07/31/2024 — The “Magnificent 7” stocks (i.e., Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA, and Tesla) have powered the current bull market since the low of October 2022. These seven stocks have appreciated so much over this time that, at present, they represent 30% of the overall market capitalization of the S&P 500® Index.

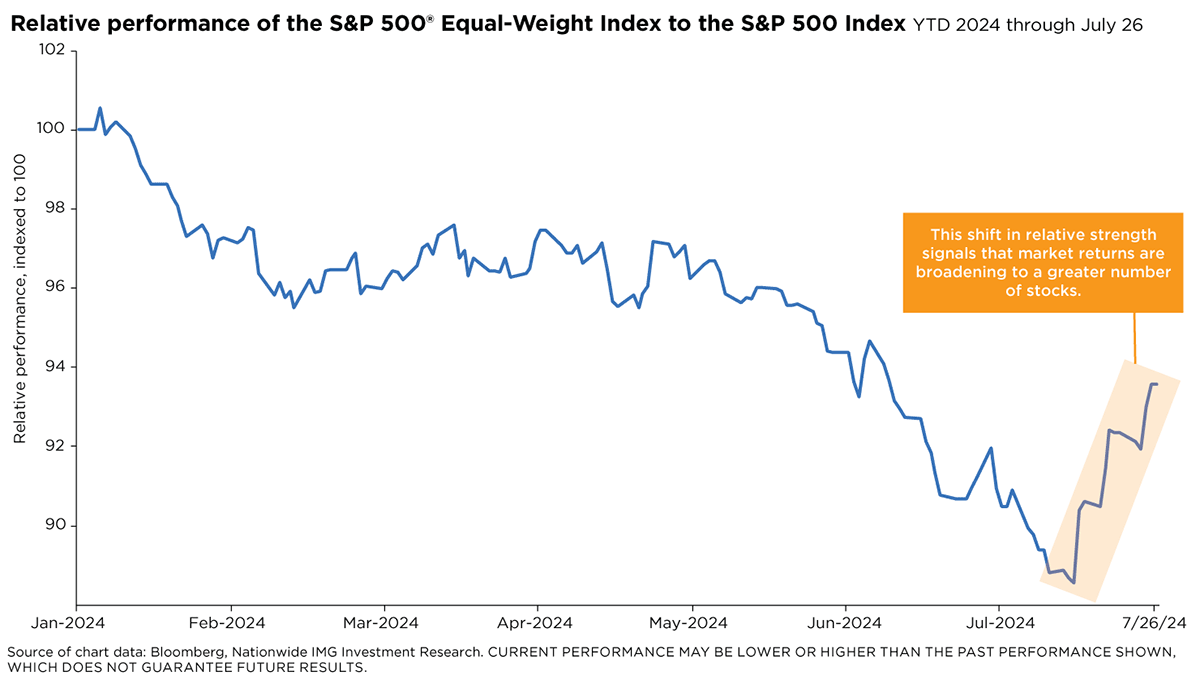

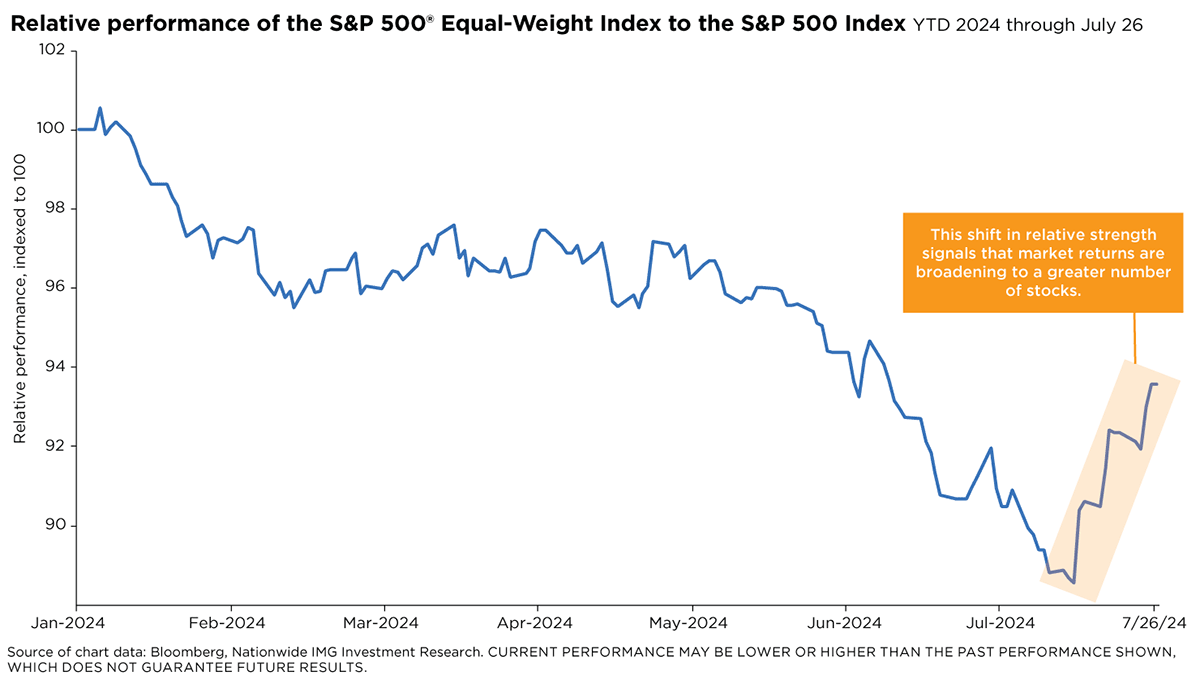

The Mag 7 have collectively contributed around 70% of the S&P 500’s year-to-date gain. However, their performance has slipped over the last two weeks as value stocks, especially small-cap stocks, have assumed market leadership.

Stock market bears see risk in the S&P 500’s overconcentration, which leaves overall Index performance vulnerable to declines in the Magnificent 7. However, the current rotation may reveal a more resilient bull market that’s less dependent on the performance of the Mag 7 stocks.

When the Mag 7 declined, the rest of the S&P 500 followed suit for much of the current bull market. However, in the five days ending July 16, most of the Mag 7 stocks were either negative or flat, yet the S&P 500 didn’t collapse. This could potentially signal a notable change in market dynamics. Over those five days, the S&P 500 rose 1.6%, while the S&P 500® Equal-Weight Index rose 4.4%. The S&P 500® Value Index increased 4.7% during this spell, while the Russell 2000® Index gained a staggering 11.6%.

Market breadth has also improved as stocks outside the mega-cap tech names have outperformed. As of July 19, three-quarters of the stocks in the Russell 2000 Index traded at 20-day highs, compared to just half in the S&P 500. This is not to say the leadership of the Magnificent 7 is ending soon. The recent rotation might reflect, among other reasons, that earnings growth for the Mag 7 may moderate in the next few quarters while the growth rate for the other 493 S&P 500 stocks is forecasted to accelerate over the same timeframe.

That said, investors should not be surprised if the market consolidates soon. For the trend in rotation to become sustainable, we’ll need to see improved earnings growth outside of the Mag 7, resilient economic data that helps buttress lofty earnings expectations, and pronouncements from the Federal Reserve that point toward easing monetary policy.