Key takeaways:

- After a long period of U.S. stock market leadership, international stocks have rallied in 2025 and outperformed U.S. markets.

- There are many factors favoring international stocks at present, including attractive valuations, improving economic conditions and a weakening U.S. dollar.

- Assessing client allocations to international stocks can help them follow a more globally balanced approach to investing.

10/13/2025 – U.S. investors enjoyed a long period of leadership for domestic stocks over the past two decades. More recently, however, this trend has shown signs of shifting.

In a reminder that markets are cyclical, international stocks have rallied strongly this year and are outperforming U.S. markets. The MSCI EAFE® Index, which tracks developed-market stocks outside of the U.S., has soared over 26% for the year-to-date, while the S&P 500® Index lags with a year-to-date return of just around 15%.

Investors who are well-diversified in global equities have likely seen the benefit of their international exposure. Unfortunately, many U.S. investors are underweighted to this asset class.

What is portfolio drift? How does it affect client portfolios?

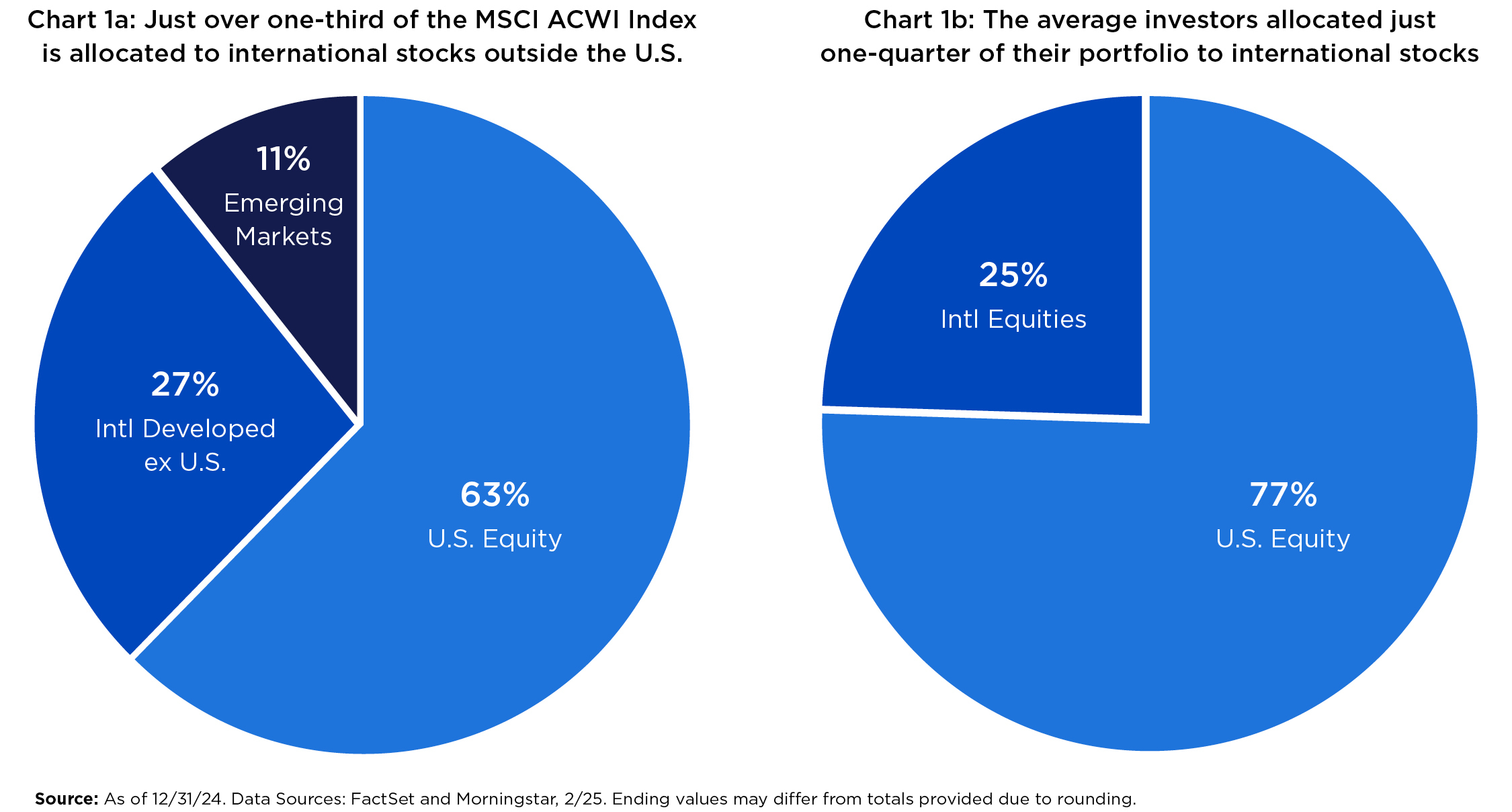

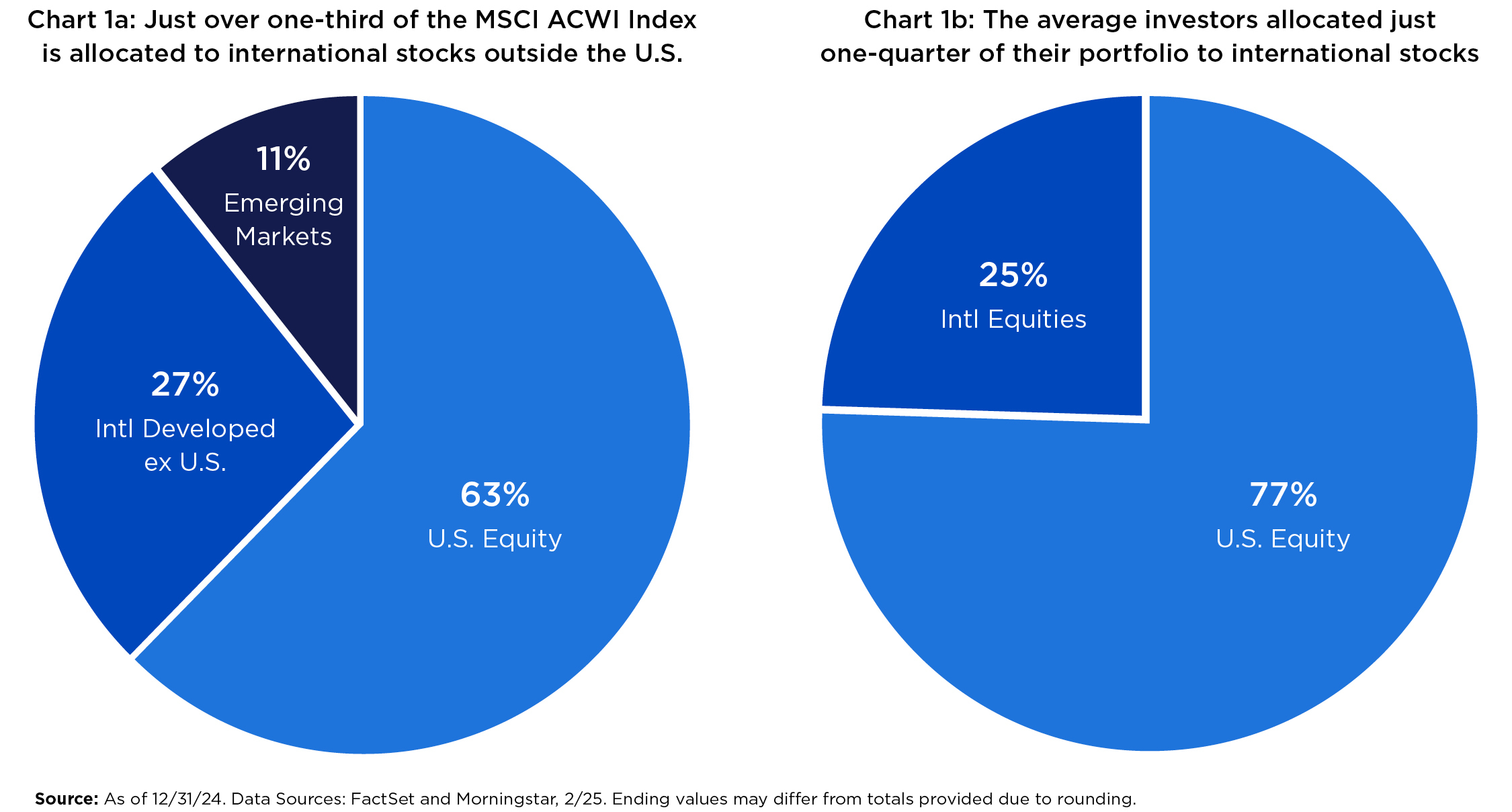

After the extended run of U.S. stocks—powered mainly by large technology firms—many U.S. investors may discover their portfolios have drifted too far toward domestic equities. While non-U.S. stocks comprise nearly 40% of global equity market capitalization (as measured by the MSCI ACWI® Index , the average investor has only around one-quarter of their stock portfolio allocated to international stocks. (See the chart below.)

With momentum potentially rotating to international markets, now is a good time for you to review your clients’ stock exposure and offer guidance on portfolio adjustments so they can participate in the growth opportunity offered by international equities.

There are many forces that typically drive the cyclical trends between U.S. and international stocks, Today, more attractive valuations and improving economic conditions have helped brighten the prospects for international stocks relative to the U.S. But one of the most influential forces is currency valuations.

While the U.S. dollar has weakened throughout 2025, international stocks have soared on the ensuing tailwind. U.S. dollar weakness boosts international returns for U.S. investors by increasing the value of foreign earnings when converted back to U.S. dollars. An appreciating U.S. dollar has the opposite effect, lifting U.S. stocks and weighing on dollar-based international investors. This factor helped U.S. markets outperform in the last decade, but now the effect is happening in reverse.

Why is the U.S. dollar on the decline?

What’s driving the U.S. dollar’s depreciation this year? Easing monetary policy by the Federal Reserve has been a factor; lower interest rates can make dollar-denominated investments less appealing, potentially leading investors to seek higher returns elsewhere and weakening the dollar.

There’s also pervasive uncertainty on several policy issues that have a direct impact on the greenback: trade, taxation and fiscal spending. Today, the U.S. carries a higher debt-to-GDP ratio (at 119.4%1) than most of its developed-market peers. A narrowing gap in GDP growth expectations between the U.S. and other developed economies also sets the stage for a weaker dollar over the medium term—and a potential boost to international equity returns for dollar-based investors.

In contrast, other developed-market economies are showing cohesion, especially in the eurozone. Broader European solidarity on defense and economic reform creates the certainty and stability that investors favor—a very different environment from the discord surrounding the region’s debt crisis in the early 2010s. Moreover, there are early signs of structural shifts in reserve allocations among central banks and a growing chorus about the long-term desirability of the U.S. dollar’s “exorbitant privilege” in global financial markets.

What should clients consider when investing abroad?

Clients may not be so familiar with the opportunities and risks of investing in international markets, and many may benefit from the insights you can offer.

For example, a weaker dollar can enhance returns on international investments, but investors should weigh currency risks and consider active management or diversified strategies when investing beyond U.S. markets.

Additionally, currency hedging can reduce short-term volatility but requires accurate timing. While unhedged international investments may benefit from continued dollar weakness, diversified funds may help manage currency risk more effectively than individual stock selection.

As a financial professional, this may be a good time to sit down with clients and revisit their allocations to international equities. A reassessment can help ensure their portfolios remain aligned with their long-term objectives, while also capturing the potential benefits of a more globally balanced approach to investing.