10/23/2023 — Many people look forward to retirement as a time to relax and enjoy life at a more leisurely pace. After managing the demands of a career, retirement allows people to spend time on things they truly value, whether it’s with family and friends or pursuing lifelong interests.

That doesn’t mean retirement is without stress. Health care can be a specific pain point for many retirees, especially as they navigate the financial implications such as understanding Medicare and planning for future health care expenses.

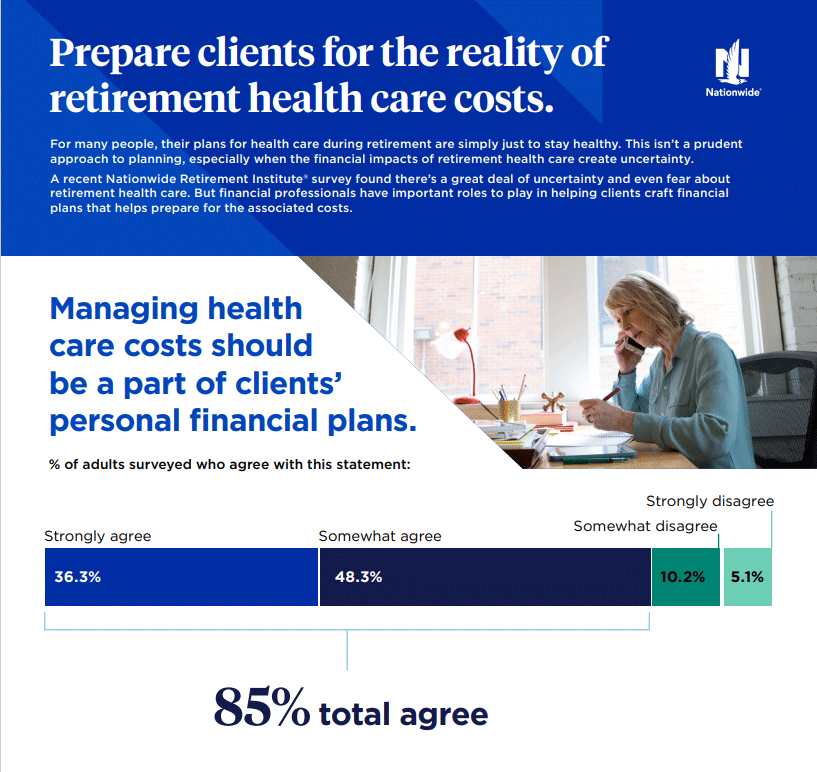

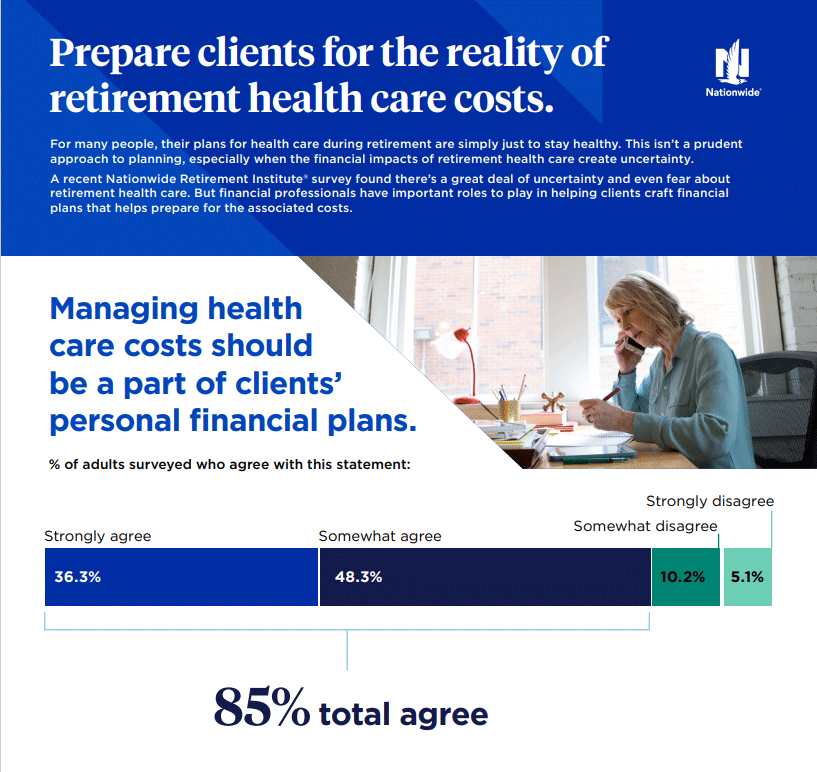

The Nationwide Retirement Institute® recently surveyed over 1,000 U.S. adults, including current retirees and those still in the workforce, about their views on health care in retirement. The results of this survey show there’s uncertainty and even some fear about affording health care during retirement, but there’s also an opportunity for financial professionals to step up and help clients put a plan in place to help manage these future costs.

Living longer, healthier lives in retirement

For current and soon-to-be retirees, their quality of life depends a lot on maintaining good physical and mental health. Many current retirees said they feel confident in their ability to stay healthy throughout retirement.

But in the bustle of our daily lives, our health needs tend to get shuffled down the to-do list. Things like family relationships and work commitments are important to maintain, but our personal health is the fiber that allow us to hold it all together.

I’ve known for a long time that I needed to move my own health up the list of priorities. Years ago, I was diagnosed with gestational diabetes during my second pregnancy, and I promised to do the work to bring my own health into line. I’m amazed to see the physical gains I am making show up in my mental health. Today, I am able to be more present at home and work, and my daily self-investment is improving my mood, clarity, and resiliency.

These mental gains are valuable in managing the stress that comes with retirement planning, specifically related to the financial aspects of health care—affordability, Medicare, and out-of-pocket expenses. I hope the investment I’m making today in improving my health care will help me manage the stresses that many people experience as they get older. For example, nearly half of retirees (47%) expressed regret in not taking better care of their health earlier in life so that their health care expenses in retirement would be lower.

View the infographic

Additionally, there appears to be a disconnect between expectations for a healthy retirement and what it may take for retirees to maintain their health as they get older. Most adults expect they’ll need the services of primary care physicians throughout their retirement, but fewer expect to require specialized care from cardiologists, orthopedists, or mental health professionals. This may be a case of people underestimating how much their physical or mental health may change over time or ignoring the inevitabilities of aging.

There’s also a great deal of optimism around the future of health care in improving the quality of our later years and making retirement health care more affordable. Excitement around artificial intelligence (AI) has reached the health care realm, where AI holds the promise of helping medical researchers discover breakthroughs and develop treatments more quickly.

One-quarter of adults (26%) think medical and technological advances impacted by AI could add to their lifespans. Those who expect AI to impact medical and technological advancements expect it to add an average of 11 years to their lifespans. While longer, healthier lives may lead to a better quality of life, it’s important to recognize the costs that come with living longer and the concerns many people have about making their retirement savings last. Three in five adults (61%) said they’re worried about living a long time and running out of money in retirement.

Medicare costs and coverage options

Any client planning conversations around retirement health care costs should include Medicare. You may find some potential blind spots among clients in how much they know or don’t know about Medicare. For example, while 60% of adults said they know how Medicare covers health care costs in retirement, nearly three-quarters (72%) of adults wished they had a better understanding of Medicare coverage.

The predictable results of this mix of confidence and uncertainty are common misperceptions about Medicare among a wide range of investors. Many people in our survey showed they’re unsure about when to enroll (i.e. while they are working or getting ready to file for Social Security benefits) in the different parts of Medicare.

There’s also widespread misunderstanding or uncertainty about Medicare coverage for long-term care expenses, where 72% of adults either answered incorrectly or weren’t sure that Medicare pays for these costs. (In general, long-term care costs aren’t covered by Medicare.) Additionally, 61% said incorrectly or weren’t sure whether Medicare is adequately funded. (At present government funding levels, it isn’t.)

So, even when clients believe they know enough about Medicare, they still may benefit from a refresher on basic Medicare knowledge. In particular, it’s valuable to point out what health care costs Medicare typically covers, what costs clients are likely to pay out of their own pockets, and how Medicare premiums can affect their retirement budgets.

As you talk and work with clients on their retirement plans, focusing on specific aspects of Medicare can go a long way toward helping them make more informed choices as they enter retirement.

Plan ahead for retirement health care costs

Even with the high level of concern about health care in retirement, many people do not know about how much of their spending in retirement will go to health care expenses. Others don’t know where to begin to get an estimate of how much they may end up paying for health care in retirement.

Over the last 10 years, there’s been an increase in the percentage of adults age 50+ who say they’re "terrified" of what health care costs could do to their retirement plans (62% in 2023 versus 56% in 2014). Fear also increased among adults age 50+ (66% in 2023 versus 58% in 2014) with a higher net worth (investable assets over $250,000) as they may be worried about how health care costs could deplete their wealth.

One of the best ways for financial professionals to counter these rising fears is through planning. Planning starts with an estimate of future health care costs, either per year or over the course of a full retirement.

Perhaps not surprisingly, a majority of people (75%) either are unsure or don’t know how to estimate their health care costs in all of retirement. Those who felt confident enough to make a guess most often underestimated what their out-of-pocket health care costs could be. For example, most people think their total retirement health care costs would be under $55,400.

Nationwide’s Health Care Cost Estimate makes it easy for financial professionals to help clients get a personalized picture of future health care costs.

How financial professionals can help

Health care planning may not seem like a natural fit for a financial advisory practice, but the financial impact of retirement health care costs means there’s a role for financial professionals to play in helping clients prepare for these future expenses.

A vast majority of people (85%) believe managing health care costs should be part of personal financial planning. Over one-third (36%) feel strongly about this. As a financial professional, the good news is you don’t have to bear this responsibility all on your own. The guidance you offer should complement information from other sources such as a client’s family members and their network of health care professionals.

But don’t overlook opportunities to differentiate the value you bring to your clients’ financial plans. One approach is to offer guidance on Medicare because many clients aren’t getting any guidance on these decisions. Over half of people working with a financial professional (52%) haven’t received any advice on how or when to file for Medicare benefits.

To underscore how integral Medicare planning can be for your business, almost three in four adults with a financial professional or those who plan to ask a financial professional about Medicare report that if a financial professional could not show them how to navigate their Medicare choices, they would be likely to switch to one who could.

Tap or check out our Medicare planning resources to help you simplify the complexities of the program with your clients.

Additionally, consider opportunities to help younger clients save for current and future medical costs through a health savings account (HSA). Almost half of working adults (46%) have access to HSAs through their employers, yet only a quarter of employed adults (29%) have enrolled in these plans and are making contributions to their accounts.

Share this HSA fact sheet to help explain how these accounts work and why they’re a valuable part of a comprehensive financial plan.

Planning for retirement health care costs is essential

With all the focus on building wealth and planning income for retirement, health care planning can get lost in the shuffle. Clients often overlook or underestimate health care costs, until retirement comes and these expenses start to add up.

Planning for retirement health care costs is critical — and challenging. Aging brings many challenges, and talking with clients about these challenges can be intimidating and emotional. That’s why Nationwide offers resources you can use to help build a personalized plan for clients, starting with a more accurate picture of a client’s needs and expenses.