04/17/2024 — Investors hate inflation because it diminishes the long-term future value of savings. The best way for investors to fight inflation in their investment portfolios is to allocate a portion to stocks because stocks have historically delivered a rate of return above the average inflation rate.

This idea has grown in significance with the surge in inflation over the past few years. It’s been almost two years since inflation hit 9% yearly—the highest level investors had seen since the early 1980s. As measured by the Consumer Price Index (CPI), the inflation rate has moderated since then, with the headline CPI rate reported at 3.5% on a year-over-year basis for March. That’s still far from where inflation was during the last decade when investors became accustomed to inflation rates below 2.5%.

Inflation is proving to be "sticky," as the economists say. As consumers, we can see how sticky it is when we visit the doctor’s office or the grocery store. Inflation rates for specific categories such as medical care, food, and shelter have risen even higher than the overall rate. But more critically for long-term investors planning for retirement, inflation in these areas has been well above the Federal Reserve’s 2% inflation target for much of the past ten years.

These longer-term price pressures help explain why investors today are changing how they think about planning and investing for retirement. A recent Advisor Authority survey, powered by the Nationwide Retirement Institute, found that over half of pre-retirees (57%) see inflation as the most immediate threat to their retirement portfolios in the next 12 months.

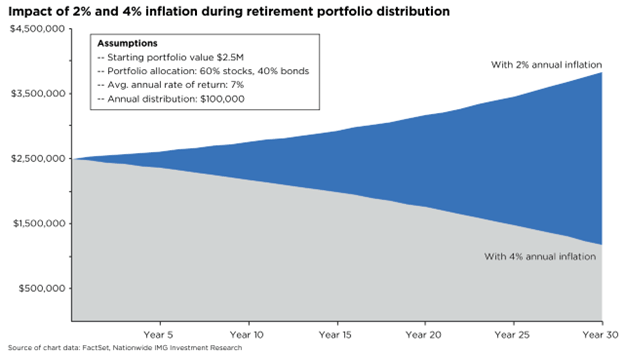

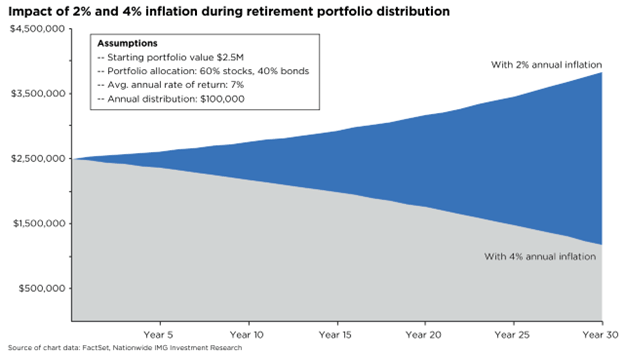

The accompanying chart shows why financial planning and prudent investing are crucial to retirement investors in helping offset the damaging impact of inflation. For this illustration, let’s assume a hypothetical investor with a $2.5 million retirement portfolio, invested in a balanced portfolio of 60% stocks and 40% bonds. During the next 30 years of retirement, let’s assume this investor earns an annual average return of 7% for the portfolio but is also withdrawing $100,000 each year.

The difference between a 2% and 4% annual inflation rate starkly illustrates the potential risks of inflation on a retirement investor’s portfolio. At 2% inflation, this investor still manages to stay ahead after 20 years, but at 4% inflation, the investor is at risk of depleting this portfolio over a long retirement.

How can financial professionals help investors protect their retirement savings from the threat of sticky inflation? First, advise them to control their spending and review their household budgets to ensure their savings rates align with their retirement goals. Second, help investors stay invested through the business cycle and avoid making investment and financial decisions based on emotion. Third, guide investors to a suitable portfolio allocation that incorporates equities in a way that’s aligned with their time horizon and risk tolerance.

An appropriate investment strategy, a plan for managing risk, and a balance of cash needs for the present and the future can create a potent formula to help investors blunt the sting of inflation over the long term.