Key takeaways:

- Because of economic uncertainty, many Americans are becoming more cautious with their finances and finding difficulty in seeking key financial goals.

- Financial professionals can use the trust they have established with clients to build greater confidence in their financial plans.

11/07/2025 – For many Americans, the economic picture looks complicated these days. On the one hand, the economy looks pretty strong—growth has been resilient, companies are delivering profits and stocks hover in record territory after an extended bull market rally.

On the other, the economic impacts of inflation and tariffs are making many consumers unconfident about the future. As economic uncertainty has risen, consumer sentiment has fallen and caution is becoming the default option for financial and economic matters.

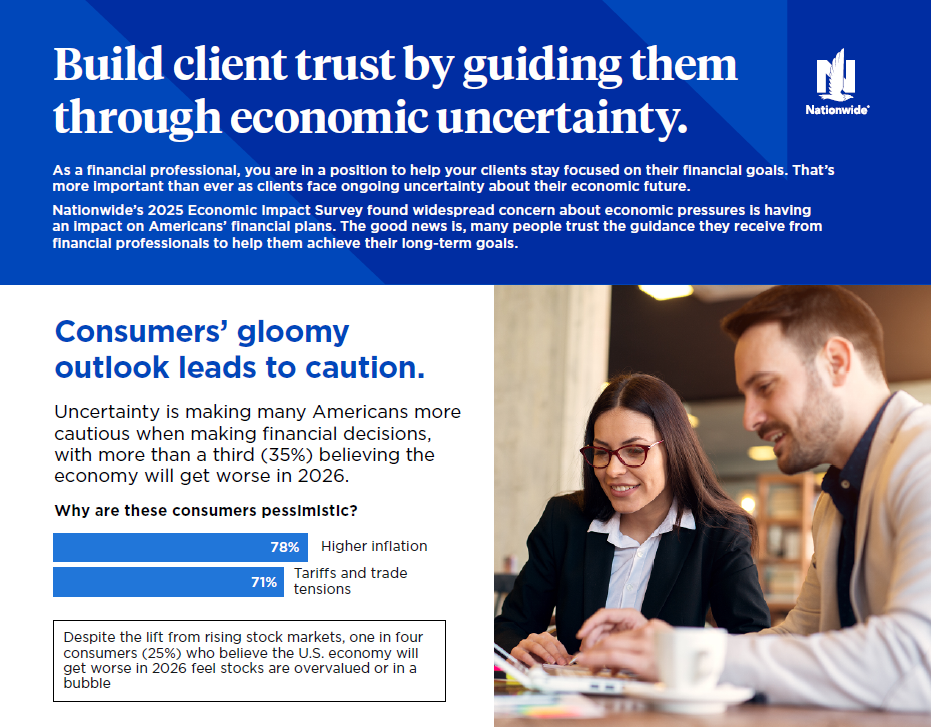

The results of Nationwide’s 2025 Economic Impact Survey reflect this complicated picture. A majority of American consumers (55%) told us they feel secure in their personal finances, but more than a third (35%) believe the U.S. economy will get worse in 2026.

As a financial professional, this growing sense of uncertainty and caution has implications for your clients’ financial plans. As they grow tentative in an uncertain economy and volatile market climate, your clients run the risk of starting to react emotionally and make decisions that are contrary to their long-term financial plans.

There is a bright side to consider, and it’s important for your role as a financial professional. Clients place a lot of value in professional financial guidance. With year-end reviews just around the corner, now is a good time to act as their trusted resource for insights and ideas to help them stay true to their financial plans and reach the goal of lifetime financial security.

What’s driving this sense of unease?

Our survey found that several factors are contributing to investors’ uncertainty and their more cautious stance with their finances. High inflation tops the list of concerns among those who believe the U.S. economy will get worse in 2026; Of these consumers, 78% cited rising consumer prices as a reason behind their pessimistic outlook and 71% cited the impact of tariffs.

And despite potential optimism from rising stock markets, many see risk beneath the surface. One in four consumers who believe the U.S. economy will get worse in 2026 feel stocks are overvalued or potentially in bubble territory. That signals a potential disconnect between recent portfolio performance and perceived financial security.

View the infographic

For financial professionals, understanding the motivations behind this shift toward caution is important. Insights from our survey suggest a prevailing mood of hesitation and re-evaluation, where consumers are cautious about spending and unsure about making major financial decisions.

Economic uncertainty is not just eroding consumer sentiment—it’s also changing behavior. Many Americans now feel their financial goals are slipping further away. Consumers that we surveyed anticipate greater difficulty in 2026 meeting many of their key financial objectives, including:

- Managing health care costs: 43%

- Paying off debt: 39%

- Saving for retirement: 34%

- Protecting portfolios from market volatility: 31%

This situation calls for deeper conversations with clients about behavioral finance. You can help them narrow the confidence gap by bridging the emotional and rational aspects of money. That may include refreshing their knowledge of investing fundamentals, resetting their expectations to be more realistic and achievable, and emphasizing a disciplined approach to financial planning.

Trust is your strategic advantage

Even as economic uncertainty grows, one finding from our survey stands out as a tremendous opportunity for financial professionals: trust.

Only one in four consumers we surveyed currently work with a financial professional. While that number is low, it does show a clear opportunity to connect more people with the benefits of financial guidance. Those currently working with a financial professional are reaping these benefits; nearly half of current clients (48%) say their advisor is their most trusted financial resource. That vote of confidence surpasses even close family and friends and is higher than any other source cited by survey respondents.

The trust clients have in professional financial guidance has tangible behavioral outcomes. Among consumers with a financial professional relationship, 87% turn to that professional when they want personalized help in developing their financial plans. While a personal touch is preferred, consumers still use technology as they consider financial decisions but there’s a large trust gap. While 28% of consumers have used artificial intelligence for financial planning, only 6% consider that guidance trustworthy—far lower than the trust they have in financial professionals.

The human touch still matters

The message for financial professionals from our annual economic survey is clear: Uncertainty about the future is making Americans more cautious today, but the trust they have in personal financial guidance is a foundation for building confidence.

Plus. these survey results come at an opportune time—as you look ahead to year-end review meetings with your clients, you can use these insights to prepare questions about their current financial picture and consider strategies that help them stay focused on their goals.

Clients who have engaged with financial professionals often demonstrate better financial behaviors; they’re more disciplined, more diversified and less emotional when making investment decisions. That all adds up to greater financial confidence, especially in times with economic outcomes are uncertain and market volatility is common.

Americans may be entering 2026 with increased caution, but a cautious economic sentiment creates an opportunity for financial professionals to demonstrate their value in lasting ways. When uncertainty rises, the human element of financial advice becomes not just relevant but indispensable.