Markets and economy

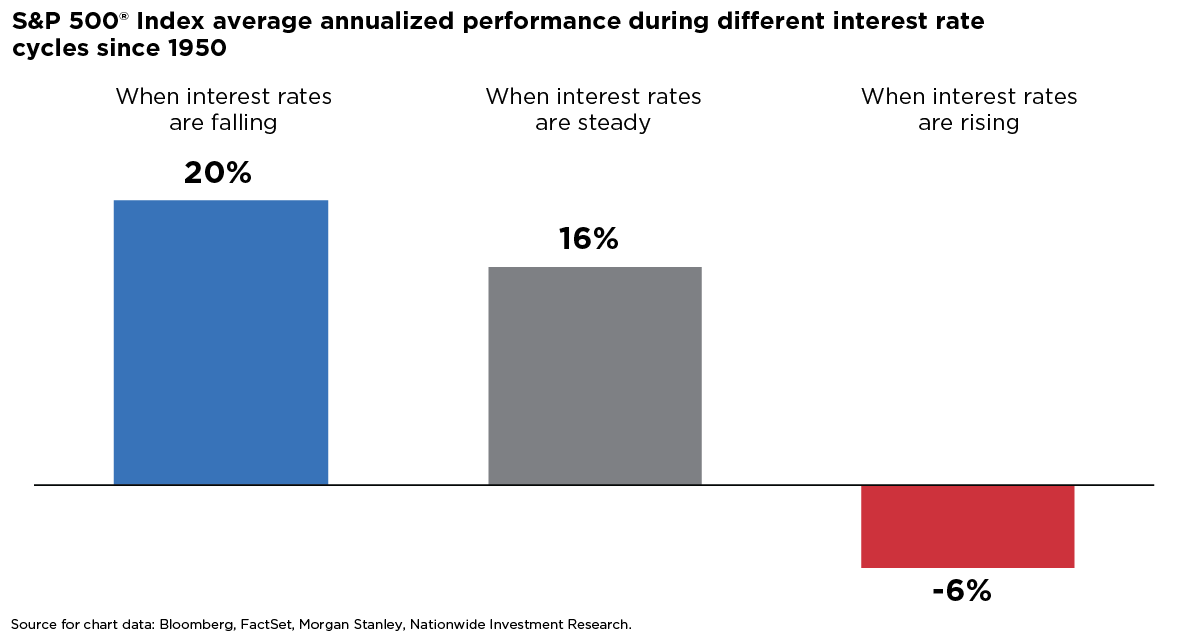

When rates fall, equities often rise—

here’s what history shows

Stay focused when news breaks

Author(s)

Mark Hackett, CFA, CMT

Chief Market Strategist, Nationwide Investment Management Group

Mark Hackett is the Chief Market Strategist for Nationwide’s Investment Management Group, bringing more than 20 years of experience in the asset management industry to the role.

Trending articles

In the coming years, more people will begin to think about the costs of health care in retirement and the possibility of needing long-term care (LTC) in the future, especially as the number of Americans reaching age 65 hits an all-time high this year.

Considerations for financial professionals on supporting retirees through economic uncertainty.

This guide explores strategies for securing long-term care for children with special needs through special needs trusts, ABLE accounts, and government benefits.