02/19/2024 — This year is a turning point in our country. In 2024, more Americans will reach age 65 than ever before in U.S. history. While this is a significant event from a demographic perspective, it also raises an important question: are workers who are nearing retirement really ready for their financial future?

To answer this question, the Nationwide Retirement Institute® surveyed 1,000 Americans between the age of 60-65, split between those who are still working and those already retired. In reviewing the survey results, we found that many people who have yet to retire may be overestimating how comfortable they’ll be in retirement.

For example, the average age that current workers expect to retire is 67. Yet current retirees retired on average at 60, with nearly 2/3 indicating that was earlier than they planned. Moreover, 77% of older workers in our survey said they expect to be at least moderately comfortable in retirement. However, fewer current retirees in this age group (68%) said they were financially comfortable.

In my view, the disconnect between retirement expectations and the realities of current retirees reflects the many uncertainties and unknowns American workers have about their retirement preparations. For many Americans, the primary vehicle for retirement planning is in the workplace with their retirement plan. Leading an organization that focuses on this exact population, we have a duty and honor to help more workers take steps to feel more confident in their financial futures.

For decades, we have educated Americans to save for retirement. That is still an absolute need, and we have an opportunity to help these workers protect that hard earned savings.

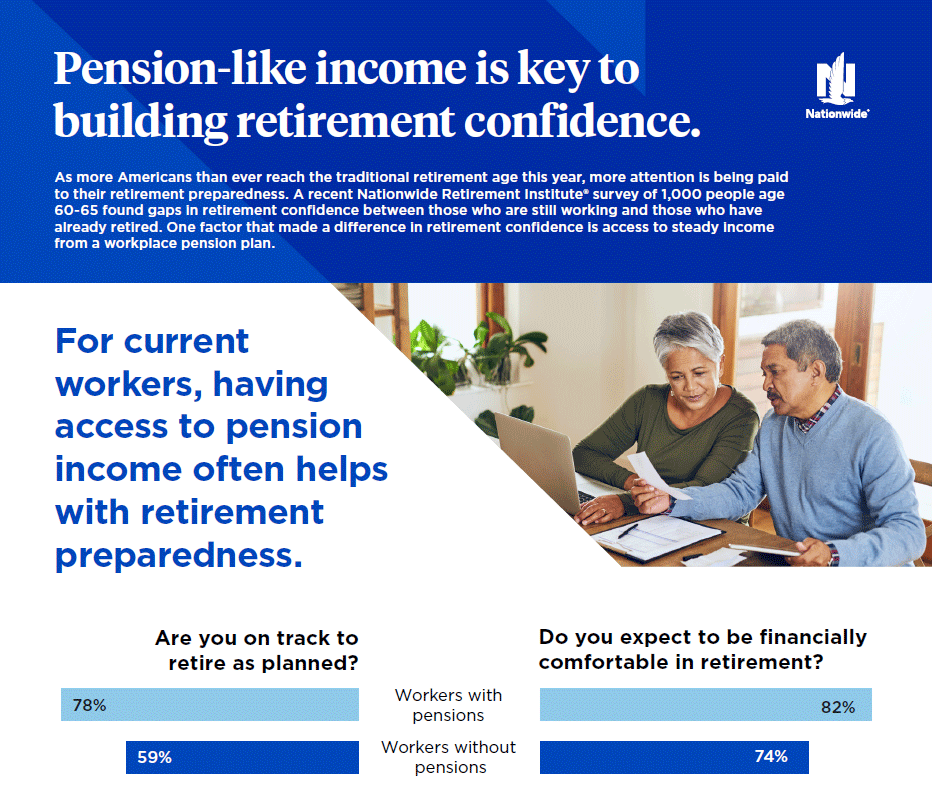

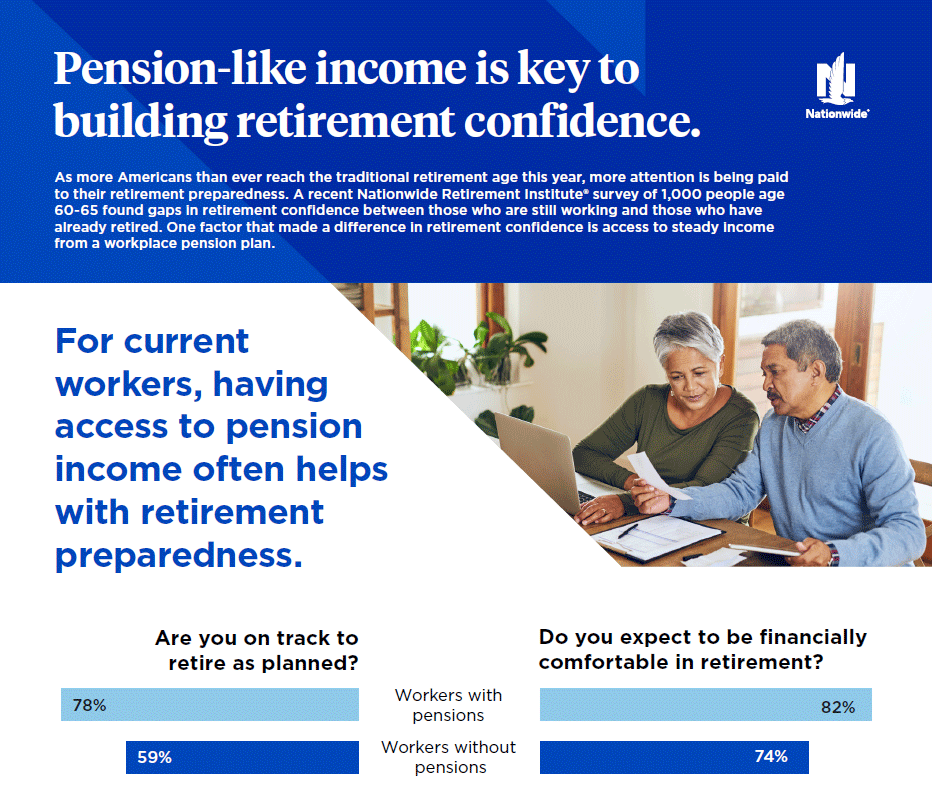

Consistent retirement income breeds confidence

There’s a correlation between consistent income and retirement confidence: those that can count on a pension are more confident about their financial futures.

Current workers who have pensions are more likely to say they’re on track to retire when planned, compared to those who don’t have pensions at work (78% versus 59%). Moreover, those workers with pensions also expect to be more financially comfortable when they eventually enter retirement (82% versus 74% of those without pensions).

View the infographic

When these workers do retire, that pension income results in a greater sense of financial comfort (74% versus 63% of retirees without pensions) and fewer concerns about outliving their money (64% versus 74%). Having a pension also appears to be tied to greater happiness and financial security in retirement, and contributes to higher levels of physical, mental, and emotional health.

Plan participants want pension-like income

We know, however, that workplace pensions aren’t as common as they once were, and for those workers who have a pension, newer employees often have more restrictive tiers of income benefits. That means for many American workers, they can’t count on the benefits of consistent income in retirement that pensions provide. But we’re hoping to change that one defined contribution plan at a time with protected retirement income solutions that can be offered with a plan’s investment lineup.

These protected retirement solutions, often referred to as ‘in-plan guarantees’ are an investment option inside a defined contribution retirement plan. A participant who elects to put some portion of their retirement savings into this solution have the ability to turn their retirement savings into income. This benefits the participant in two ways: it’s guaranteed to last throughout retirement and it’s protected against market downturns. In other words, these solutions provide the benefits of pension-like income.

In a survey we conducted in 2023, we found that workers highly value the confidence these solutions would bring to their retirement. Among older workers participating in a 401(k) plan at work, 73% wished their plan offered a pension-like income option. Additionally, 87% of participants said they would be interested in rolling over their retirement savings to a protected income option if one was available in their employer-sponsored retirement plan.

Building retirement confidence is good business

It’s not just employees who like these in-plan solutions. Employers also stand to benefit by helping their workers better prepare for and live in retirement.

For example, workers who feel financially prepared for their futures are less likely to delay retirement. When more workers can retire on time, employers may see the impact of lower compensation and benefit costs among highly paid workers. A reduction in delayed retirements may also ease constraints on hiring and promoting talent in a company’s workforce.

Employers may also enjoy an upward bounce in productivity from employees. In last year’s Nationwide Retirement Institute® survey of plan participants, 73% said financial worries had a severe impact on their productivity at work. By offering an in-plan guarantee, plan sponsors can address these concerns, helping workers feel more confident about their financial futures and stay focused on their day job.

Other ways to boost confidence among plan participants

There’s more in our latest survey that retirement plan sponsors may find helpful in growing plan participation and promoting retirement confidence.

In our survey, we asked workers and retirees in their early 60s what advice they’d give to their younger selves about preparing for retirement. The most common pieces of advice were around saving and planning for retirement earlier in life. (Respectively, 63% and 41% of survey respondents gave these answers.)

As financial professionals, we’re well aware of the powerful benefits that compounding investment growth offers for those who take advantage of the time they have before retirement by starting to save early. This lesson from older retirement savers is one that younger workers should learn on their first day on the job.

There are other life lessons from older workers that plan sponsors can share with participants at all stages of retirement planning. For example, maximizing plan contributions and enrolling in auto-escalation features are great ways to accelerate your retirement plan.

It’s also important that employees hear perspectives that challenge their expectations for retirement. For example, younger workers shouldn’t expect to work as long as they want, they may not be able to count on Social Security as much as they think, and their living expenses may be higher than planned.

Learn more about protected retirement income

As an industry, we’ve done a great job providing tools and solutions to help participants accumulate assets. At Nationwide, we believe that offering protected retirement income solutions in-plan are the next generation of retirement planning, giving more focus on a plan for not just saving-for but living-in retirement. This represents a tremendous opportunity for the financial services industry to re-define success as achieving a secure retirement where savers aren’t worried about outliving their income.

This is why we offer solutions built to address the very concerns that are eroding participants’ retirement confidence. Whether you’re a plan sponsor or a financial professional, you have a vital role to play in helping participants understand the benefits that in-plan guarantees can offer.

Learn more about how you can help restore retirement confidence with help from Nationwide.

Financial professionals: Click here.

Plan sponsors: Click here.