Key takeaways:

- Help clients manage emotions during market volatility to avoid poor investment decisions and stay focused on long-term goals.

- Use diversified portfolios and a disciplined approach to buffer against market fluctuations and achieve long-term objectives.

03/26/2025 – Volatility is not an anomaly in financial markets; it is a defining characteristic. For investors with long time horizons, the best way to manage volatility is to ignore it; in the past, volatile periods in the market have been short-lived and smoothed out by long-term gains.

That’s easier said than done. Volatility is a problem because it can lead investors to react emotionally and make poor investment decisions. Media coverage of the financial markets often makes this problem worse as news headlines increase the likelihood of emotional investor reactions.

Staying invested through the market’s ups and downs can help investors stay on course toward their long-term financial goals, but that requires patience and discipline, particularly when the market is amid a volatile period.

As a financial professional, the guidance you provide can be valuable to clients during spells of intense market fluctuations. You can help them counter the emotional impact of volatility with prudent guidance and a well-crafted financial plan around their individual goals, time horizon and risk tolerance.

Short-term pain, long-term gain

Underlying any volatile spell in the market is investor emotion. It’s often said that investors climb a “wall of worry” in the short term as different forces push their emotional buttons. That creates ideal conditions for market volatility to start.

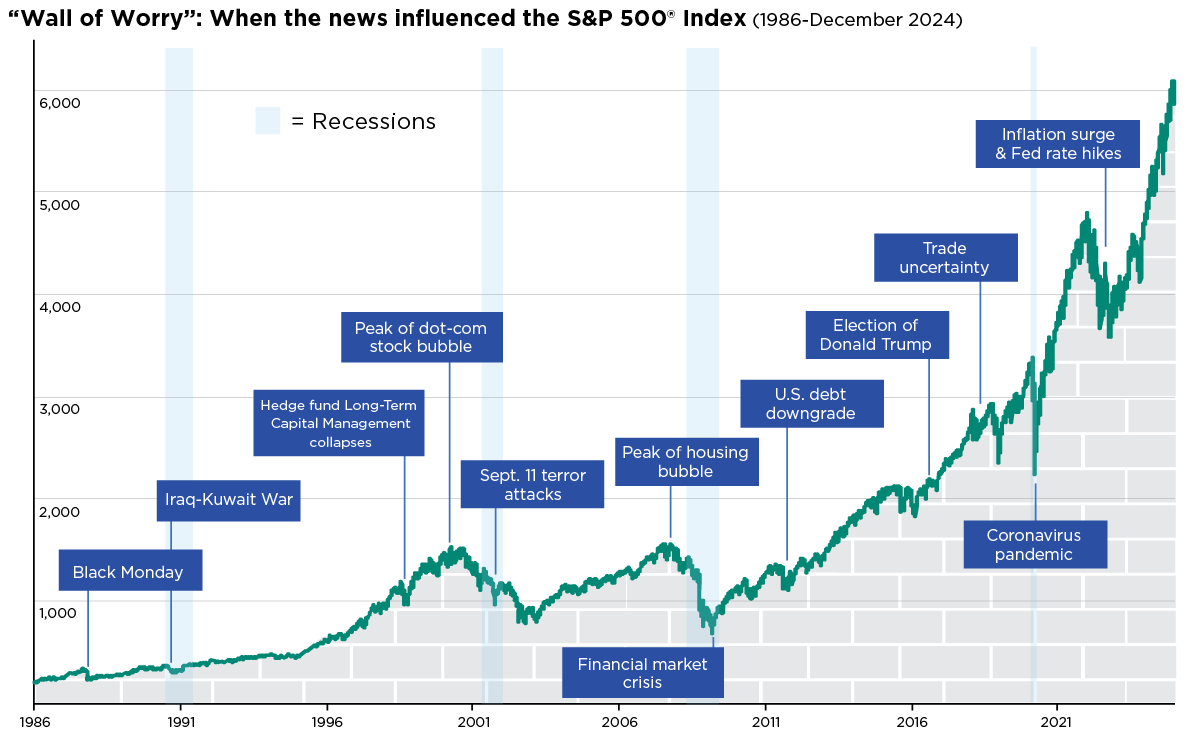

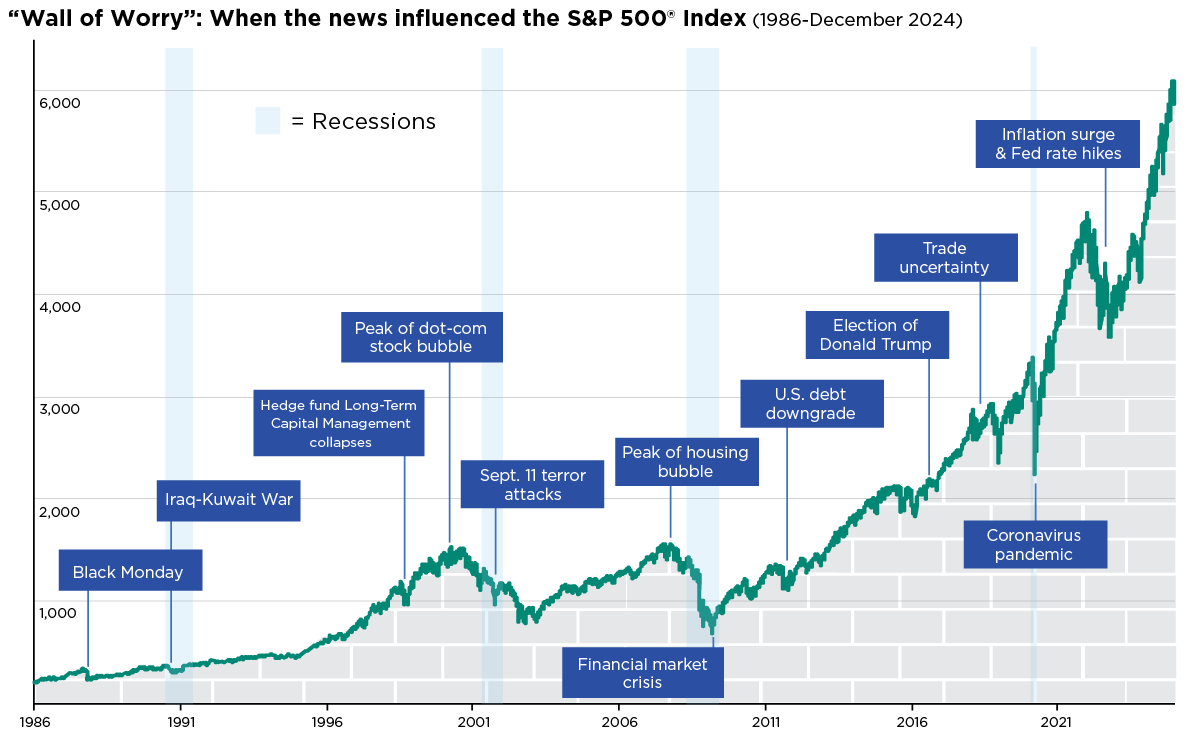

The forces that cause emotional reactions from investors can be internal to the financial markets, like changes in interest rates, or external events like as geopolitical conflicts. As the chart below illustrates, periods of volatility, though often unsettling, have historically proven to be temporary setbacks within the market’s long-term upward trend. In hindsight, what may seem like pivotal moments in isolation often become minor inflections.

Framing market volatility within the “wall of worry” concept can help clients navigate uncertainty with a greater perspective, on devoid of knee-jerk emotional reactions. While market swings may feel sudden and unsettling, they are often the result of concerns that have accumulated. More importantly, history has shown that these periods of turbulence are fleeting and overshadowed by the market’s long-term upward trajectory. To illustrate, the S&P 500® Index is up around 170%, as of this writing, since the COVID bottom, rewarding investors that maintain a long-term perspective.

How volatility affects the "cycle of emotions"

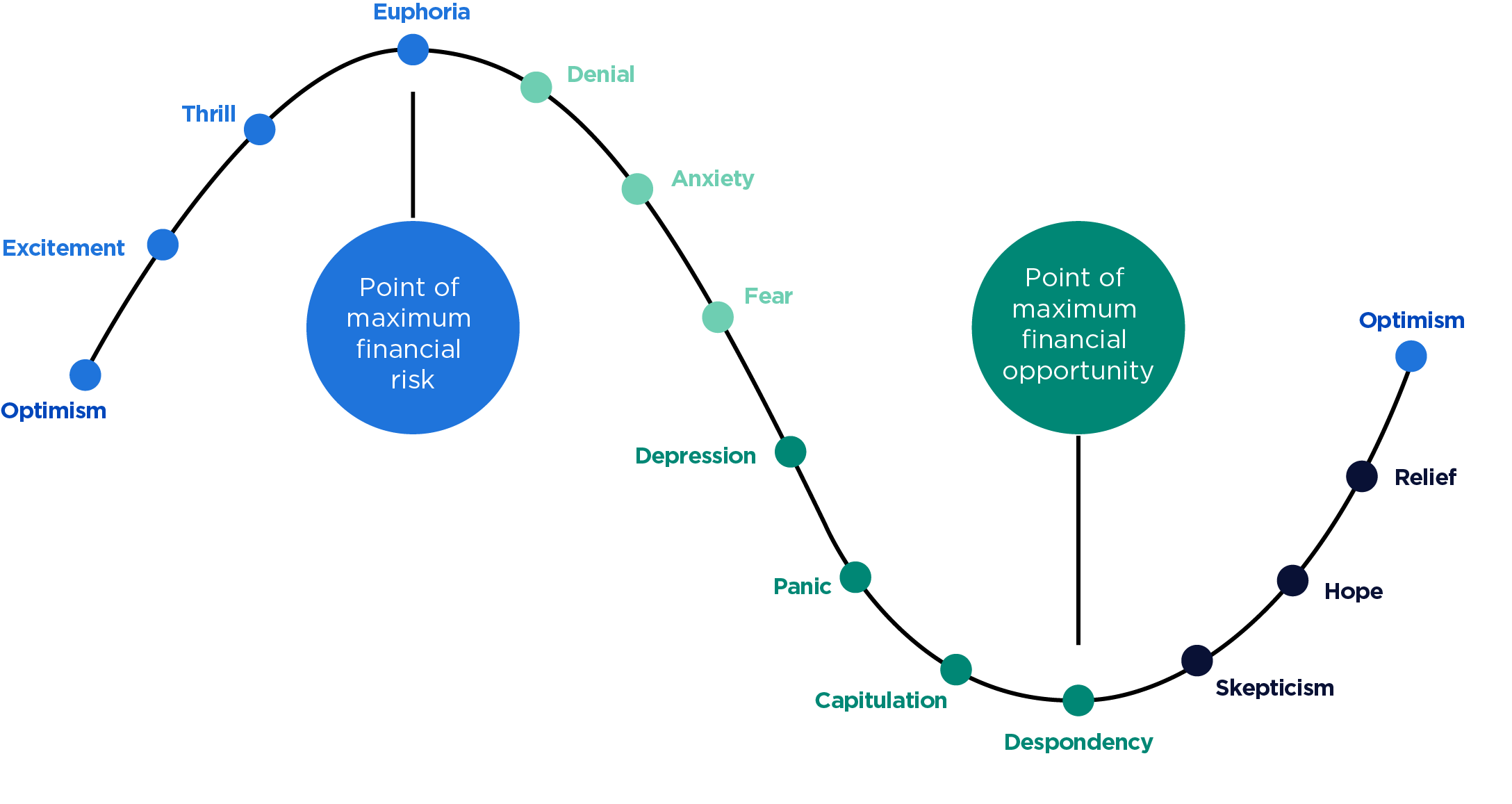

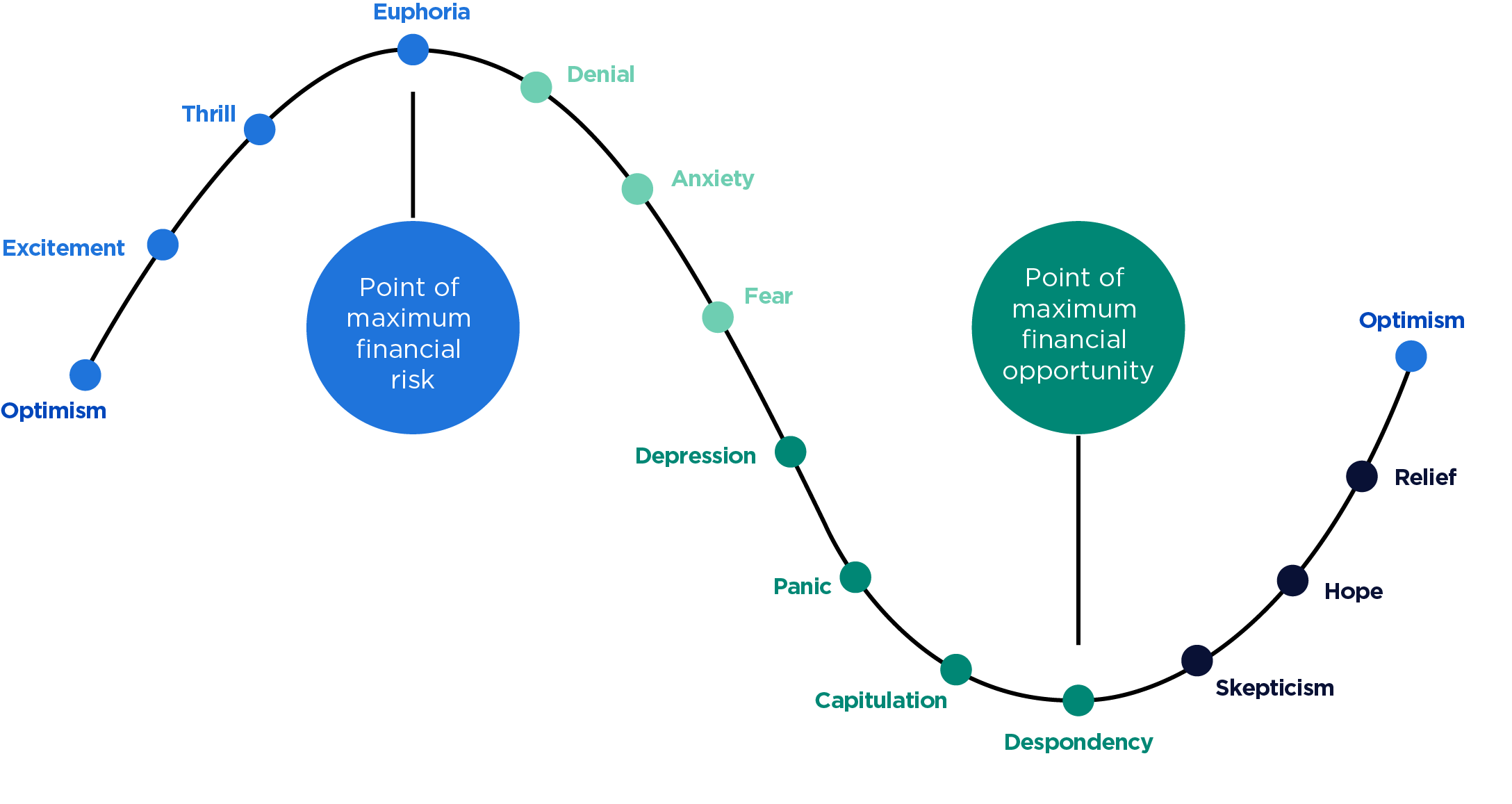

An awareness of the "cycle of emotions" can help investors keep a focus on their long-term investment goals in times of market volatility.

The cycle of investor emotions looks like a typical boom and bust period for the investment markets. For example, as stock prices rise, investors grow more optimistic and more willing to buy stocks, which moves the market higher. Investors continue to buy as optimism turns to euphoria at the market peak.

Then anxiety sets in. Downside volatility triggers fear and panic, leading investors to sell stocks. As the market continues to decline, panic escalates into capitulation, and eventually, despondency takes hold as investors adopt a risk-off stance.

The emotions involved in this cycle can lead to actions that are counter to prudent investment decision making. For example, buying when prices are high and selling when they’re low.

The emotional rollercoaster of investing, particularly panic selling, can severely undermine a client’s ability to achieve their long-term financial aspirations. Selling equity investments after panic sets in—usually at the market bottom—often means investors miss the subsequent recovery.

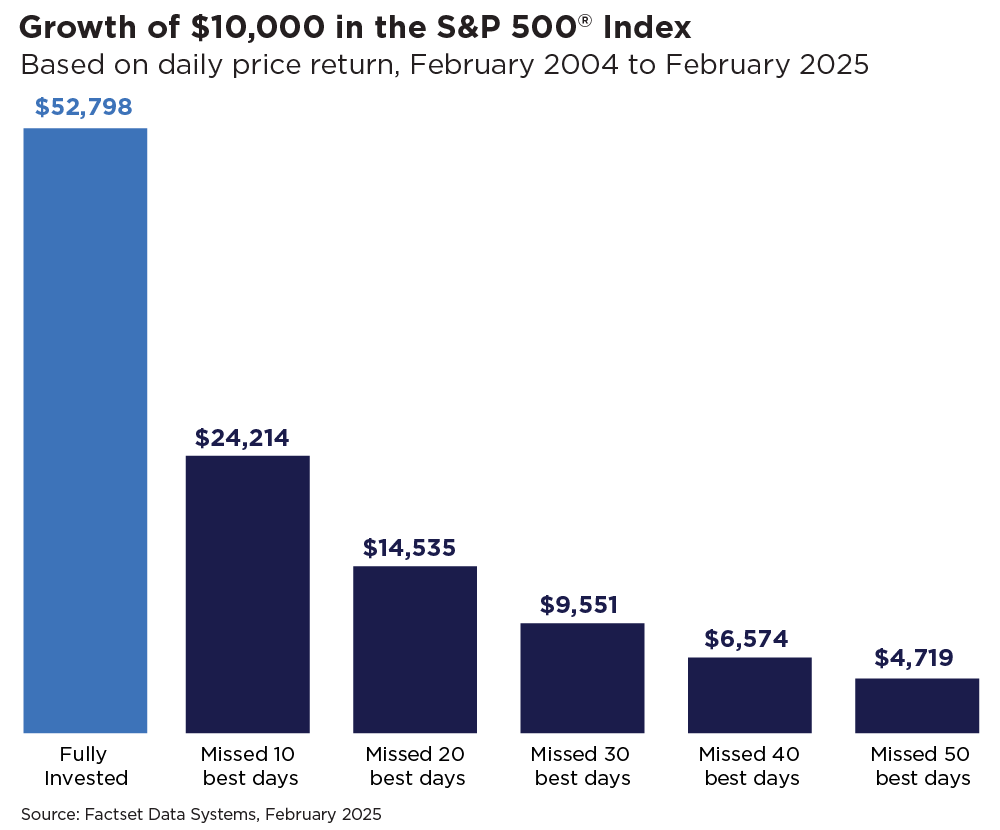

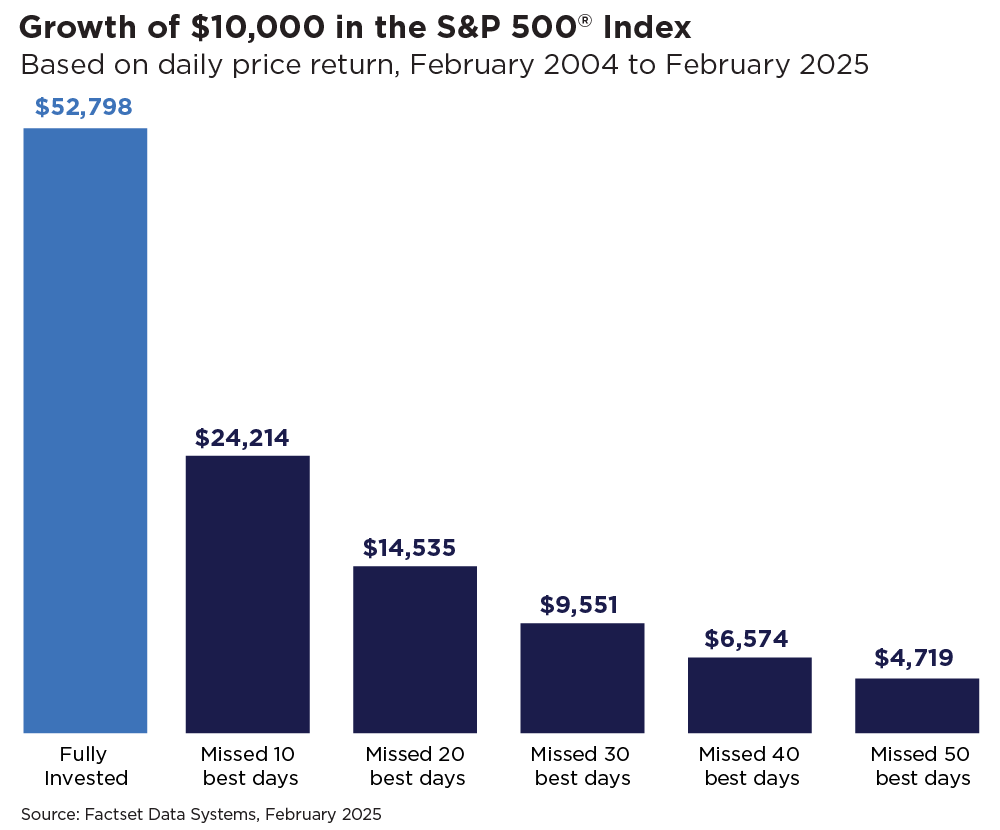

Plus, the rebounds that follow downturns can often include some of the strongest days for the stock market. Missing out on these "best days" can have a detrimental effect on the value of an investment portfolio. As the chart below shows, the more days that are missed, the worse the consequences can be.

Bad investment behaviors will likely continue until clients break free from the emotional cycle. Many investors may think they can pick the best time to get in and out of stocks, but the emotional nature of investing makes it impossible to time the market successfully. Truly, the best way for clients to reach their goals is to ignore volatility and stay focused on the long term.

How professional guidance helps manage volatility

Yet, this advice may fall flat when investors are feeling the pull from news headlines during volatile market spells. This is when the objective guidance you offer as a financial professional can be valuable.

Your role as the "voice of reason" can help countered the emotional reactions that often blossom in volatile markets and help your clients stick with their investment plans.

One of the best ways you can reinforce this guidance with clients is by building their investment plans around portfolio diversification, which helps investors take advantage of the performance differences between asset classes. A diversified portfolio helps investors by building a buffer against volatility and making a client’s investment portfolio more resilient to market fluctuations.

Help your clients regulate their emotions during market volatility by sharing resources that explain the cost of emotional investing. By tuning out the market noise and maintaining a disciplined approach to investing, you can help clients keep more of the money they save and keep on track to their long-term financial goals.