Guidance is needed as recent retirees move into retirement.

Financial professionals are attuned to the challenges recent retirees face in the early years of retirement.

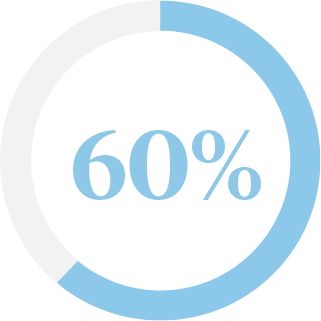

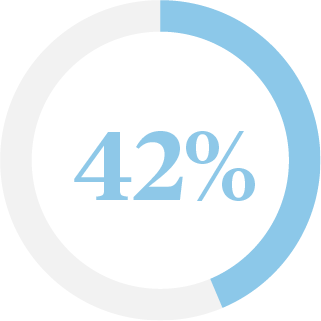

Among the biggest challenges recently retired clients have faced in their first two years of retirement: