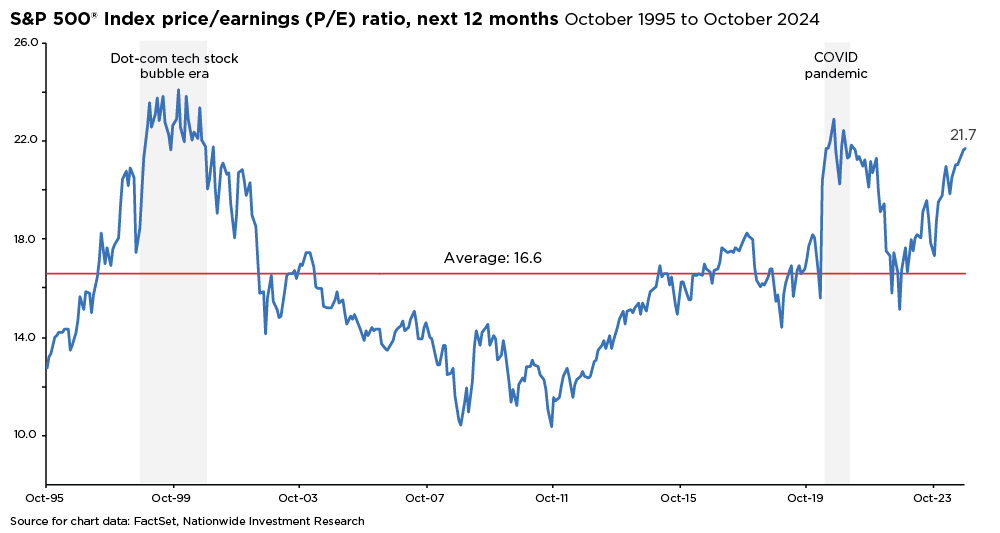

As the bull market enters its third year, the remarkable expansion of valuations for the S&P 500 is noteworthy. The forward P/E ratio has surged 44% since the October 2022 low, accounting for over two-thirds of the Index’s total price return of 64% during this bull-market run. As the accompanying chart illustrates, we’ve only seen valuations at these levels during the peak of the dot-com era tech stock bubble (1998-2000) and the 2020 COVID pandemic.

Given that stock valuations are approaching historically high levels, investors should note the factors driving this upswing and consider the implications of elevated valuations going into 2025. One important lesson to remember: valuations are often poor predictors of short-term returns.

Several factors are driving the S&P 500’s lofty valuation. First, strong corporate earnings and positive GDP growth estimates have created a supportive backdrop for equities over the past two years. Second, abundant market liquidity, influenced by actions from the U.S. Treasury, has significantly countered the Federal Reserve’s tightening policies. Third, record equity buybacks among companies, totaling around $1 trillion so far in 2024, have provided a supportive foundation for valuations. Fourth, the Index’s dominance by the “Magnificent Seven,” representing about 30% of its market capitalization, has bolstered valuations. Fifth, prevailing optimism surrounding artificial intelligence has fostered a euphoric sentiment, further inflating market valuations.

Altogether, these elements have created a complex interplay of growth, demand outstripping supply (via buybacks), and bullish sentiment that supports the current market landscape. However, it’s reasonable to assume that multiple expansion is unlikely to be the primary driver of equity returns as we look toward 2025. Instead, earnings growth should become more important for sustaining the stock bull market. Further valuation increases may show that multiple expansion is poised to become a headwind, challenging long-term equity returns.

Two primary catalysts could challenge valuations in the coming quarters: declining earnings growth expectations and rising yields. Investors should carefully monitor earnings growth estimates for any signs of weakness, as any divergence between fundamentals and price action could act as a headwind. Analysts have been lowering their 2025 earnings projections, and while valuations have not yet been affected—a win for the bulls—material declines in earnings expectations could cause stock valuations to falter.

Yields also warrant attention. Any unexpected increase in yields—because of inflationary pressures or better-than-expected growth, for example—could temper the S&P 500’s high valuations. For these reasons, investors should always have a financial plan in place and explore various diversification strategies with their financial advisor to help them stay on track during periods of volatility to achieve their long-term goals.