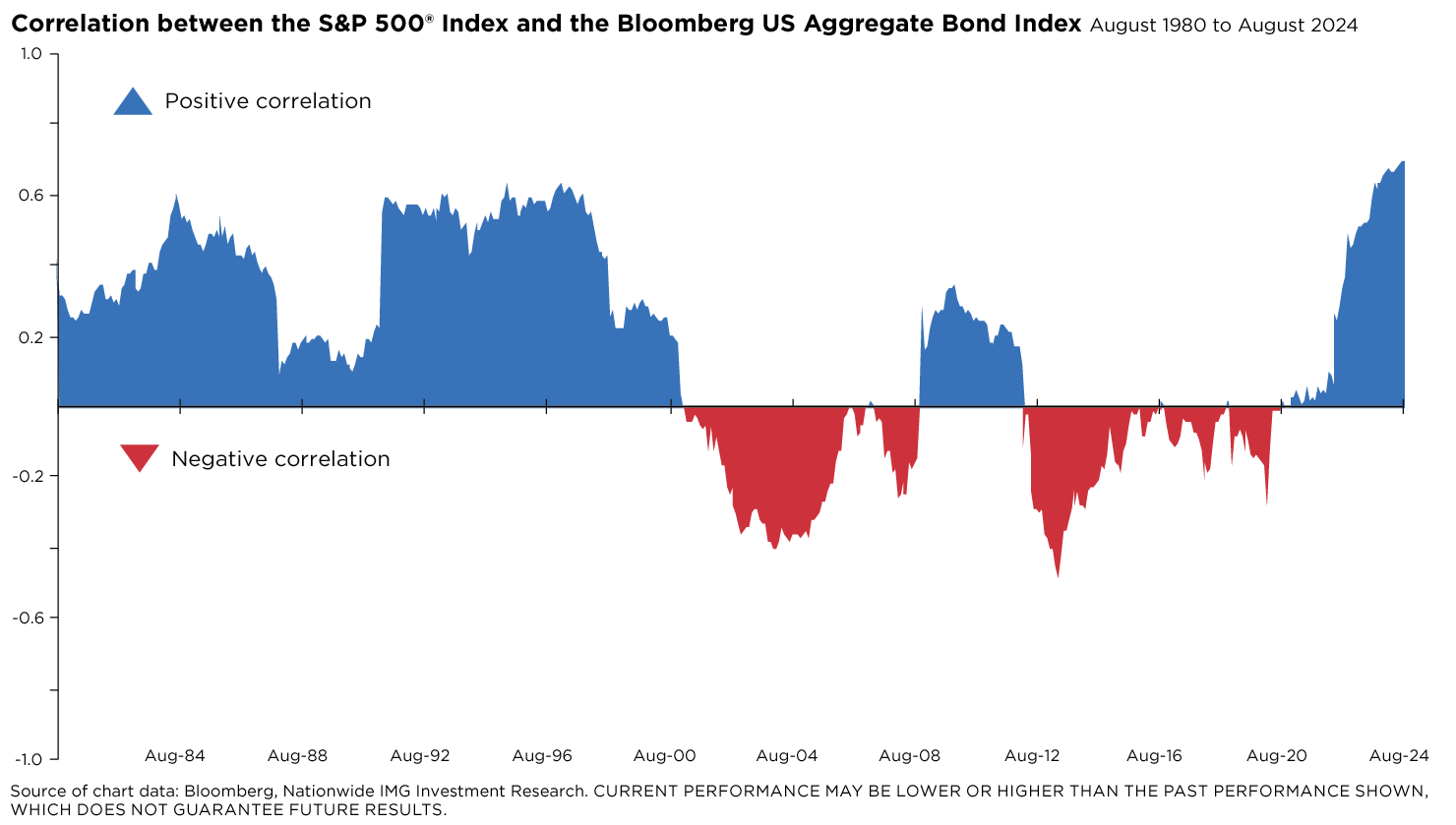

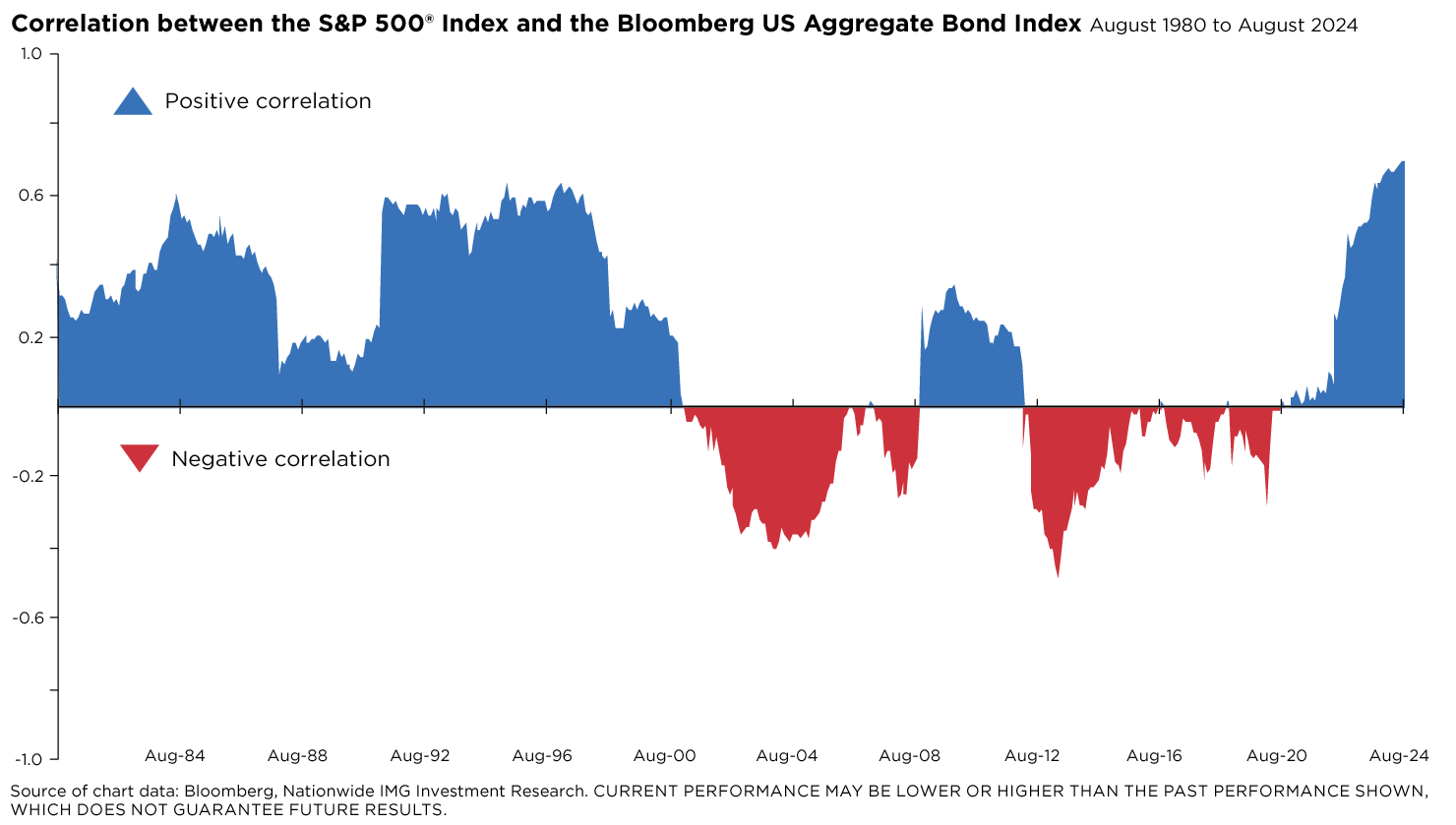

08/21/2024 — If there’s a silver lining to the recent stock market volatility, it’s in the bond market’s performance over this time. Bond values rose during the latest spell of equity market turmoil as interest rates tumbled and recession fears increased. The lift in bond prices provided some ballast against declining stock values, showing the potential for negative correlation with bonds to act as a hedge against stock market risk.

That potential hasn’t been the case for the last several years, as stocks and bonds have moved mainly in the same direction at mostly the same time. The positive correlation between stocks and bonds, especially in 2022, hurt investors in balanced portfolios such as the traditional 60/40 stock/bond blended models. But could we soon see a return to the historically inverse relationship between stocks and bonds, where bonds rise when stocks fall (and vice versa)? If so, that would be a welcome development for investors counting on their balanced and diversified portfolios to keep them on track to their investment goals.

A balanced mix of stocks and bonds in a portfolio typically works well for managing risk because the two asset classes exhibit negative correlation, meaning they tend to perform differently in similar market conditions. That changed with the onset of the COVID pandemic. The quick shift in inflation and monetary policy trends, including one of the fastest increases in interest rates on record for the Federal Reserve, upended the inverse relationship between stocks and bonds. That’s why the traditional 60/40 portfolio suffered greatly in 2022, as stock and bond values correlated positively and declined in tandem.

We have seen more of the same in 2024, thanks to ongoing inflation concerns and the increasing likelihood of a recession. However, the latest Consumer Price Index update, which showed the annual pace of inflation falling below 3% for the first time in three years, may indicate a regime change back to the historical stock/bond relationship. As inflation gets closer to the Fed’s 2% target, interest rates will likely continue to decline. That would help bond values when equity market risk is rising.

Investors should understand that different fixed-income market segments still offer attractive yields and decent downside protection, given that real interest rates are at their highest levels in 17 years. Additionally, investors should carefully consider the term structure and duration of their fixed-income holdings because volatility may likely continue, whether sparked by overzealous hopes for bigger rate cuts or an unorthodox economic cycle that defies expectations.

After several years of bonds offering little protection against stock market losses, falling inflation could pave the way for the traditional stock/bond relationship to return and underscore the benefits of portfolio diversification.