10/30/2023 — Every four years, the country’s attention is drawn toward the race for the White House. With Election Day 2024 now just over a year away, we’ll soon see passions across the political spectrum heat up as presidential primaries and candidate debates move to center stage.

Election seasons can stir intense emotions in people. When these emotions begin to influence decisions clients make about financial planning, you have a recipe for long-term financial mistakes.

A recent Advisor Authority survey, powered by the Nationwide Retirement Institute® found that many investors are connecting their portfolio performance and financial well-being to the outcome of the next presidential and congressional elections.

View the infographic

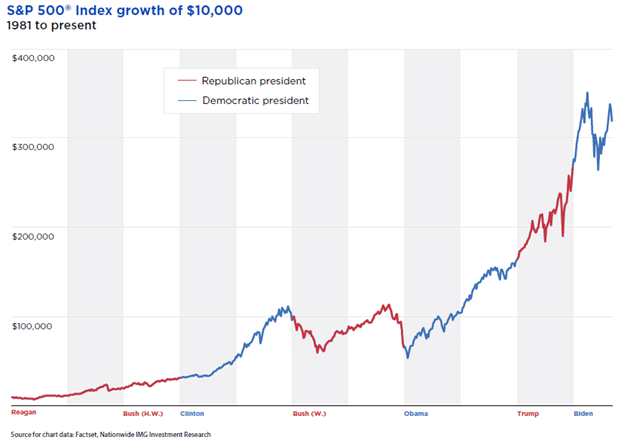

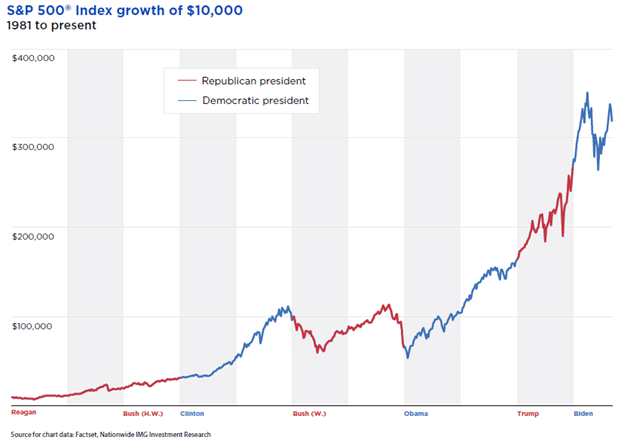

Stock market performance after elections

One of the more significant findings from our survey was that nearly half of investors (45%) believe the outcome of the next election will have a bigger impact on their retirement plans and portfolios than market performance. Moreover, around three out of five investors said the results of next year’s presidential election will have a direct, immediate and lasting impact on the stock market.

Not only are these sentiments not new—they come up in every election cycle—but they’re also unfounded when you look at the historical record. In fact, no matter which political party controls the presidency or Congress, stock market performance has been about the same according to historical data.

Where do these misperceptions come from? In my view, there’s an emotional aspect to elections and politics that can influence people in different ways. Financial decisions are personal and are often tied to emotions, so the fervor around elections can shape how confident or worried people feel about making decisions with their money.

Market misconceptions around elections

- One-third of investors (32%) believe the U.S. will plunge into a recession within the next 12 months if their preferred political party fails to win power in the next election.

- Nearly the same percentage of investors (31%) expect their taxes to increase and their future finances to suffer if the outcome of the election doesn’t favor their preferred political party.

The rise of political partisanship in recent years may also be contributing to these misperceptions, especially for investors who are more politically engaged and aligned with one party or the other. Not all investors are politically inclined, but those who are may see the markets as less risky and more attractive when their preferred party is in power. In contrast, when their party is out of power, they’re likely to feel more pessimistic about their finances and see greater risk in the markets. We analyzed this dynamic using consumer sentiment data in this white paper.

To dispel these misperceptions with clients, you can emphasize your role in providing objective financial guidance by keeping them focused on the real drivers of market performance – the economic climate and company fundamentals (e.g., earnings, profit margins, revenues.)

This is not to say politics has zero influence on the economy. It does in the way elected officials implement their policies, such as raising taxes (which would decrease company profits) or increasing spending (which would impact interest rates and the bond market.) But investors are better served by focusing on the fundamentals because that’s what matters over the long term. To do that, it helps to tune out the noise.

Preparing clients for an emotional election year

As your clients’ financial professional, you can be their best ally in the coming months by helping them resist the temptation to allow their emotions to influence their financial decisions. If you’re like many financial professionals in our survey, you may already be taking a more balanced and nuanced view of the election than your clients. Over half of financial advisors (56%) believe staying the course and not changing their clients’ investment strategies is the best course of action in an election year.

Nearly all financial professionals in our survey (96%) said they have strategies in place to help their clients protect their assets against market risk. We saw higher adoption rates for annuities, mutual funds or ETFs, and diversification strategies as ways of helping protect clients’ assets in case of market volatility.

As we get closer to the 2024 election, investors are likely to see campaign messages and advertising that portray worst-case scenarios if the opposing political party wins control of the White House or Congress. These messages have the unfortunate effect of creating anxiety in investors – and some may not have any connection to facts and fundamentals. This is the moment when objective guidance and sound financial advice can help clients maintain a big-picture perspective for their financial plan, helping them avoid short-sighted or emotional decisions.

For most investors, their long-term financial goals extend beyond the four-year election cycle and will outlast changes in the balance of power in Washington, D.C. Establishing a long-term plan or revisiting the plans they already have in place can help ensure clients remain focused on their goals and factors under their control regardless of who wins in next November’s election.