Key takeaways:

- Trends in Q1 earnings reports will shape investor sentiment, portfolio positioning, and market dynamics as the second quarter evolves.

- Investors should temper their expectations for stellar earnings in Q1, given the potential for slowing growth on the horizon.

04/09/2025 – First-quarter earnings season is poised to be an early indicator of the U.S. economy’s resilience in the face of higher-than-expected tariffs announced by President Trump last week on “Liberation Day.” Stock markets reacted sharply to the news, as concerns over rising inflation, disrupted supply chains, and strained corporate profits spread.

More skeptical market analysts argued the tariff threat was already priced into stock valuations, while others contended that the economic fallout hinges on whether the tariffs remain narrow and targeted.

But upcoming earnings reports will be key for investors who are looking for direction amid the political uncertainty and market chaos. Several trends will help shape investor sentiment, portfolio positioning, and market dynamics as the second quarter evolves.

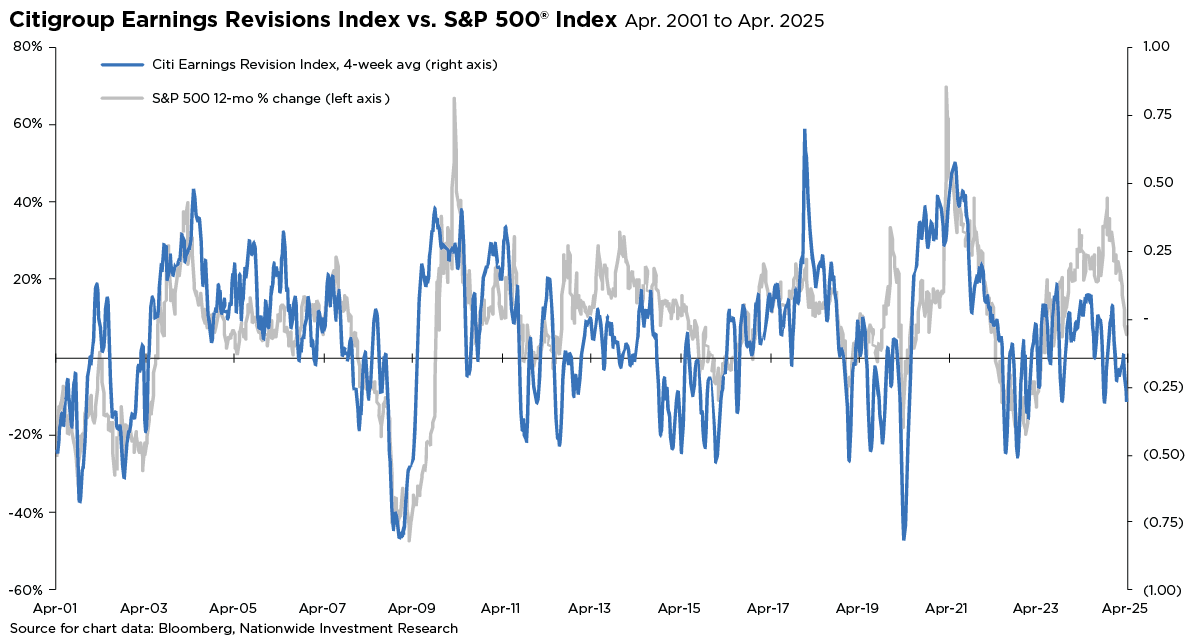

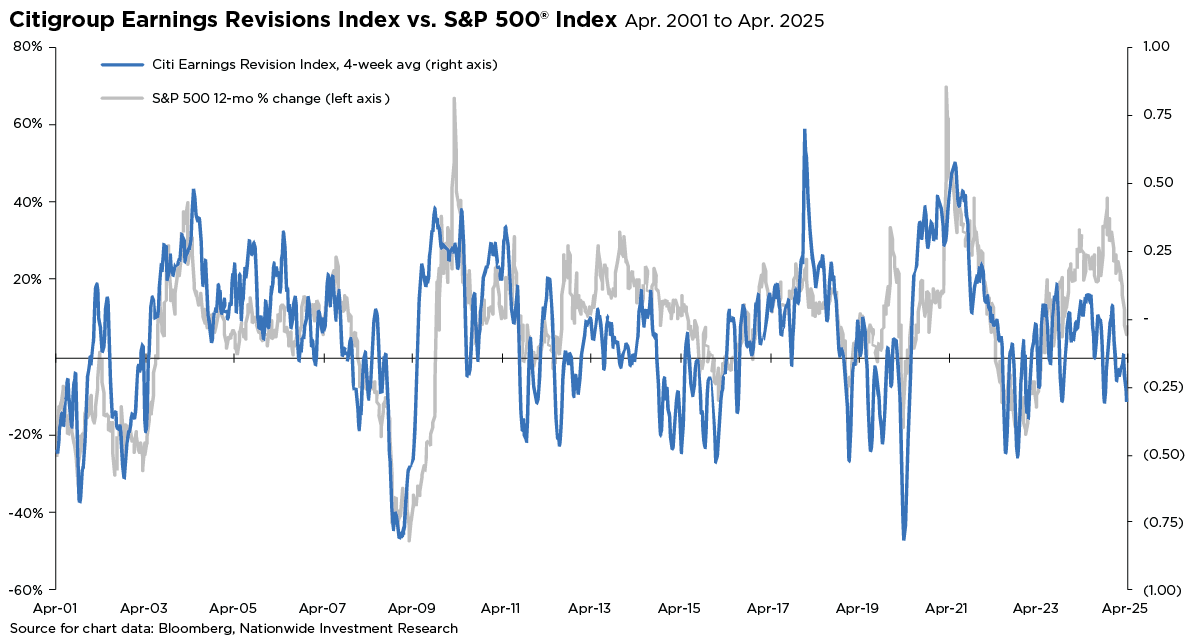

Top of the list is the trajectory of earnings, especially given the likelihood of an economic slowdown that would significantly affect revenue and corporate margins. Further, an elevated increase in recession probabilities likely implies that downward earnings revisions will likely gain momentum as the earnings season unfolds. Investors should also pay attention to the magnitude of earnings beats and corporate guidance on future quarters, particularly as recent soft-data readings such as the ISM Manufacturing survey have signaled weakness.

Investors should temper their expectations for stellar first-quarter results, considering the remarkable 18% earnings growth rate achieved in the fourth quarter of last year. Given the potential for slowing growth on the horizon, investors should be cautious about implied growth rates. For example, 2025 earnings estimates for S&P 500® Index firms have been revised downward over the past few months, likely reflecting the dislocation stemming from policy uncertainty

Curiously, estimates for 2025 earnings still project growth exceeding 10% for the full year, notably higher than the long-term historical average of approximately 6%. A resetting of earnings-per-share (EPS) expectations is likely, raising whether 2025 corporate margins need to adjust downward, especially considering the current macroeconomic backdrop.

CEO confidence during the first quarter was dreary, which might have implications not only for capital expenditures and labor but also for a key theme for this year: a broadening of market performance. If weaker economic growth is confirmed by Q1 earnings and is not merely an aberration, this might drive EPS estimate cuts and further de-rating of valuations, potentially amplifying market volatility in the coming months.

So, what should investors do? Well, the good news is that diversification works. If you have a balanced and diversified portfolio, you’ve likely weathered the pullback better than those with concentrated positions in U.S. large-cap stocks such as the “Magnificent 7.” Also, international stocks are up relative to domestic equities for the year and bond prices have provided a modest level of ballast to portfolios.

For investors worried about the impact of tariffs and the implication on portfolio allocations, sectors such as industrials, technology, and consumer discretionary may be more exposed to tariffs because of their heavier reliance on imports. Financials, utilities, and real estate are more likely to be insulated from a trade war.