09/19/2024 — Key takeaways:

- High medical costs and debt burdens are affecting how many people save for retirement, according to our latest health care costs in retirement survey.

- Among a majority of adults, there’s widespread doubt about Medicare’s future and misunderstanding about how Medicare works.

- Financial professionals can help address the uncertainties around retirement health care costs by simplifying financial planning and decision making.

Concerns about the future of Medicare contribute to the uncertainty many Americans feel about managing health care costs in retirement. The high cost of living today is already squeezing many households, which can make planning for future health care needs including medical expenses and costs for extended care seem like a lower priority.

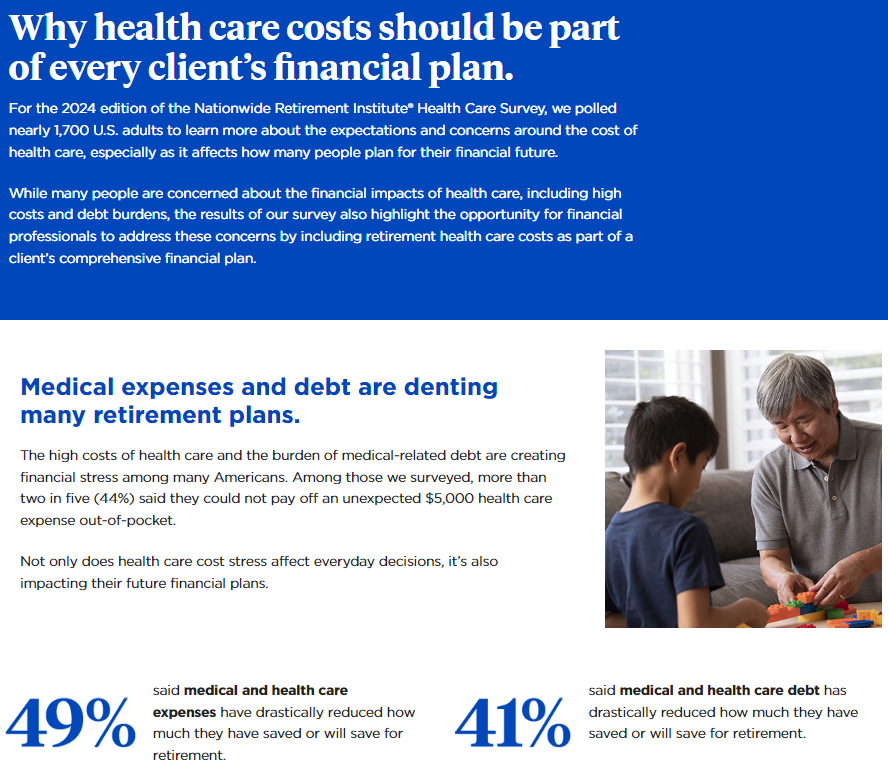

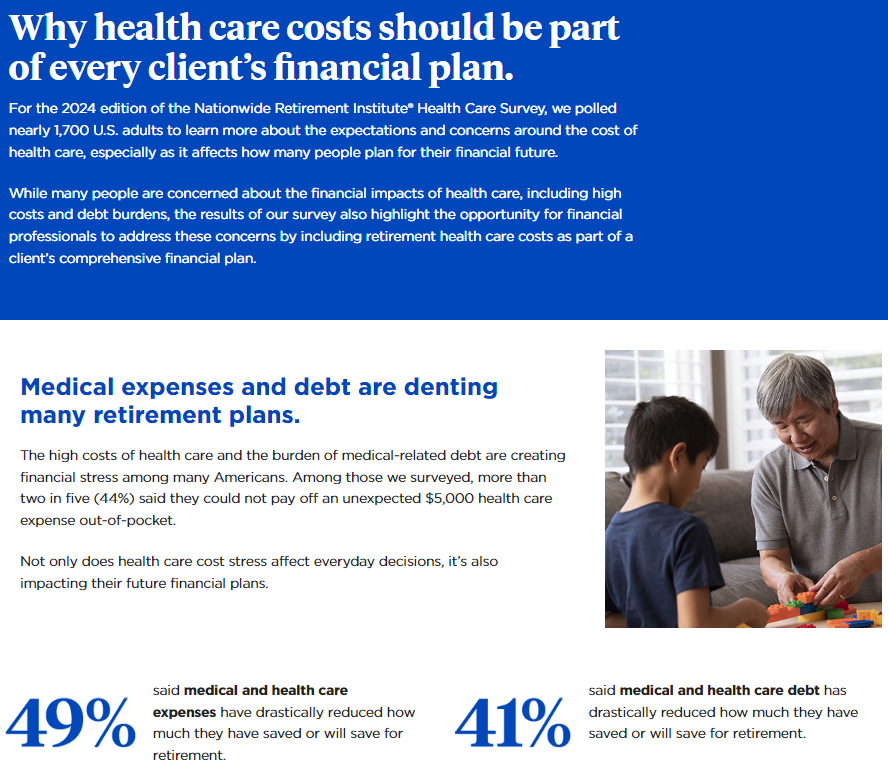

The latest edition of the Nationwide Retirement Institute® Health Care Cost in Retirement survey polled nearly 1,700 U.S. adults to learn more about the expectations and concerns around the cost of health care and its impact on their financial future.

As financial professionals and solutions providers, we need to address the uncertainties and ease the fears around retirement health care costs. The best way we can approach these topics is to simplify the financial planning and decision-making processes.

Health care spending today is affecting saving for tomorrow

For many people, the financial impacts of health care in the present day—from rising costs, to increased debt burdens—are affecting their ability to save for tomorrow. Almost half of adults we surveyed (49%) said they have drastically reduced how much they have saved or will be able to save for retirement because of current medical and health care expenses.

Insurance policies and savings products like Health Savings Accounts (HSAs) can help with medical expenses and managing out-of-pocket costs. But a surprise or emergency health care expense has the potential to be financially devastating. Many people have to borrow or use credit cards to cover unplanned health care costs, which can have an adverse effect on people’s ability to save for their financial future. Around two in five adults (41%) said medical debt has drastically reduced how much they have saved or will be able to save for retirement.

With many people struggling to balance their household budgets and pay their bills on time, planning for health care needs in the future often takes a back seat. In our survey, 70% of adults said they’re not sure or can’t estimate how much their expected retirement health care costs will be.

View the infographic

Medicare misgivings and misunderstandings

The general consensus is a majority of Americans will rely on Medicare to help cover a significant share of their health care expenses in retirement. Despite the importance of the program to so many people, there is widespread doubt about Medicare’s future and a lot of misunderstandings about how the different parts of Medicare actually work.

Let’s start with the misgivings. More than three in five adults (63%) worry that Medicare won’t be available in the future when they will need it. But these feelings of doubt shouldn’t deter people from planning for future health care costs. Financial professionals should acknowledge them but keep clients focused on estimating the cost of their future health care needs, then designing a financial plan to help cover these expected costs.

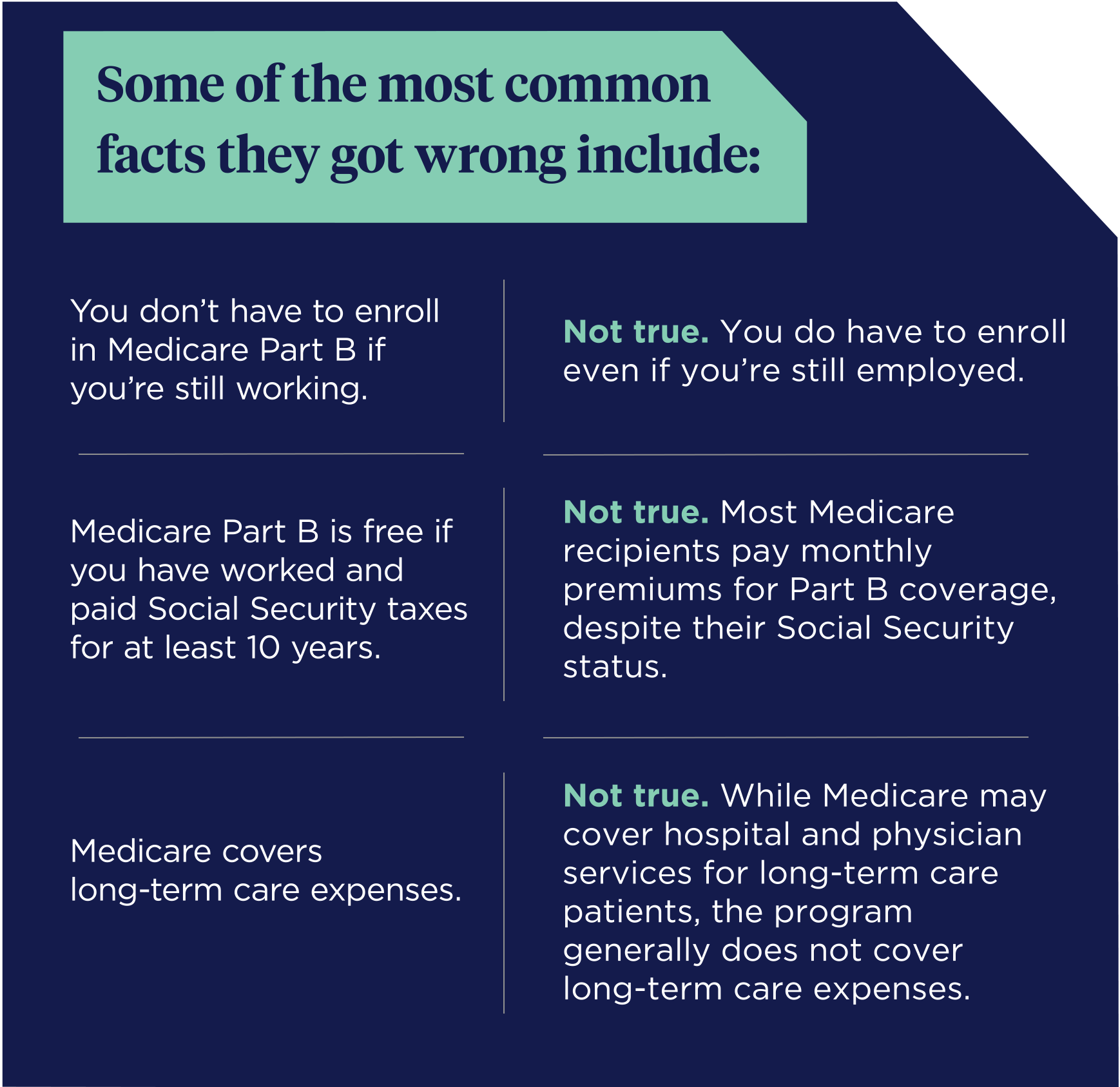

Next, the level of misunderstanding about Medicare shouldn’t be surprising—two in three (67%) said they wished they understood Medicare coverage better. Many people are unfamiliar with the basics, which offers financial professionals a good place to start their health care planning discussions with clients.

For example, we quizzed survey respondents on some of the basics of Medicare. In a true-or-false question format, many people either answered the questions incorrectly or weren’t sure.