07/29/2024 — Retirement comes with its share of challenges, many of them financial. But for the most part people view retirement favorably, looking forward to the freedom it brings.

One key factor for retirees in their ability to enjoy retirement is having a source of steady income. Retirees gain confidence by knowing they have a regular income stream that can cover their essential living expenses. For many current retirees, Social Security fills this critical role because benefits are guaranteed for life and adjusted annually for cost-of-living increases.

However, there is widespread doubt and uncertainty about the future of Social Security. According to the eleventh-annual Social Security survey from the Nationwide Retirement Institute®, one half of the 1,800+ adults surveyed said they didn’t know what percentage of their pre-retirement income is, or will be, replaced by Social Security. Among those who did know, the average replacement percentage was 43%. Higher-income retirees reported slightly lower replacement rates (which can be expected), but even for this group Social Security benefits represent a considerable foundation of income in retirement.1 This highlights the importance of Social Security as a core pillar of retirement income.

The challenges of planning for retirement income and understanding Social Security are also opportunities for financial professionals to help clients make informed decisions about their retirement, not only around Social Security but how it can be the foundation of a comprehensive retirement income plan.

View the infographic

The long-term impacts on financial security

The problems facing the Social Security program have been widely reported for several years. The current projection from the Social Security Board of Trustees estimates a 25% reduction in scheduled benefits will be needed by 2035 in order to keep the program viable for future retirees.

Most Americans are aware of the issues surrounding Social Security’s future. Around 3 in 4 adults (72%) worry about Social Security running out of funding in their lifetimes, and nearly 4 in 5 (79%) agree that the program needs to change.

There’s also widespread support for different fixes to improve Social Security’s long-term financial health, from raising the minimum eligibility age to enacting higher payroll taxes on high-wage earners or employers.

However, it’s uncertain if there’s enough political will in Washington D.C. at present to enact any of these changes. While there’s still time to build political support, a reduction in future Social Security benefits remains a very real possibility.

If benefits are cut down the road, many people don’t have plans in place to make up the difference. Only around one-quarter of adults (23%) said they are or would plan to generate income from their investments and retirement savings in the event of a 25% reduction in Social Security benefits in the future.

There’s not much individuals can do to affect the future of Social Security, beyond voting for Congressional representatives who are proposing workable solutions. What people can do is take actionable steps to address their long-term retirement income needs, which would include Social Security benefits in addition to other income sources. One way to map out these steps is through a retirement income plan designed with guidance from a knowledgeable financial professional.

Enjoying retirement to the fullest

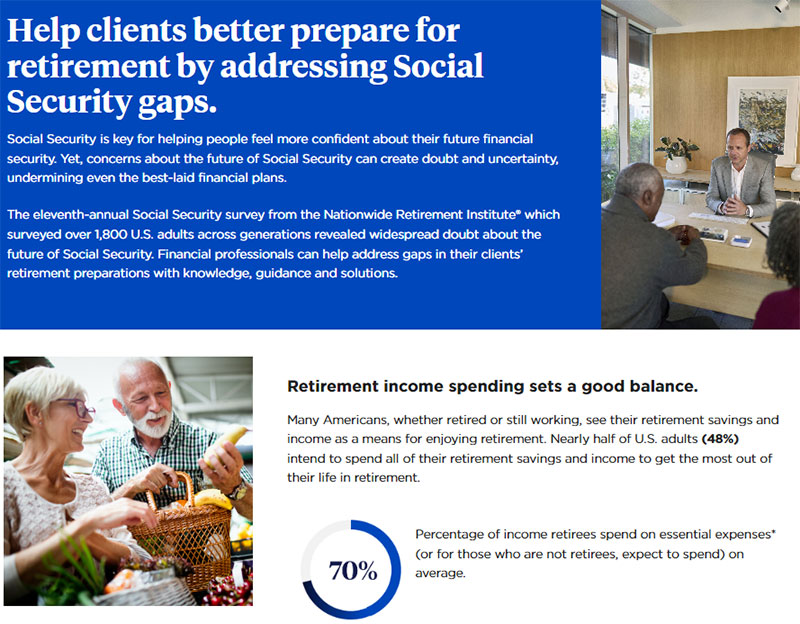

Many people plan to spend all of their retirement savings and income in order to get the most out of life in retirement. Yet, many people—including over half of those age 60-65—underestimate how much income they’ll need in retirement, often by a significant amount. Those not yet retired expect to need less pre-retirement income to cover their living expenses in retirement—58% on average—but many aren’t expecting their costs of living to decrease once they retire. Nearly one-half of non-retired adults (47%) believe their living expenses will stay the same in retirement.

There’s an obvious disconnect that financial professionals can help resolve by taking a personalized approach to help clients better plan for retirement income and spending. It’s important for clients to understand that Social Security benefits alone won’t be adequate to help them achieve financial security in retirement. An effective retirement income plan should consist of multiple sources. Clients seeking steady income may want to consider annuities as one of these income sources.

One place you can start is to help clients understand their options for filing for Social Security and consider strategies that could help maximize their benefits. Many people don’t consider the long-term impact of claiming Social Security early, or they may not know their monthly benefit can be as much as 80% higher if they don’t file at the earliest eligibility age and delay filing until age 70.2

This is not only an area where you can distinguish your practice in the market, offering guidance on Social Security can also be critical for client retention. Among people in our survey who currently work with a financial professional or plan to ask one about Social Security in the future, 82% say they would be likely to switch financial professionals if their current one couldn’t show them how to maximize their Social Security benefit. This percentage has somewhat increased since our 2023 survey, when 79% said they would be likely to change financial professionals.

Help close the retirement income gaps

Many clients may also benefit from a broader approach to retirement income planning. With so many people failing to think about generating income from their retirement savings or investments, helping clients design a plan for retirement income that includes multiple sources—retirement savings, investments and Social Security—can give them confidence and the means to enjoy retirement without worrying about running out of money later in life.

Income is not the only concern clients may have about planning for retirement. Our survey found 3 in 4 of current clients of financial professionals (75%) are interested in learning from a financial professional how inflation could impact their retirement when thinking more about managing their savings in retirement. While cost-of-living adjustments to Social Security help protect retirees from overall inflation, some spending categories such as health care, housing and insurance often see price increases above the annual inflation rate. That means throughout a long retirement, retirees would need to rely more on other sources of income to help close the gap with rising costs in these specific categories.

As you sit with clients to discuss ways to help ensure their financial security throughout retirement, make a point to cover some of the key risks that could alter their retirement income and spending plans. Our survey uncovered strong interest among clients in learning about the costs of health care and long-term care in retirement, as well as changes to tax laws and the impact on their personal tax rate during retirement.

Help simplify the complexities of Social Security

To help you with these planning discussions with clients, turn to the Nationwide Retirement Institute® for insights and resources that simplify the complexities of Social Security and retirement income. Resources like the Nationwide Social Security 360 Analyzer® can help answer client questions around when to file for Social Security benefits and how to maximize their retirement income.