06/20/2024 — Key takeaways:

- LTC is not a place, it’s an event that your plan for.

- LTC planning takes patience and may take several appointments.

- Have a toolbox of LTC solutions ready; men and women may not want the same type of policy.

Many people associate the words “long-term care” (LTC) with nursing homes, but in reality, LTC is more likely to take place at home. LTC is not a place, it’s an event that needs planned for just like any other event we’d plan for in retirement. Many people are concerned with the fact that there must be a loss before benefits are paid, and that they won’t get any return if all goes well. Knowing this, what do we need to know to help get clients over the hurdles and towards a plan that’ll help cover a potential LTC event? Below we’ll share 6 tips to customize your client’s LTC plan and anticipate the hurdles that may arise during these conversations.

#1 Focus on home health care

To keep the conversation positive, it can be helpful to avoid the words “long-term care” in the beginning and focus on conversation openers such as “Let’s discuss how to fund keeping you in your home as long as possible should you start needing some help.” While statistic dumping generally doesn’t work to motivate clients, it may help to educate clients on the number of people getting care at home. According to The American Association of Long-Term Care Insurance, approximately 73% of initial LTC claims were for care at home. Another 18% of claims were for assisted living, where individuals are often able to live in an apartment-like setting surrounded by their own furniture and belongings, and only 9% of people go to nursing homes.1

Home health care can be the least expensive or the most expensive form of long-term care, because costs vary greatly depending on the type of care is needed as well as the number of hours and days per week care must be paid for. When a client focuses on a goal such as staying at home as long as possible, he or she may be more willing to plan and fund this goal with LTC coverage.

#2 Avoid sticker shock

When doing LTC planning, some financial professionals use “LTC Assessments” or “LTC Estimators” to help calculate what care expenses might be for the client. That can be a good idea, but keep in mind the number produced by the assessment should be your starting point, not the end number. A more palatable way to discuss costs is to start small and work up. Find out how important leaving an inheritance to loved ones is, and what proportion of the client’s assets he or she wants to leave to heirs. This information could identify additional resources. For example, a client may decide they want to leave all invested assets to their children, if possible, but the value of the home could be utilized to help pay for LTC costs if necessary. And don’t forget to leave the surviving spouse provided for.

You can also look for non-essential income that can offset LTC costs. The amount to insure will be the shortfall between estimated costs and non-essential income and assets. Keep in mind that even with the best planning, no plan can be guaranteed to cover all costs associated with a potential long-term care experience.

#3 Women buy long-term care; Men buy returns

Financial professionals sometimes make the mistake of showing only one type of policy solution to a couple, then wonder why they only get one party (or neither) to purchase LTC coverage. As it turns out, 82% of people buying LTC policies are married, yet women are more likely to buy a policy.2 People buy what looks and feels good to them and provides a sense that their need is met. Long-term care is not at the top of the list with many clients (especially men), so the solution you offer should meet an underlying need or concern. That may mean showing different solutions to each party of the couple. Be ready with a tool-box full of solutions so each individual feels their needs and concerns are being considered. That might include a joint life linked benefit LTC coverage.

- LTC for her – Generally, women are more overtly open to purchasing a LTC solution, thus want a solution that best addresses the concerns they have should a LTC event occur. Their concerns may be more emotional, worrying about how their care needs could impact other family members; therefore, they may focus on having enough coverage (benefit periods, inflation, etc.), allowing a family member to be paid to provide care, and so forth. Traditional LTCi policies and linked benefit LTC policies may be more customizable than LTC riders on life insurance.

- RETURNS for him – Often, men don’t want to believe they’ll need long-term care—and if for some unforeseen reason they do need it, they likely will be counting on their spouse to provide care. To get a man’s buy-in, you may have to appeal to his sense of logic. Show him something that isn’t a waste of money if the policy is little or never used and present it as a solution that provides a return one way or the other. Life insurance with a LTC rider has a death benefit that provides true leverage with a decent rate of return that can be illustrated with an internal rate of return report. Additionally, if he has some interest in LTC, a Linked Benefit LTC policy may be of interest since it has cost recovery if the policy is not used.

#4 Meet secondary concerns

Long-term care coverage has various factors for the client to consider when making the decision to insure. Thus, it’s important to identify any secondary fears or concerns a client may have so you can present a solution that meets their needs. That may mean presenting a different LTC solution to each party of the couple. Some common fears with a corresponding solution are:

Common fear: “What if I never need long-term care—is this still a good investment?“

Response: You can show the client a LTC rider on life insurance and the rate of return on the policy that could result whether long-term care is needed or not. Being able to visualize the actual return on the policy may warm up a client getting cold feet.

Common fear: “At the very least, I want my money returned to my kids if I never need care.”

Response: You can show the client a linked benefit policy, where the death benefit is equal to or more than the premium paid, thus assuring the client that there is no loss of premium dollars.

Common fear: “I dealt with my mother’s LTC policy, and it was a nightmare collecting and sending in all the bills for reimbursement – I would rather just pay my own way and keep it easy!“

Response: You can show the client a cash indemnity policy. These do not require monthly bills and receipts to be sent in, and the insurance company places no restrictions on how LTC benefits are used.

#5 Choose your words wisely

Your choice of words is crucial to success. Keep the conversation focused on LTC solutions, not LTC policies, so you are viewed as problem solver, not a salesperson. Avoid words like “burden” and “stuck” and replace them with words like “challenge” and “juggling” to help keep the conversation considerate of the caregiving experience. No one wants to be described by someone else as a burden to others. It’s totally realistic yet respectful, however, to say something like, “it can be a challenge for adult children to juggle care for a parent with their own life’s responsibilities.” Making these word substitutions can help you have a more thoughtful conversation while maintaining a realistic discussion.

#6 Find assets to reposition

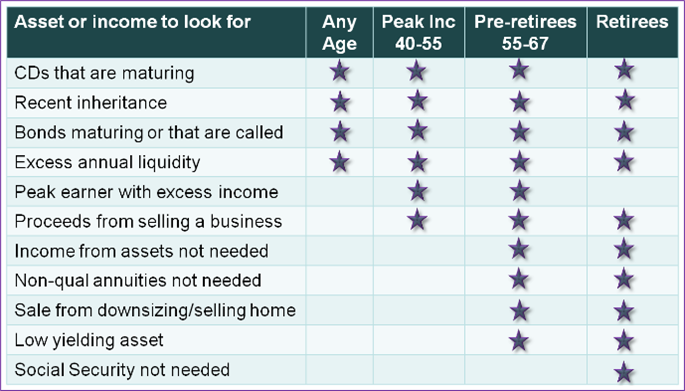

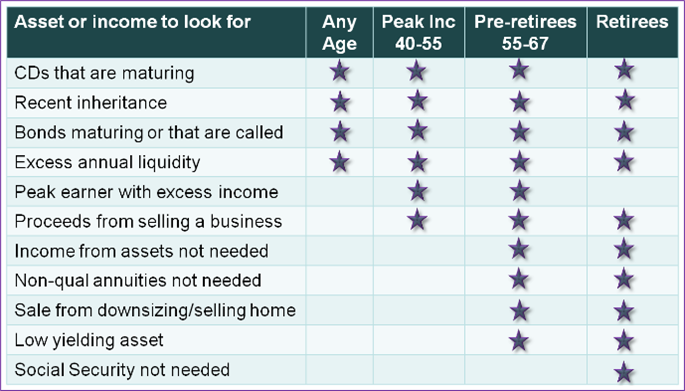

Spending money on things you hope to never use isn’t first on people’s list of things to do. If possible, finding assets that can be repositioned before speaking to clients can help your appointment run more smoothly. If you’re working with a new client, part of gathering information can include looking for assets that might be better positioned with long-term coverage care in mind. This chart may help give you ideas of where you can help a client look for money to fund a plan, and what ages certain assets are more likely to be available:

You can ask the client if he or she owns any CDs (Certificates of Deposit) and when they are coming due. This may provide a good funding source for a single premium LTC solution. Annuities not needed for retirement income can provide a source of premium for LTC solutions. Low return assets may provide more value as a funding source for LTC solutions instead of remaining in its current position. Unexpected windfalls of cash such as an inheritance, downsizing a home, or selling a business can also provide funding for premiums.

Final thoughts

With thought and preparation, presenting LTC solutions can have a successful outcome. Keep in mind that LTC planning may take several appointments and that LTC planning may get emotional for some clients, especially when discussing caregiving experiences they may have had (have a box of Kleenex handy!) When you’re ready to customize your client’s LTC plan based on their individual concerns, you can proactively address any roadblocks. With the variety of LTC solutions available today, you have the ability to customize a plan that can serve your client’s needs while also addressing their concerns.