Rising inflation and higher interest rates stress many people and families, but this survey shows how these pressures can spread from their daily lives to their financial future.

Market participants are also affected by these economic uncertainties. On one hand, consumer spending has remained strong thanks to low unemployment and resilient real income growth. Consumer debt levels, as measured by credit card balances as a percentage of disposable income, have been normalizing at their pre-COVID averages.

On the other hand, we’re seeing the potential impact of higher interest rates and financing costs on the declining personal savings rate, which dropped to 3.2% in March, the lowest level since October 2022. When personal budgets are tight, saving for the future can be less of a priority. Our survey also found that just 38% of investors have a “magic number” for their retirement nest egg, a specific target amount they plan to accumulate for retirement.

These divergent indicators highlight the discordant nature of the current economic cycle. However, the discussions around the strength of consumer spending and the weakness of personal savings present an opportunity for investors and financial professionals to re-assess their current financial picture against their long-term goals for retirement.

When considering an appropriate retirement savings rate, investors should remember that it depends on several factors and that no one-size-fits-all number suits everyone. Some investors have different expectations for when to retire or what lifestyle they want to maintain, which could require a higher savings rate.

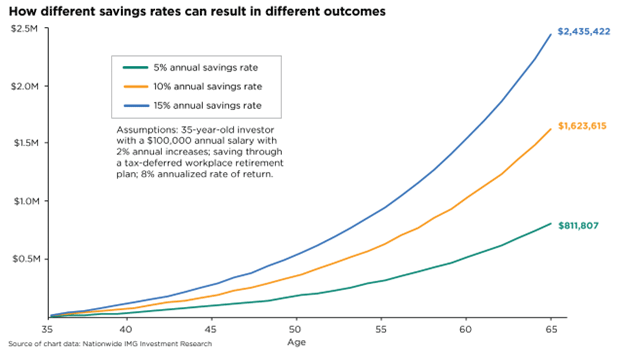

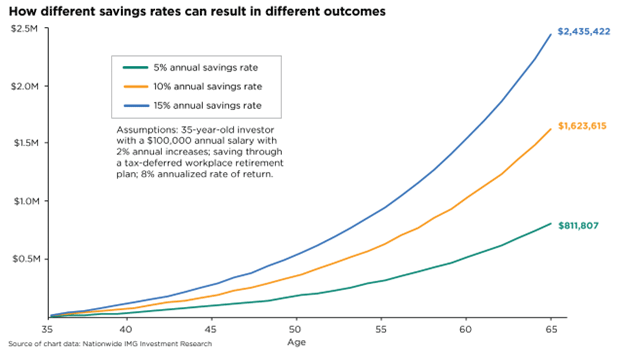

But it’s also important for investors to consider how different savings rates can result in different investment outcomes. Let’s use a hypothetical 35-year-old investor as an example, who earns $100,000 annual salary with 2% annual increases. Also, assume this investor is saving 5% of their income each year through their workplace retirement plan and realizing an 8% annual investment return (tax-deferred). In 30 years, this investor will have a retirement balance of $811,807.

Now, if that same investor decided to save 10% of their income at age 35, all else being equal, their balance would be over $1.6 million at age 65—yes, that’s twice as much money. At a 15% savings rate, the ending balance would be even more impressive at over $2.4 million—or triple the lower savings rate.

Saving for retirement can often feel daunting, especially in the face of economic challenges. Still, investors can achieve their savings goals by creating and following a solid financial plan with the guidance of a financial professional. Living and spending within one’s means and gradually increasing savings rates over time can help investors develop confidence in their retirement plans and be reassured about their financial future.