Close the gap between awareness and action.

Many Americans understand the importance of health care cost planning, but few are taking action. Financial professionals can help clients close this gap with tools and resources that make it easier to plan for future health care costs.

Become a trusted resource for health care cost planning.

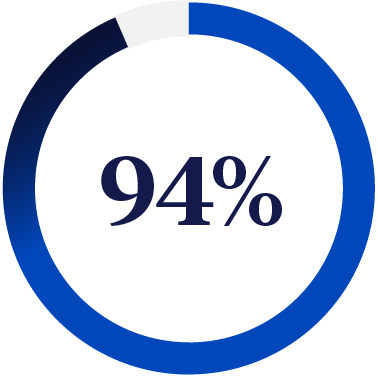

As clients confront the complexities of health care cost planning, financial professionals have the opportunity to help them understand and prepare for the challenges ahead. A majority of U.S. adults (90%) believe that managing health care costs should be part of personal financial planning.