08/14/2024 — In recent weeks, investors have endured the kind of volatility not seen since the initial days of the pandemic. Whenever markets swing to and fro, it’s understandable that investors feel the pull of their emotions. A rebound after a down day for stocks, like we saw last Thursday (August 8), may give investors hope for a quick end to the volatility. It may also create fear of a “dead cat bounce,” where the rebound is a prelude to further declines.

Investment managers have a range of technical indicators in their toolboxes that can help them assess market conditions. Credit spreads are one of the more reliable indicators—and one that has historically been a proverbial “canary in a coal mine” for signs of future trouble in the financial markets.

The “spread” is the difference in yields between two types of bonds. Usually, the yield on U.S. Treasuries (and specifically, the 10-year Treasury bond yield) is used as the baseline because Treasuries are considered relatively “safe” securities, given the full faith and credit of the U.S. government backing them. On the other side of the equation are often corporate bonds, either high-rated investment-grade bonds or low-rated high-yield bonds.

What do corporate bonds have to do with the stock market? The size of credit spreads—or, more critically, how the spreads are changing—can give a sense of how investors see the prospects for economic growth, which naturally impacts company results. When economic prospects appear favorable, investors don’t demand as much yield over the yield of “safe” U.S. Treasuries because the risk is low (i.e., investors are confident the bond issuer will pay principal and interest for the bond term.)

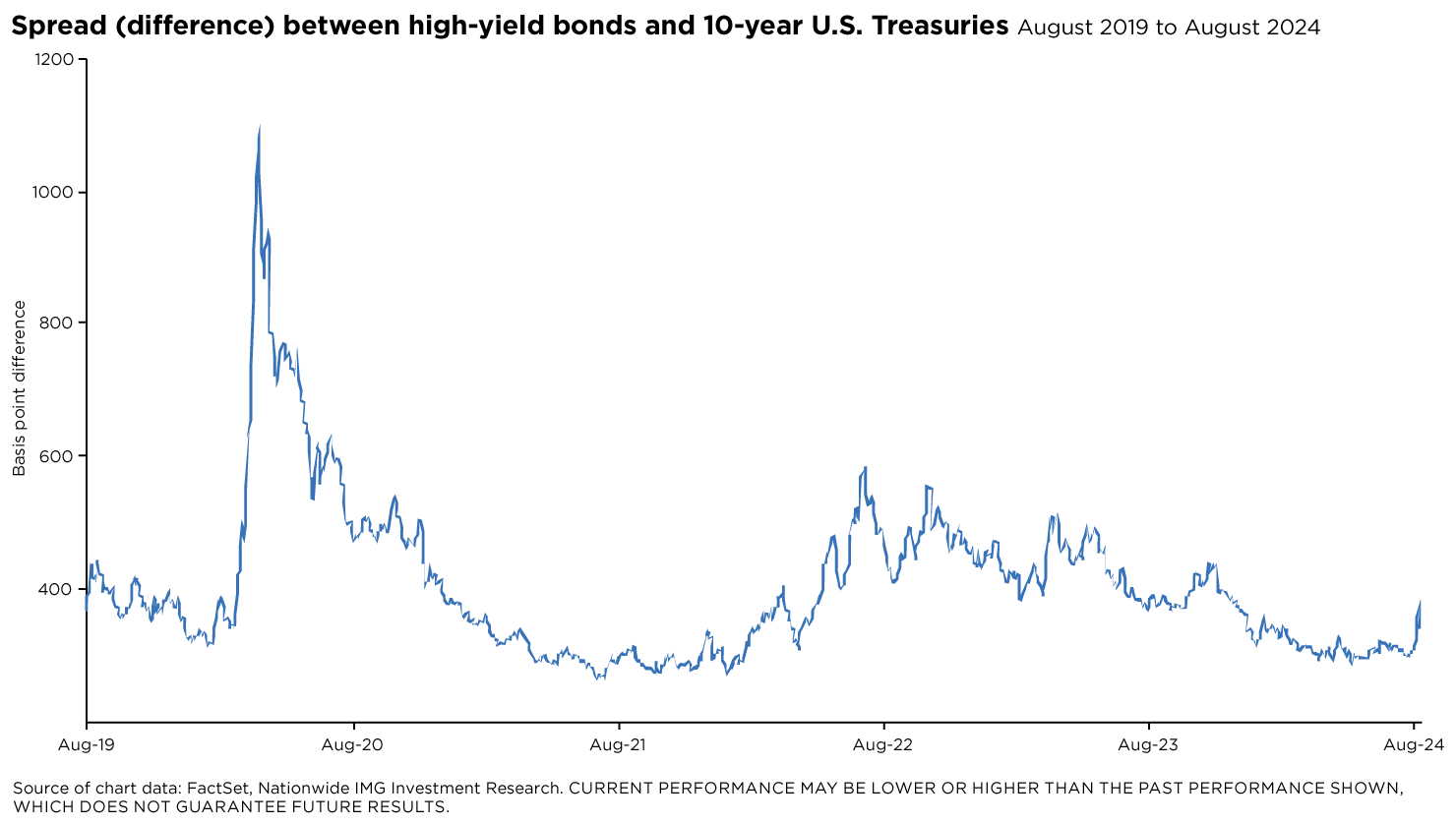

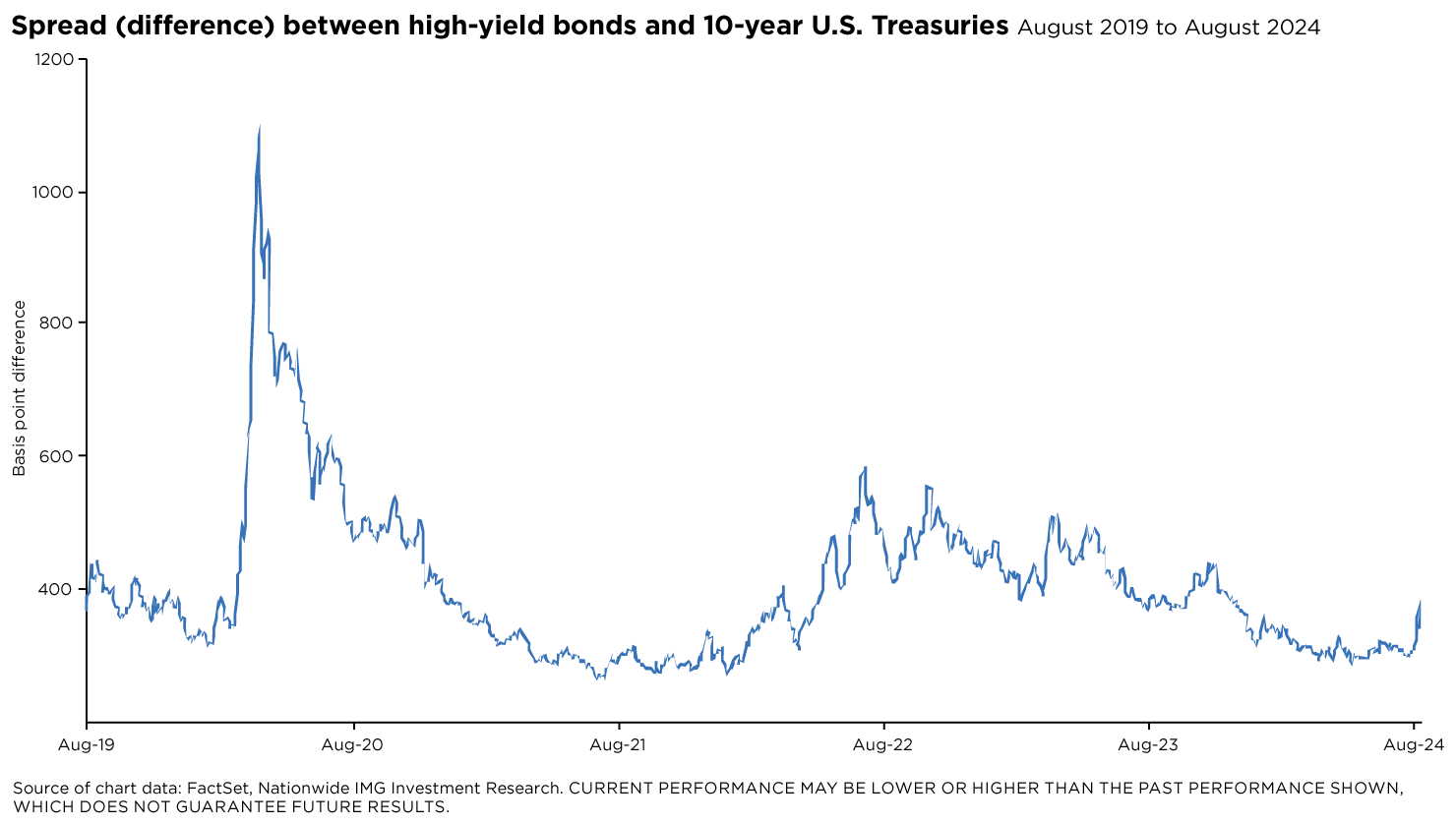

Until the first week of August, the bond market seemed indifferent about the potential for weaker economic growth or a misstep by the Federal Reserve. Then, a shift in the outlook for the economy (partly by weaker employment numbers) caused spreads to widen, particularly for high-yield bonds (e.g., bonds issued by low-rated companies).

On July 24, the spread between high-yield bonds and the U.S. Treasury benchmark was at its tightest level since 2007, approximately 302 basis points (bps). That was well below the median spread of 454 bps since August 2000. Then, because of recent market volatility, spreads increased to 393 bps on August 5—the widest level since November 2023—before settling by the end of the week at 357 bps.

Spreads can also be measured between two types of bond maturities—for example, 2-year and 10-year U.S. Treasuries. A wider spread in these two yields indicates investors see greater risk over the longer term relative to the near term. This also occurred over the past two weeks, signaling a rise in uncertainty among market participants.

While recent moves in credit spreads shouldn’t imply an impending spike in corporate bond defaults or rapid reduction of economic growth, investors can monitor credit spreads for signs of shifting market sentiment to gauge how it may impact momentum in the current stock market environment.