Key Takeaways:

- Generation Z (ages 18-28) is many years away from retirement, but many Gen Z investors already feel uneasy about their financial futures.

- When working with Gen Z clients, give consideration to their unique financial situation and listen in order to understand.

- Help Gen Z clients recognize the longevity challenges they will likely face, offer education and knowledge to empower smart financial decisions, and design a holistic financial plan that will help ensure they won’t outlive their income in retirement.

05/23/2025 – Make way, Millennials. The next generation of young adults—Generation Z (ages 18-28)—is entering the workforce and beginning to grapple with the financial demands of an ever-changing world. And for a group that’s likely to live for decades once they reach retirement, it’s vital that they start saving and planning for retirement now.

As a mother to two Gen Z daughters, this is a generation I am intimately familiar with. I’ve heard and felt their concerns, their doubts, and their anxieties about the problems that lay ahead. With all the changes they’ve lived through in just a few years, it’s not surprising to discover Generation Z is somewhat pessimistic about the future.

In our latest Advisor Authority survey, powered by the Nationwide Retirement Institute®, we polled Gen Z investors about their financial habits and views toward retirement advice. For these young people, retirement may seem like a lifetime away and feel like a very steep mountain to climb. That could explain why 44% of Gen Zers we surveyed say they feel behind in their retirement savings goals and are working to catch up.

For financial professionals who are working with Gen Z clients, or who want to work with Gen Z in the future, it’s important to understand the unique challenges this generation faces. On one hand, they’re just getting established in their working and financial lives. On the other, they’re confronting an uncertain future and seeking guidance that addresses their unique needs.

Rising to today’s financial challenges

For Generation Z, adulthood comes at a precarious time. After living through the COVID pandemic and the following years of rising inflation, higher interest rates and soaring real estate prices, it’s not surprising they are overwhelmed by today’s volatile environment.

With the costs for nearly everything on the rise, many Gen Zers find it hard to spend within their means and stick to a prudent budget. Our survey found that four in ten Gen Z investors (40%) worry about their ability to afford their monthly bills over the next 12 months.

Student loan debt also poses a challenge for this generation. Around three in ten Gen Zers currently have outstanding student loan debt, with an average balance of nearly $23,000.1

This burden is weighing down Gen Z at an important time—when they should be taking the next big steps in adulthood like buying a house or getting married. Nearly half of Gen Z investors (46%) cited paying down loans and debts—not only student loan debt but also credit cards and car loans—as a top financial commitment over the next 12 months.

These early years of adulthood are also an important time for saving for the future. We know that starting early on a savings plan and tapping the power of compound growth has a huge impact on future financial security. Saving early in your career also helps build a healthy habit that can last a lifetime.

At this stage in their young lives, Generation Z is trying to balance short-term financial demands while also saving for the long term. But this is where a financial professional can play a valuable part by helping their Gen Z clients with a plan that accounts for both financial goals.

Looking for a brighter long-term view

Retirement may be decades down the road for Generation Z, but that doesn’t mean they’re not thinking about what their future financial picture may look like. Unfortunately, what they see isn’t pretty.

Many Gen Zers are uneasy about their retirement prospects, and this outlook is altering their views and behaviors toward retirement planning. It may not be surprising to learn that Gen Z has a more unconventional view of retirement than older generations. In our survey, 38% of Generation Z believe the standard retirement age of 65 isn’t relevant to them in today’s economic environment. Around half (48%) now plan to work longer since working from home makes it unnecessary for them to retire at 65.

These attitudes may change over time, as their working lives unfold and retirement becomes more of a reality. But many Gen Z investors are making the mistake right now of thinking a secure retirement is too far out of reach. Even worse, they’re behaving like it. As many as 17% of Gen Zers say at this point in their life, they are spending more on leisure expenses because they believe they may never be able to retire.

Something Generation Z may not be considering is that they could potentially live decades longer in retirement than prior generations. The longevity challenge may place added pressure on their ability to draw income from accumulated savings for as long as they may need it. This pressure makes saving more and saving earlier in life more of an imperative for Gen Z investors.

View the infographic

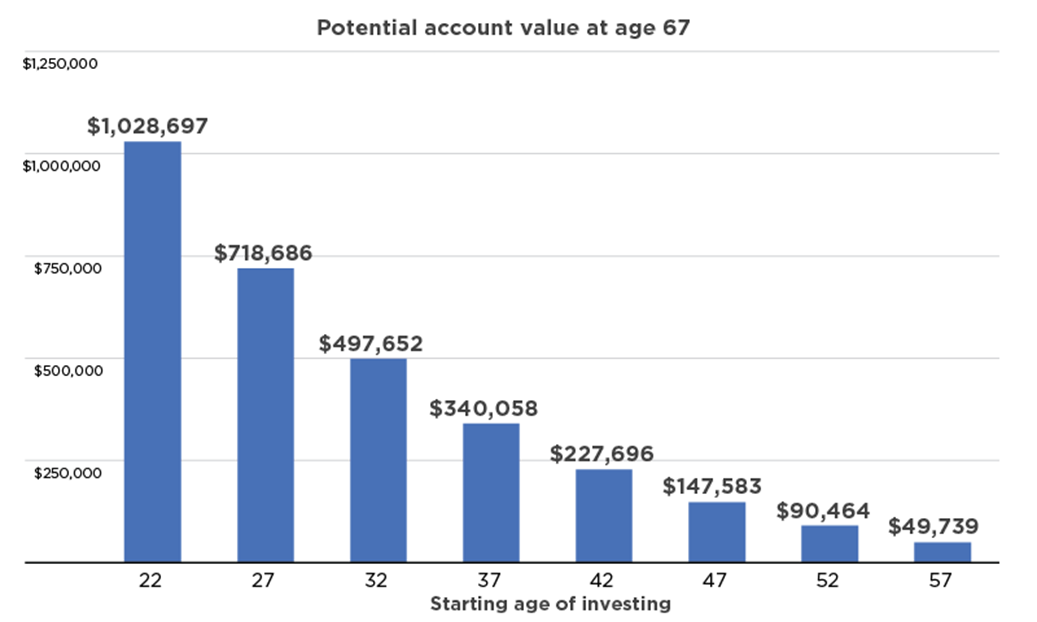

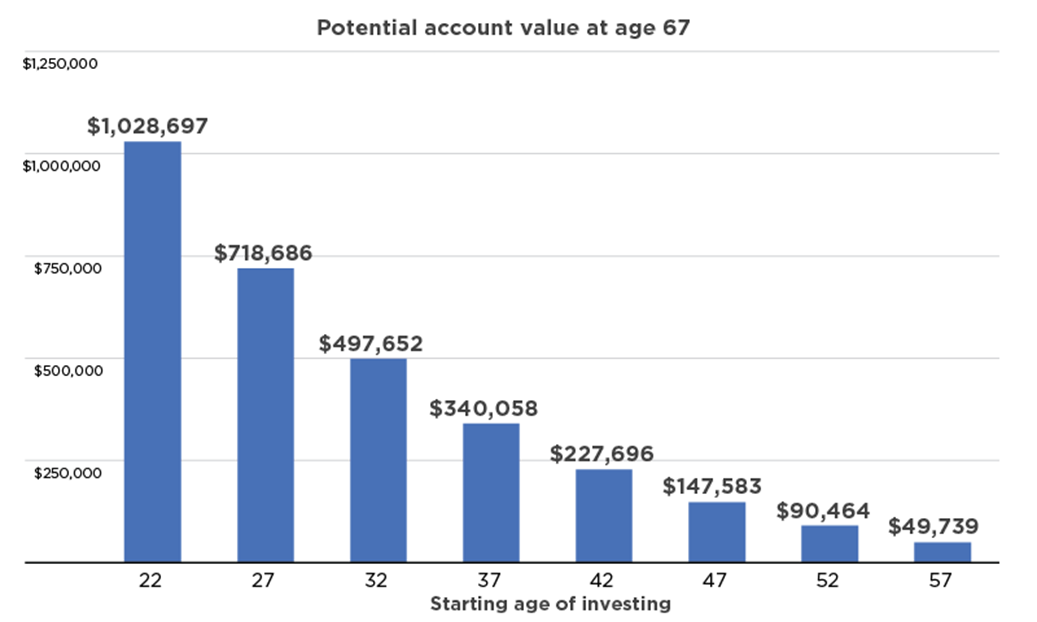

This is where financial professionals can prove their worth. It’s important to help Gen Z clients not only understand the consequences of putting off retirement planning but also show the impact that starting early can have on their long-term financial security. While short-term financial demands may work against Gen Z investors right now, time is their biggest advantage and one they should put on their side.

Where Gen Z goes for retirement advice

Born and raised in a fully-digital age, Gen Z is very comfortable going onlinez for information and guidance. That includes finance, where “finfluencers” (financial influencers) dispense advice on social media on saving, spending and investing. Some of the more popular topics include FIRE, which stands for “Financial Independence, Retire Early”, and micro-retirements, which are extended breaks in the middle of a career path.

Many Gen Z investors value a personal touch, too. But one-third of Gen Z investors (33%) think they’re either too young or too early in their retirement planning journey to rationalize pursuing financial advice.

So, do traditional financial professionals stand a chance with prospective Gen Z clients? Our survey points to some opportunities for you to stand out from the crowd.

First, education: Despite the fact that 62% of financial professionals with Gen Z clients we surveyed indicated Gen Z are more financially literate than previous generations, some critical knowledge gaps remain. Just around one-fifth of Gen Z investors (19%) say they understand how compounding interest works when investing over time. That’s concerning to me because time is Gen Z’s biggest advantage right now—and one they should be fully focused on leveraging.

It's not how much you save that matters, it’s when you start to save—that’s the message financial professionals need to emphasize with Gen Z clients. Because the younger you are when you start a retirement savings habit, the more you can put compound growth to work for your financial future. For a Gen Z client, starting to save in their 20s gives them more time to build up savings, so they could also save in smaller amounts than if they waited until their 30s or 40s.

Here’s what it would look like for a Gen Z investor saving just $250 a month, earning an average annualized 7% rate of return on their investments. This illustration also assumes no saving rate increases or withdrawals during this time. Waiting just five years can make a tremendous difference in the size of their retirement nest egg.

Second, personalization: more than a third of Gen Z investors in our survey (34%) said they’re more likely to work with a financial professional who understands their goals at this stage in their lives. This brings me back to the balancing act—recognizing the competing short- and long-term priorities of your Gen Z clients should be the basis of a holistic and personalized financial plan that’s designed round their unique needs. We need to help young savers understand that saving is not an all or nothing proposition. It may be a huge mistake to wait to begin saving until they have their competing expenses more under control.

The Gen Z opportunity for long-term client relationships

Our survey asked financial professionals with Gen Z clients what they thought arewere the most important topics for these clients to understand as they begin their careers. Among the topics listed, both short- and long-term planning topics rose to the top.

The popular short-term topics included:

- Basic budgeting and building healthy spending habits (cited by 52% of financial professionals)

- Debt management and strategies for avoidance (cited by 49% of financial professionals)

The most common long-term topics are:

- Starting retirement planning early (cited by 54% of financial professionals)

- Understanding the basics of investing and compounding growth (cited by 49% of financial professionals)

But for financial professionals who really want to connect with this generation of savers, they’re are going to need to lead with empathy. As you meet with current or potential Gen Z clients, make sure you consider their unique financial situation and listen to understand. Help them recognize the reality of the longevity challenge, then enable them with the education and knowledge to make smart financial decisions. Finally, design a holistic financial plan with their specific needs in mind to help ensure they won’t outlive their income in retirement.

It’s encouraging to see that financial professionals are focusing on the right things with Gen Z clients. You can make connections with Gen Z clients by helping them establish a plan built for future financial security and on saving and starting relationships that can last for many years to come.