Key takeaways:

- Macroeconomic risks and policy uncertainty are likely to persist through the second half of 2025.

- As in the first half of the year, investors who tune out headlines and stay focused on fundamentals may be well-positioned to take advantage of market opportunities.

07/10/2025 – If you didn’t know how stocks actually performed for the first half of the year (they gained around 5% as measured by the S&P 500® Index) and had only heard about the events—a global trade war, geopolitical strife, a downgrade of U.S. debt, rising inflationary pressures, and a more hawkish Federal Reserve—you might think stocks ended up in the red. It’s likely you wouldn’t believe that during this time, the stock market saw one of its fastest recoveries following a 15% correction on record, or that the S&P 500 was at a record high at the midpoint of the year.

And yet, all of those events unfolded over the past six months—stocks delivered a respectable return. This resilience highlights a key market truth: performance is often shaped less by absolute outcomes and more by steady, incremental progress toward stability.

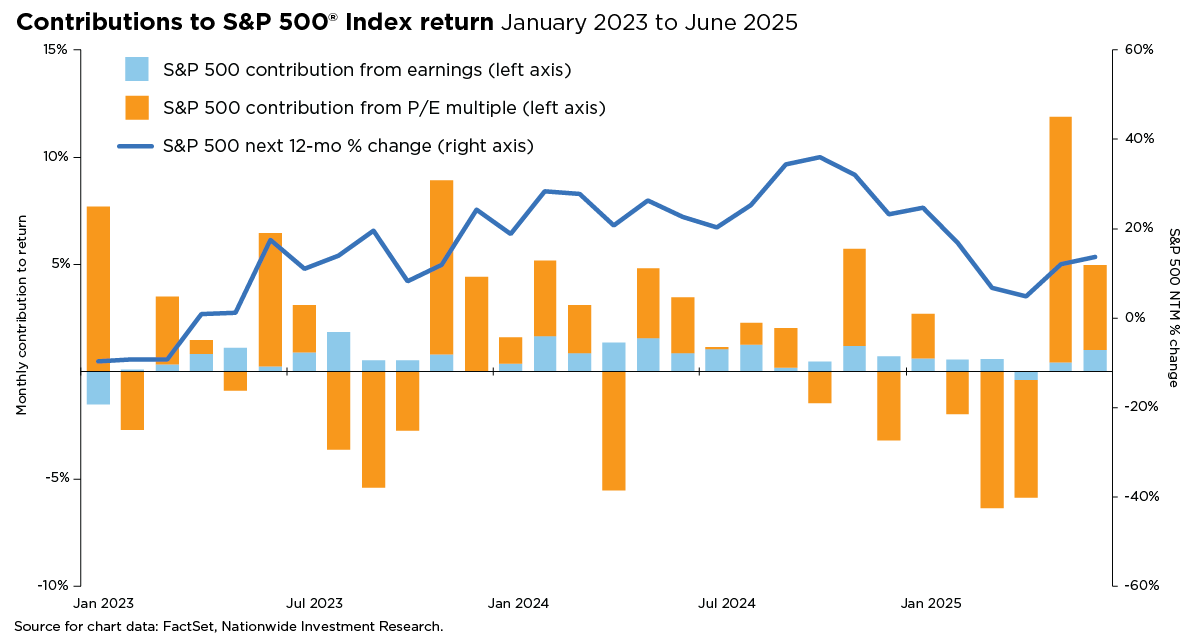

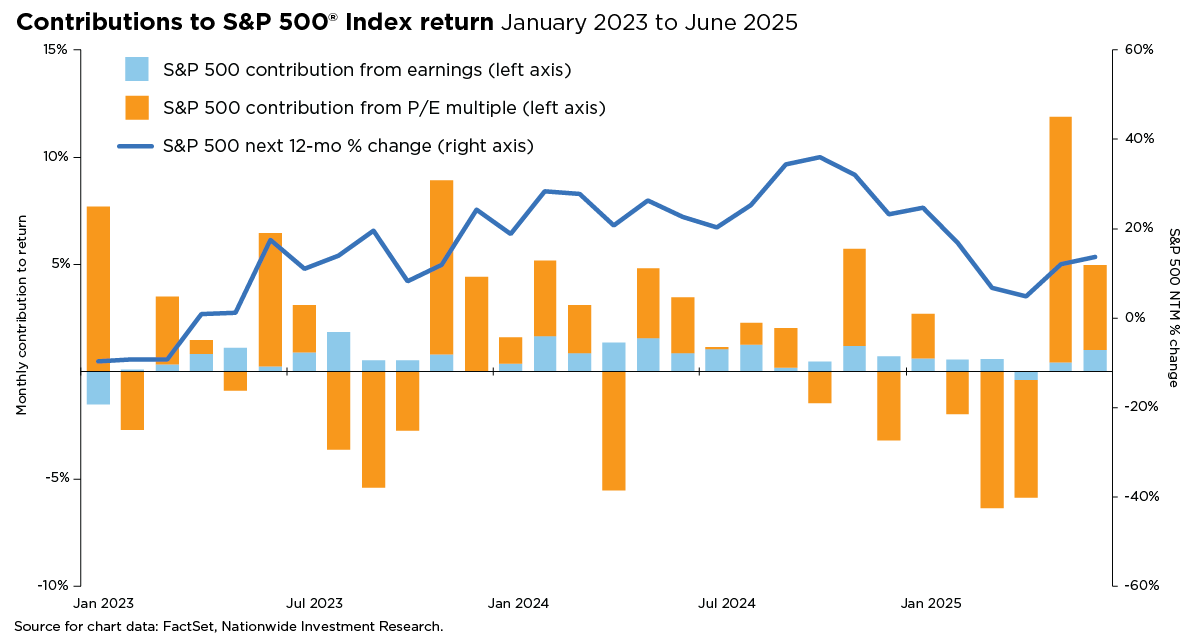

With the first half of 2025 in the rearview mirror, investors are naturally asking what’s next. Macroeconomic risks and policy uncertainty are likely to remain—and with them, continued market volatility. These forces are expected to play out across four key dimensions: valuations, positioning, sentiment, and fundamentals. Starting with valuations: the forward price-to-earnings (P/E) ratio for the S&P 500 has climbed back to 22x, a level that leaves less room for error. Elevated valuations can make markets more vulnerable to negative surprises, creating a more fragile backdrop. Notably, the recent pullback in the Index was largely driven by P/E compression, while the rebound to record highs was powered by multiple expansion. That dynamic could flash a contrarian signal in the near term.

For positioning, institutional investors are still underweight equities relative to historical norms. If the market continues to grind higher, this underexposure could act as a tailwind, as institutions may be compelled to rebuild their equity allocations to keep pace.

Sentiment has improved after a sharp reset earlier this year. However, skepticism and cautious positioning remain high compared to historical norms. That lingering wariness could actually help support the recent rally, especially as investors gain more clarity on tax policy, tariffs, and corporate earnings.

Lastly, fundamentals continue to show resilience. Q1 earnings growth exceeded expectations, and with a relatively low bar set for Q2, muted trade policy developments could provide an additional catalyst. This better-than-feared outlook is reinforced by the recent stabilization in analysts’ earnings revisions for 2025 and 2026.

As shown in the accompanying chart, earnings strength has helped anchor the market amid ongoing volatility. Still, a tough environment for corporate profitability and limited forward guidance present risks to second-half expectations. The first half of the year offered a clear takeaway for the second: tune out the noise and stay focused on the fundamentals. In a market shaped by uncertainty, discipline and perspective remain key.