View the infographic

What will retirement look like for tomorrow’s retirees?

What’s different about today’s retirement outlook? First, many investors (61%) don’t feel the norm of retiring at age 65 as applying to them. There’s a positive aspect to this shift; many current and future retirees see the importance of staying physically and socially active, so they’re defying the idea of retirement as a time of rest.

But there’s a downside, too. Many older workers expect to keep working past age 65 because they believe they’ll need the income or need to save more for retirement. Unfortunately, while some older workers want to stay employed out of choice, a greater number find they are forced into retirement because of a layoff, a health problem or the need to provide care to a family member.

Second, many investors (50%) don’t have a "magic number" or specific target amount of retirement savings they’re aiming for. This idea was popular many years ago; think of Lee Eisenberg’s book The Number, which was first published in 2006. According to our Advisor Authority survey, today, just 38% of investors have a retirement "magic number".

The "number" has fallen victim to shifting expectations for retirement, as well as the unpredictable nature of planning in an uncertain economic climate. Rather than to focus on a number—which is dependent on different variables such as spending habits, debt levels, area of residence and more—investors should think more about their overall financial plan and how it aligns to their long-term goals. That, more than aiming for a target, will do more to help ensure a comfortable retirement.

How is retirement planning changing?

Economic challenges are compelling people to make some difficult financial decisions as they try to manage different financial priorities.

For instance, many people know it’s important to save for retirement, but putting money aside for the future can be hard to do when they’re dealing with so many financial challenges today. Inflation remains persistently high, especially for many essential goods and services. Plus, it looks like interest rates could stay higher for longer, which adds to the costs of many people who are carrying high levels of debt.

The squeeze is forcing many to make the difficult but important choice to forgo discretionary spending in order to keep their household budgets in balance or to avoid going into debt. This is especially true for those who are closest to retirement.

Non-retired investors age 55+ and retired investors told us they’re adjusting priorities to meet financial commitments in today’s economic environment by cutting back on many "nice to have" purchases perhaps because they’re worried about how they’ll pay their monthly bills in retirement. Some of the common discretionary purchases on the decline include luxury goods (47%), leisure activities (44%), entertainment (44%) and vacations or travel (38%).

Where do financial professionals fit in?

Given this concerning outlook for Americans’ financial future, many financial professionals are stepping up to respond, "How can we help?"

Financial professionals are on the front lines of the current retirement challenge. Of those surveyed, nearly half (48%) said the rising cost of living has influenced their clients to rethink or redefine their retirement planning strategies.

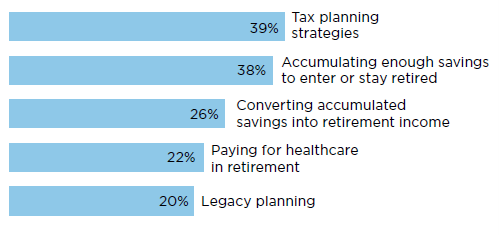

Financial professionals offer a vital support line to investors who are struggling with planning for retirement while keeping their financial house in order. Clients who are currently working with financial professionals are finding success in getting the help they need, most frequently in these areas: