Key takeaways:

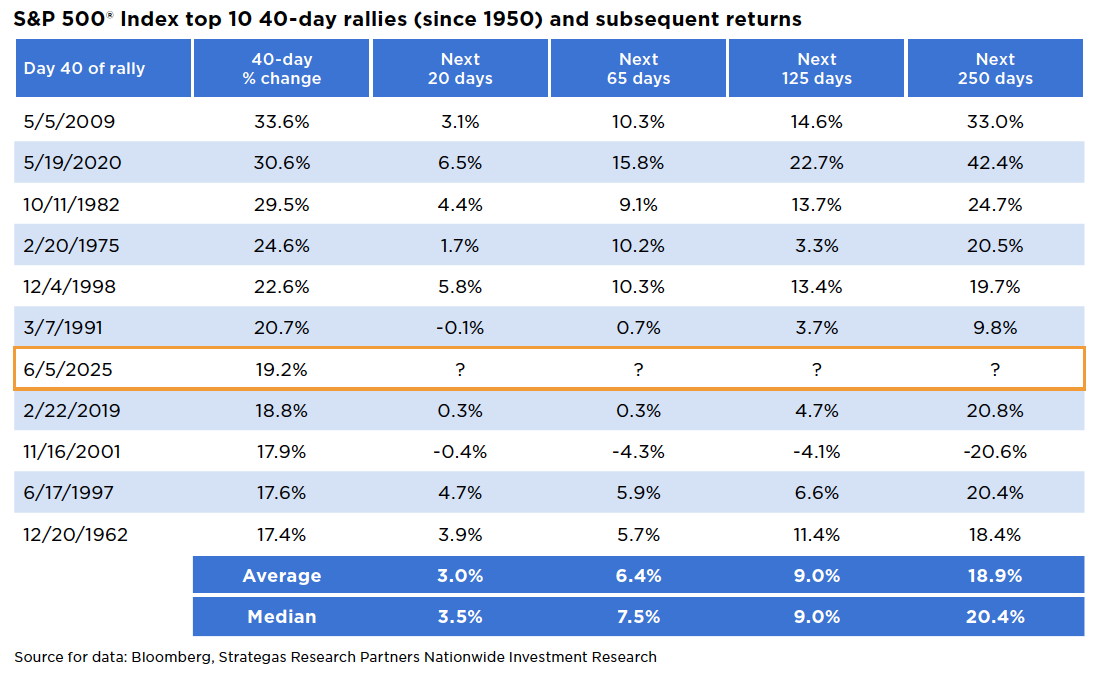

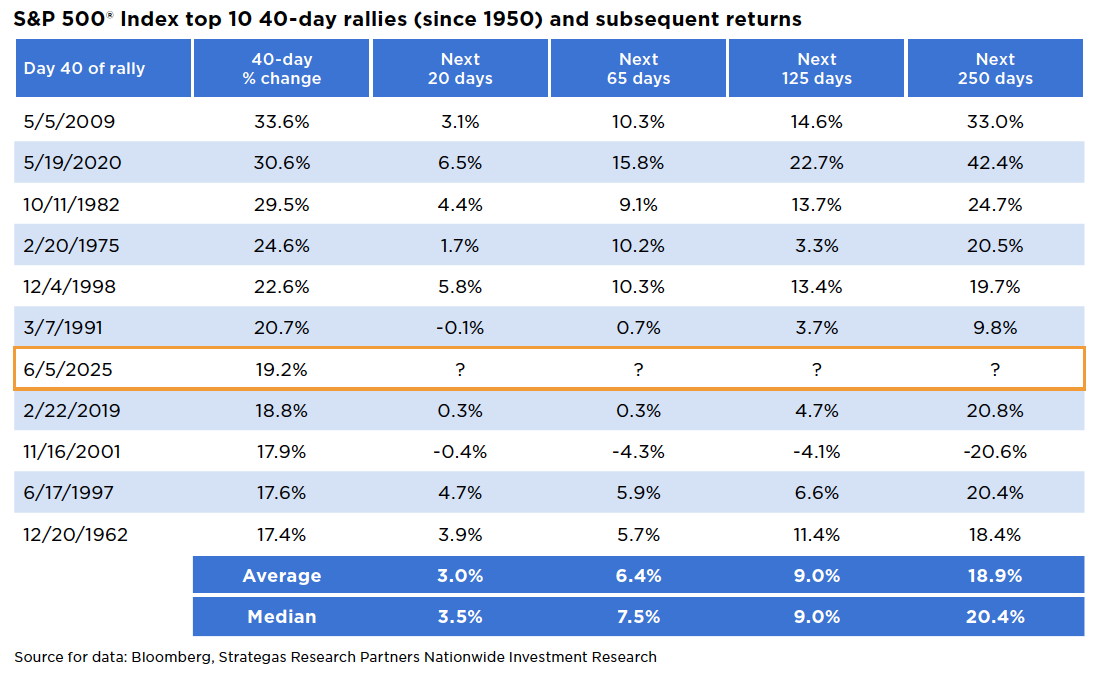

- The stock market’s 40-day rally ranks among the strongest on record—but it’s not without precedent.

- Historically, after similar 40-day surges, the S&P 500® Index has often continued to deliver strong returns over the following 12 months.

06/12/2025 – The S&P 500® Index has staged a strong rally since its April 7 low, following President Trump’s decision to pause his proposed “Liberation Day” reciprocal tariffs. From that point through Thursday, June 5, the index gained 19.2%—marking one of the ten strongest 40-day advances for U.S. equities since 1950.

Investors may question the sustainability of the recent rally, particularly as institutional investors and hedge funds have adopted a more cautious stance. Despite ongoing tariff uncertainty and early signs of trade-related disruptions to business activity, equities have continued to climb the proverbial “wall of worry,” pushing back toward record highs. Looking ahead, some market forecasts suggest that future equity performance may hinge more on underlying fundamental strength.

However, a look at historical data suggests this rally is far from an outlier. The S&P 500’s recent 40-day gain closely mirrors patterns seen in past market recoveries over the last 75 years. Historically, such strong short-term rallies have often been followed by continued strength, with the index typically delivering solid returns over the subsequent 12 months. (See accompanying table.)

Some investors may be hesitant to stay invested—or add exposure—when stocks are at or near all-time highs, especially following a sharp rally like the one we’ve just seen. While equities may remain sensitive to shifts in policy, interest rates, and economic conditions, a choppy trading range or modest pullback shouldn’t be cause for alarm. Given the strength of the recent rally and historical patterns, short-term volatility may present opportunity rather than risk.

That said, elevated market levels shouldn’t deter investors from maintaining equity exposure. Historical data show that investing at or near all-time highs has not significantly diminished long-term returns. This underscores the importance of staying focused on long-term goals rather than short-term market timing.

Looking ahead, economic, geopolitical, and trade-related uncertainties are likely to keep market volatility elevated. Investors can help manage these fluctuations by maintaining diversified portfolios, avoiding market timing—whether at highs or lows—and working with a financial professional to ensure their strategy aligns with their long-term goals and risk tolerance.