01/24/2025 — Medicare and Social Security are complex, so covering the basics with clients is a good place to start. The chart below gives an overview of each program:

|

What it is |

Whom it serves |

What it provides |

| Medicare |

A federal health insurance program |

People 65 and older (as well as certain people with disabilities, end-stage renal disease, or other conditions) |

Insurance coverage for certain costs related to hospitalization, doctor visits, outpatient care, and other medical expenses |

| Social Security |

A federal income program |

People 62 and older (as well as families of deceased workers and certain people with disabilities) |

Income to help beneficiaries pay for daily living expenses and other basic needs |

How are Social Security benefits calculated?

Now let’s look at how Social Security retirement benefits are calculated. The Social Security Administration bases retirement benefits on an individual’s earnings. The amount an individual can receive at full retirement age—anywhere from 65 to 67, depending on birth year—is known as the primary insurance amount (PIA).

The PIA for each recipient is calculated based on the average indexed monthly earnings (AIME) in their 35 highest-earning years.1 However, there’s a cap on these earnings—known as the Social Security wage base—for the purposes of this formula. The 2025 wage base is $176,100.2 This base is also the maximum amount of income on which Social Security taxes are paid.

For the benefits calculation, the AIME is divided into three “bend points,” which are adjusted each year for inflation. For 2025, the benefit is the sum of these bend-point calculations:

- 90 percent of the first $1,226 of averaged indexed monthly earnings

- 32 percent of earnings between $1,226 and $7,391

- 15 percent of earnings above $7,3913

The result of that calculation is an individual’s Social Security retirement benefit at full retirement age. This amount is increased incrementally each month that benefits are delayed after full retirement age—up until age 70.

Of course, just like many other kinds of income, the amount of someone’s Social Security benefit isn’t necessarily the same as the actual payment that hits their checking account. There can be a variety of deductions from Social Security benefits, including federal income taxes and Medicare Part B premiums. The deduction of Medicare Part B premiums from Social Security payments is another reason why your clients should understand Medicare and how it affects their retirement planning.

How are Medicare benefits determined?

One of the first things your clients should know about Medicare is that, unlike Social Security, Medicare benefits aren’t “calculated.” In reality, they’re composed of certain kinds of medically necessary and preventive health care services. Each individual will take advantage of different Medicare-covered services depending on their healthcare needs and preferences.

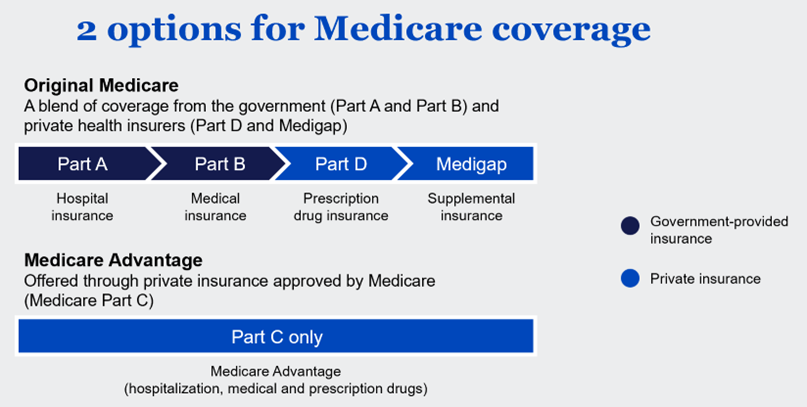

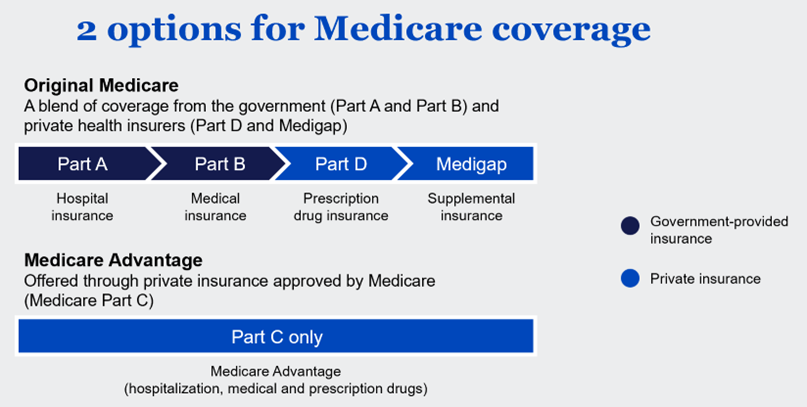

- There are different “parts” to Medicare, with different benefits. People can purchase either “Original Medicare,” which includes Parts A and B, and is usually supplemented with Parts D and Medigap coverage, or a Medicare Advantage plan that includes Part C (a combination of everything in Original Medicare).

- Medicare Part A helps to cover inpatient care in hospitals and skilled nursing facilities. It also helps cover hospice care and some home health care. As long as an individual or their spouse worked for 40 calendar quarters (10 years) or more in the U.S., there is no cost for Medicare Part A.

- Medicare Part B helps to cover outpatient services from doctors and other health care providers, clinical research, ambulance services, medical equipment, mental health services, and limited outpatient prescription drugs under certain conditions. In 2025, the base cost for Medicare Part B is $185 per month. But the cost increases for those at higher income levels.

- Medicare Part C is also known as Medicare Advantage. It’s a Medicare-approved plan from a private company that offers an alternative to Original Medicare (Parts A and B) for health and drug coverage. These “bundled” plans include Part A, Part B, and usually Part D.

- Medicare Part D helps to cover prescription drugs. It’s purchased from private insurance companies (either as a standalone or as part of a bundled Medicare Advantage plan), and the cost varies by plan.4

How are Medicare costs determined?

Many people don’t realize that Medicare isn’t free. In reality, there are a variety of potential costs involved. That’s why estimating the cost of Medicare (and related healthcare expenses) is a key part of planning ahead for retirement.

In addition to the costs of Medigap or Medicare Advantage plans, your higher-income clients may also have to kick in premium add-ons for Medicare Parts B and D. This added surcharge is called an income-related monthly adjustment amount (IRMAA), and it’s based on each person’s modified adjusted gross income (MAGI) and tax return from two years before.

Medicare premium calculations, 2025

| Individual tax filers with MAGI |

Joint tax filers with MAGI |

Income-related monthly adjustment amount (IRMAA) B+D |

Total monthly premium amount |

| Less than or equal to $106,000 |

Less than or equal to $212,000 |

$0.00 |

$185 |

| Greater than $106,000 and less than or equal to $133,000 |

Greater than $212,000 and less than or equal to $266,000 |

$74.00 |

$259.00 |

| Greater than $133,000 and less than or equal to $167,000 |

Greater than $266,000 and less than or equal to $334,000 |

$185.00 |

$370.00 |

| Greater than $167,000 and less than or equal to $200,000 |

Greater than $334,000 and less than or equal to $400,000 |

$295.90 |

$480.90 |

| Greater than $200,000 and less than $500,000 |

Greater than $400,000 and less than $750,000 |

$406.90 |

$591.90 |

| Greater than or equal to $500,000 |

Greater than or equal to $750,000 |

$443.90 |

$628.90 |

Source: “2025 Medicare Parts A & B Premiums and Deductibles,” Centers for Medicare & Medicaid Services, Nov. 8, 2024, https://www.cms.gov/newsroom/fact-sheets/2025-medicare-parts-b-premiums-and-deductibles

Strategies to mitigate IRMAA surcharges

How can you help clients minimize IRMAA costs? Because IRMAA is based on MAGI, understanding what does—and does not—go into this figure is critical. MAGI includes:

- Salary and wages

- Dividends

- Capital gains

- Business income

- Retirement income

- Untaxed foreign income

- Social Security benefits

- Tax-exempt interest

- Other income5,6

Diversifying income outside of the sources above could make a difference in how much your clients pay for IRMAA surcharges on Medicare premiums. Consider these strategies:

- Roth conversions: A Roth IRA conversion allows your clients to move money from a traditional IRA into a Roth IRA. The conversion itself is a taxable event, so the conversion would need to take place at least two years prior to the year in which IRMAA is first calculated. Future withdrawals from the Roth IRA in retirement are tax-free and do not contribute to MAGI.

- Regulating withdrawals from taxable accounts: Carefully balance withdrawals from taxable and tax-deferred accounts, such as traditional IRAs and 401(k)s.

- Leveraging health savings accounts (HSAs): HSAs can provide a triple tax benefit. Contributions are tax-deductible, growth is tax-free, and withdrawals for qualified medical expenses are tax-free. After age 65, HSA funds can be withdrawn for any reason without penalty, although income tax applies to withdrawals for expenses that are not for qualified medical services. Importantly, HSA withdrawals used for qualified medical expenses don’t count toward MAGI.

- Deferring Social Security benefits. Delaying Social Security benefits will reduce MAGI, which will also reduce IRMAA.

- Planning charitable contributions: Qualified charitable distributions (QCDs) from an IRA can satisfy required minimum distributions (RMDs) while excluding the distribution from income—potentially reducing MAGI.

Case study

To see how some of these strategies could play out, let’s look at an example of how income today can impact IRMAA later.

In 2023, a single retiree decided to do a $50,000 Roth IRA conversion. She also received $30,000 from Social Security and $35,000 from a traditional IRA. Because the Roth conversion pushed her into the next IRMAA bracket with a total income in 2023 of $115,000, she will have higher Medicare premiums in 2025.

She could have avoided this by breaking up the Roth conversion. For instance, she could have spread the $50,000 conversion across two years—converting $25,000 in 2023 and 2024. This would have allowed her to keep her income under the IRMAA threshold.

Earn clients’ loyalty

By helping clients understand how to minimize what they pay for Medicare Parts B and D, you’ll also help them decrease deductions from their Social Security checks. Providing this kind of valued guidance on a topic that’s confusing to many will go a long way toward earning their loyalty and trust throughout their retirement journey.

Additional resources

Clients can get an estimate of their Medicare costs at medicare.gov. And they can log in to their my Social Security account for an estimate of their Social Security benefits. The Nationwide Retirement Institute® also offers a wealth of insights and resources to help you create smart strategies for your clients.