Key takeaways:

- Insights from our recent survey of workplace retirement plan participants found younger savers are starting earlier while older savers wish they did.

- Starting to save for retirement earlier in adulthood tends to contribute to greater optimism and higher confidence in retirement plans.

- Financial professionals can consider features that make it easier for all employees to build long-term financial security.

1/9/2026 — A recent survey of retirement plan participants from the Nationwide Retirement Institute® reveals a surprising generational divide in retirement planning. The younger generations of Millennials and Gen Z show that early engagement and proactive planning can create confidence. The older cohorts of Boomers and Gen X offer valuable perspectives on the risks of waiting to take action.

The results from our survey highlight how different generations are approaching retirement planning—wherever they currently are on that journey—and what financial professionals can learn from them to help their clients avoid common mistakes and enhance their retirement optimism. As we consider ways to improve retirement preparedness among today’s workers, these insights give us a clear roadmap to help savers plan for a more secure financial future.

Younger savers making smart moves

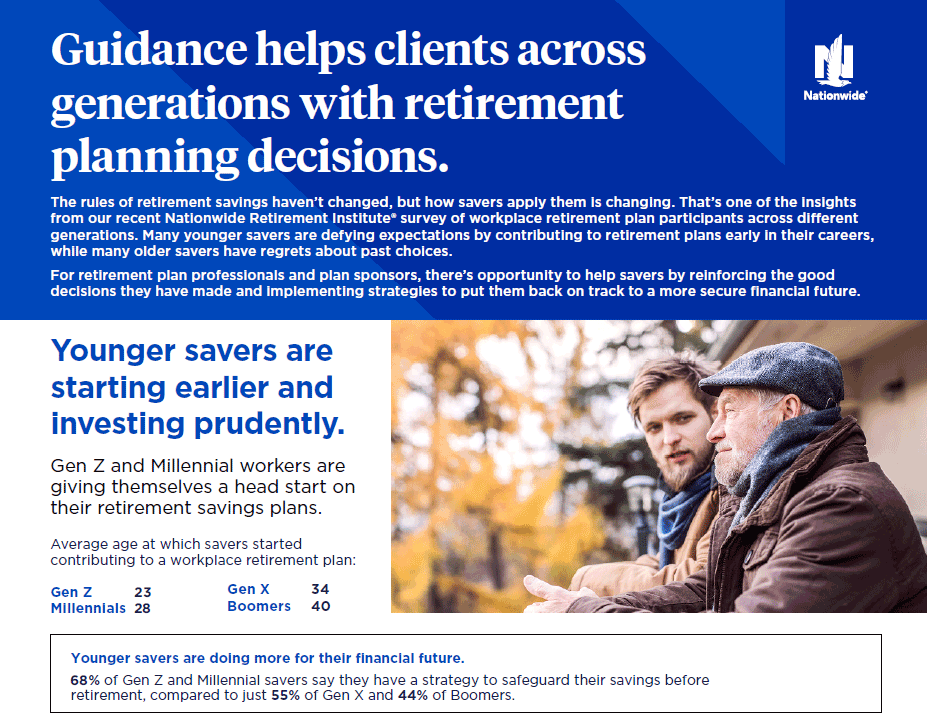

Today’s younger savers—Gen Z and Millennials—are getting a head start on their retirement plans by beginning to save earlier in their careers. Our survey found that Gen Z and Millennial savers started contributing to their workplace retirement plans on average by age 23 and 28, respectively. That’s nearly a decade earlier than Gen X savers (age 34) and Boomers (age 40).

It's encouraging to see younger adults make smart moves like this because it amplifies the power of compounding interest by building savings over a longer time horizon. This survey result may be surprising but younger savers know it’s on them to plan for their financial future because of the uncertainty around Social Security.

View the infographic

These younger generations are also showing they’re more engaged with their retirement plan, checking account balances frequently and increasing retirement plan contributions annually. They also recognize the importance of protecting their savings; nearly 7 in 10 (68%) of younger savers say they have a strategy to safeguard their savings before retirement, compared to just 55% of Gen X and 44% of Boomers.

While many Millennials and Gen Zers may struggle to balance saving for the future with more immediate financial needs, the results from our survey demonstrate the importance of starting early and starting small. Additionally, savers who started earlier feel more confident about their financial future. (More on that later.) These are valuable insights that you can share with younger savers, but also with older savers who have Millennial and Gen-Z age children.

Older savers wrestle with past decisions

For Gen X and Boomers, it’s a different story. Many have regrets about the financial decisions they made—or didn’t make. For example, more than 80% of Gen X and Boomers regret not starting to save or participate in their employer-sponsored retirement plan earlier in their working lives.

Inadequate planning for retirement income and market volatility are also major sources of regret. In our survey, 8 in 10 older savers wish they’d focused earlier on strategies to protect their savings from market volatility or convert assets into sustainable income in retirement.

To be fair, it’s never been as easy to save for retirement as it is today. Most Boomers didn’t have access to employee-directed retirement plans like 401(k)s when they started their careers, and many didn’t offer ways to plan for volatility or retirement income. And the uptake for Gen Xers may have been slow during the transition away from defined-benefit pension plans.

Still, these feelings of regret are real and can impact older savers in different ways – and many may have misperceptions as a result. For example:

- Over 8 in 10 older savers wish they understood the power of compounding interest and the benefits of maximizing contributions at a younger age.

- 54% of Gen X and 39% of Boomers still misunderstand how compounding interest works.

- More than half believe their 401(k) will provide predictable monthly income like a paycheck, which for many is not true.

How can financial professionals help these savers overcome any feelings of regret? First, there’s a clear need for education around the basics of investing. That can be a great place to start.

Second, it’s important for older savers to acknowledge that past decisions can’t be undone. But they have the opportunity in the present to make choices that can put them on track for better outcomes in the future.

Smart choices lead to greater retirement confidence

For many Gen Zers and Millennials, the choice to start saving earlier in their careers is working in their favor.

Analysis of our survey data by The American College of Financial Services found that three-quarters of savers who began saving for retirement by age 25 feel confident or cautiously optimistic about their future. For those who started saving later, just 46% said they feel confident—a 30-point gap.

Older savers, however, don’t have the benefit of time – and they certainly don’t have a time machine. So, how can you help them build retirement confidence? When faced with the reality that retirement is right around the corner, older investors are often more willing to change their approach to saving and planning. For example, increasing retirement plan contributions is one common action that Gen X investors have taken upon realizing how close they are to retirement so it is important to ensure plans offer catch-up contributions, and that participants are aware.

Another area of focus should be investments that can help investors stretch the savings they have been able to accumulate. One way of doing this is by managing downside exposure that puts the saver at risk of experiencing unrecoverable losses. Sounds impossible, right? EY recently explored how in-plan lifetime income investments can be leveraged to help – because they do more than offer lifetime income, they offer downside income protection too.

When EY tested over 1,000 scenarios, they learned that retirement income needs can be met with lower balances at age 65 when leveraging a Target Date Fund (TDF) with a guaranteed lifetime withdrawal benefit (GLWB). This is because the combination of the TDF with GLWB offers greater downside protection on the future income stream when compared to a TDF alone, which would leave the investor entirely subject to market volatility.

While often misperceived to be more conservative, these investments offer similar growth potential while introducing risk management techniques that can help savers protect and stretch what they have saved.

Your approach with these savers should not focus on the past but the present. The start of a new year is a good time to meet with them and help them reset their financial habits if necessary. With your encouragement and opportunities for education, they can make it happen.

Simplify saving through employer-sponsored retirement plans

Employers and financial professionals can help through employer-sponsored retirement plans, considering new and different features that enhance the ability of employees to build long-term financial security.

An important area to consider are features that help overcome investment inertia. Since many employees may not have the time or expertise (as we learned through their regrets!) when it comes to investing, offering many of these features automatically can help participants make the most of them.

As a financial professional you may want to review these retirement plan features and facilitate conversations with your business owner and plan sponsor clients:

- Add auto-enroll and auto-escalation features to encourage employees to save and increase contributions.

- Re-enroll participants into the plan to confirm they’ve reviewed the plan’s most up-to-date investment offering.

- Elect a dynamic default feature to ensure participants are defaulted into age-appropriate investment vehicles going forward, like offering lifetime income funds to those nearing retirement.

Nationwide can help you respond to participant needs with solutions that can increase retirement confidence and support better participant outcomes.