Key takeaways:

- Investor concerns about tariffs could become reality if rising input costs place pressure on future earnings growth.

- Investors should monitor risk and market valuations as tariff and trade policies develop in the coming months.

02/19/2025 – The specter of tariffs has injected a renewed sense of uncertainty into the markets. With trade policies subject to abrupt shifts, investors are grappling with the implications for economic growth, corporate margins, and the direction of Federal Reserve rate decisions.

The recent churn in the stock market likely reflects this unease, echoing the tariff turbulence of 2018. While the economic backdrop differs today, the underlying theme remains unchanged: uncertainty over policy direction, the risk of inflationary spillovers, and the broader implications for corporate fundamentals.

Investors should be mindful that any analysis of tariffs carries the distinct risk of becoming outdated rapidly because of the swiftly evolving nature of tariff policy. Similarly, much of the discourse about the economic costs of tariffs and potential retaliation may overstate the impact of briefly applied punitive tariffs.

That said, the nuances and range of policy levers that the new administration might employ when negotiating with other countries mean investors should monitor risk and market valuations. Various potential outcomes in the coming months will likely heighten market volatility.

As domestic politics develop, the economic impact of tariffs will hinge on their duration, extent, and potential escalation. Trade uncertainty will likely shape investors' interpretations of incoming economic data, such as the most recent Consumer Price Index (CPI) report, further amplifying market volatility as they assess the impact on their portfolios.

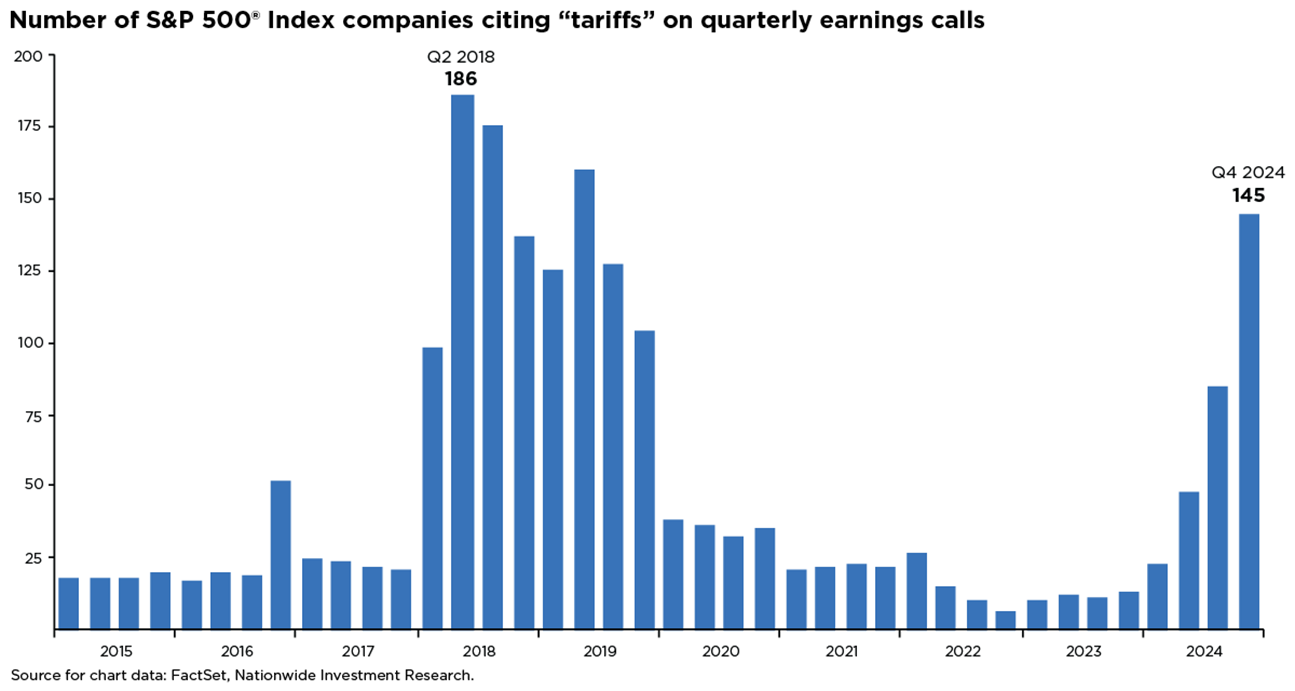

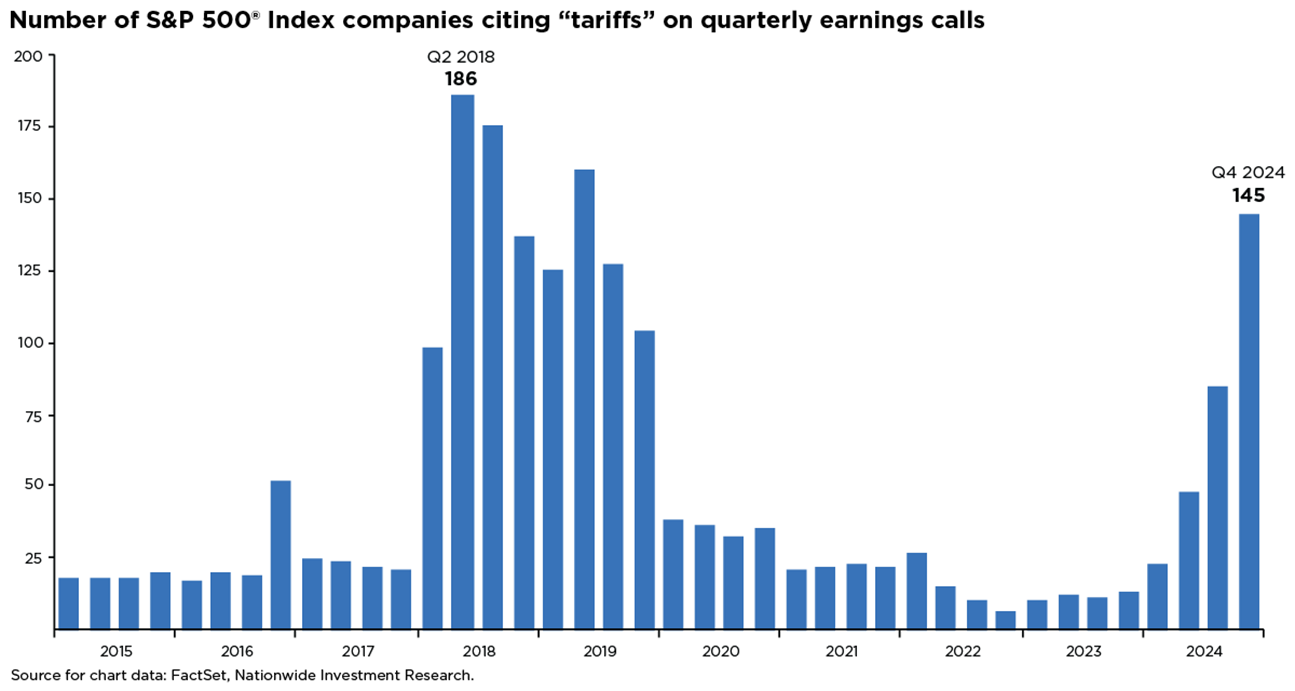

Fortunately, corporate fundamentals remain robust, as evidenced by the fourth-quarter earnings season. However, a lingering fear of tariffs could emerge if rising input costs place pressure on future earnings growth. The debate over tariffs has been a focal point for companies during fourth-quarter earnings calls. According to FactSet, mentions of tariffs on these calls are at their highest level since the second quarter of 2019. References to tariffs have been most common among firms in the industrials, materials, and utilities sectors.

With valuations lofty, earnings growth will likely be essential to drive the market higher in 2025. Recent consensus estimates S&P 500® Index earnings to exceed $270 in 2025, but uncertainty over how businesses might absorb tariff costs or pass them onto consumers could pressure margins and earnings. Different estimates suggest that every 5% increase in U.S. tariffs could trim earnings-per-share by approximately 1-2%.

Investors should brace for a relentless parade of trade policy pronouncements as 2025 unfolds, highlighting why market volatility is an intrinsic feature of the financial landscape. That being said, investors should practice portfolio diversification and focus on their long-term goals to avoid making investment decisions based on the incoming news flow.