Key Takeaways:

- Many Americans underestimate their retirement expenses and overestimate what Social Security will cover.

- Knowledge gaps around Social Security benefits eligibility, timing, and taxation could lead to lower benefits or costly mistakes.

- People are increasingly anxious about the future of Social Security, taxes, and inflation, and they’re seeking professional guidance to protect their income and to plan more confidently for retirement.

- Financial professionals can differentiate themselves by addressing these concerns and by offering integrated retirement income planning strategies.

08/18/2025 – Social Security is the largest guaranteed income stream for most retirees. But with growing concerns about inflation, the potential impact of tariffs, and worries about changes due to legislation like the recent One Big Beautiful Bill Act, many Americans are questioning whether Social Security will be enough to see them through their retirement years, and even fewer understand how to make the most of it.

This disconnect presents a challenge for the average American but also a clear opportunity for financial professionals. Clients and prospects aren't just looking for advice. They're looking for confidence. And the more uncertain they feel about Social Security, the more likely they are to seek out financial professionals who can help them build a better retirement income plan.

The 12th edition of the Nationwide Retirement Institute's® Social Security Survey confirms this demand for guidance and reveals that people are willing to take action when they don't get the help they need. The findings show that:

- 80% are interested in learning how to maximize their Social Security benefits

- 71% are interested in learning how to manage benefits alongside other income sources throughout retirement

- 69% are interested in discussing with a financial professional how to use different income streams in order to delay filing for Social Security until they reach full retirement age

- 78% of those who pay to work with a financial professional or plan to ask one about Social Security in the future would switch to a financial professional who could show them how to maximize their Social Security benefits

If Social Security planning isn't already part of your client experience, now is the time to make it a priority. Here are several relevant highlights from the survey, and ways to use them to deepen client relationships, strengthen retirement income planning conversations, and grow your practice by attracting new clients who value integrated, long-term retirement guidance.

Spending in retirement: A reality check

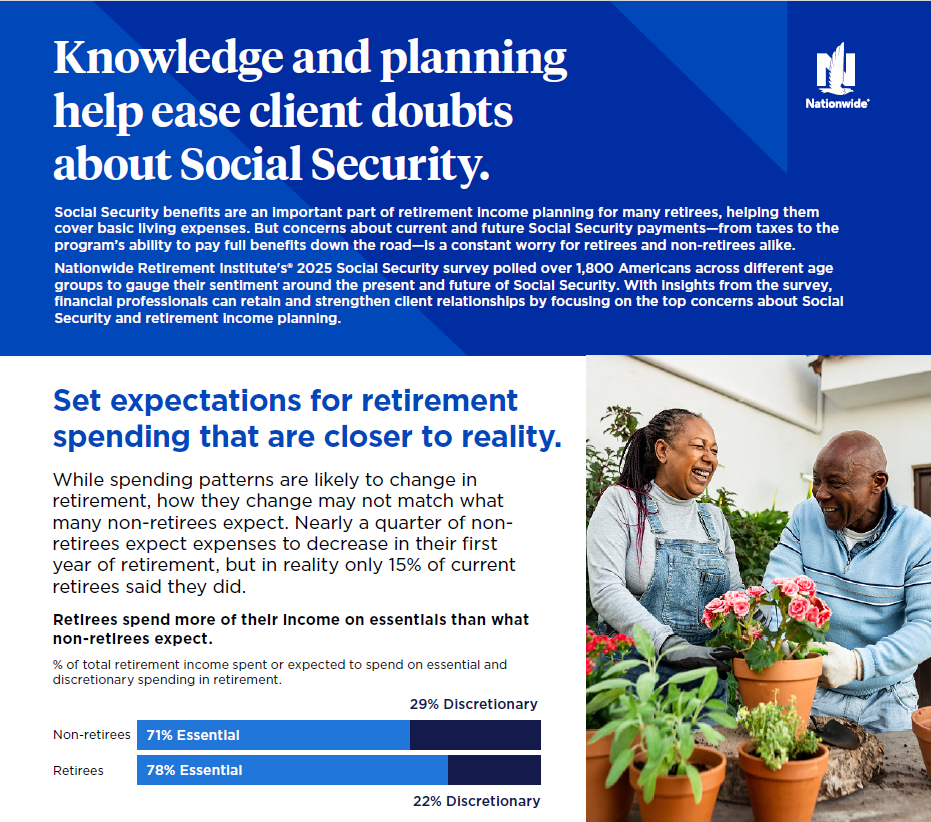

A common misconception among those we surveyed is how much they expect to spend in retirement. Nearly one in four non-retirees (24%) expect their expenses to decrease during the first 12 months of retirement. But only 15% of current retirees say that actually happened. Most say their expenses stayed the same (59%) or even increased (27%).

There’s also a discrepancy in the amount of income people expect to spend on essentials. Retirees report allocating 78% of their income on essential expenses, while non-retirees expect to spend just 71%. That seven percentage difference may not sound dramatic, but it can add up to thousands of dollars a year that retirees haven’t planned for. This conundrum is especially relevant to individuals who are already worried about outliving their savings.

Helping clients build realistic expectations around retirement expenses can lay the groundwork for smarter, more sustainable income strategies.

View the infographic

Confidence vs. knowledge: A costly disconnect

Many of our survey respondents (38%) said they feel confident in their knowledge about Social Security, but their actual knowledge is often limited. Only 21% of non-retirees knew the correct age to receive full Social Security benefits, and just 8% correctly identified all the factors that determine maximum benefit amounts.

This lack of understanding can lead to decisions to file early, missed spousal benefits, and less income in retirement—and these mistakes are often irreversible.

At the same time, it seems many people are eager to learn. Our survey found that 80% of all those currently receiving or expecting to receive Social Security are interested in understanding how to maximize their benefits, and 73% are interested in learning about how Social Security is taxed.

Policy uncertainty is driving new behaviors

Social Security doesn’t exist in a vacuum. It’s just one piece of a larger retirement planning puzzle that also needs to account for inflation, taxes and economic volatility.

According to our survey, more than 80% of Americans currently receiving or expecting to receive Social Security (83%) are concerned about Social Security viability long-term, and 74% worry the program will run out of money during their lifetime. These concerns are shaping their behavior in meaningful ways.

Sixty-one percent say they need to keep working because Social Security won’t pay enough. Younger generations report they’re planning for part-time work (28% of Gen Z (age 18-28); 41% of Millennials (age 29-44)) or a second job (16% of Gen Z (age 18-28); 19% of Millennials (age 29-44)) to offset the possible reduction of Social Security income in retirement, especially as they consider the impact of possible future Social Security cuts.

Inflation concerns are also a factor. Sixty-three percent of Americans currently receiving or expecting to receive Social Security believe that tariffs will drive inflation a great deal / somewhat beyond what Social Security COLA (Cost-of-Living Adjustments) can keep up with.

While recent legislation—such as the senior tax deduction in the One Big Beautiful Bill Act—offers some relief through 2028, many individuals still lack a long-term strategy for managing taxes and inflation throughout retirement.

Combined with uncertainty about future legislation and global trade dynamics, these inflationary pressures are prompting more people to seek out strategies that can offer lasting income stability.

As such, there is an obvious need for flexible retirement strategies that incorporate multiple income sources instead of relying on Social Security alone. As a financial professional, you can play a pivotal role by helping clients navigate inflation, taxes, and economic uncertainty with diversified, tax-smart strategies that promote lasting income stability and peace of mind.

Taxes in retirement: A planning blind spot

While people are thinking about taxes in retirement, many aren’t sure how to plan for them. Our survey found that 58% are terrified of what tax rates during their retirement will do to their retirement income, and 59% say they wish they had better prepared for paying taxes in retirement.

Less than half (48%) understand how to leverage taxable, tax-deferred and tax-free accounts when thinking about taxes in retirement. And most aren’t aware of how filing for Social Security interacts with their broader tax picture.

These gaps can lead to inefficient withdrawal strategies and higher-than-expected tax bills, especially once required minimum distributions (RMDs) and benefit taxes come into play.

The good news is, those who work with a financial professional are far more likely to feel confident. Sixty-eight percent of people who pay to work with a financial professional know how to use tax planning to get the desired outcome that they would like from the IRS during tax season, compared to 48% of those who don't. And more than half of American adults who are currently receiving or expect to receive Social Security say they would switch professionals for someone who could help them plan for taxes in retirement (54%) and plan around changes in government policies (56%).

That underscores the growing demand for comprehensive, tax-efficient retirement planning, and another opportunity for financial professionals to demonstrate deeper value, strengthen relationships, and differentiate their practices in a competitive market.

What financial professionals can do next

You don’t have to be a Social Security specialist to help clients make key decisions about it, but you do need to be proactive. Our survey findings point to a handful of high-impact actions that can help you deliver more value:

- Start the conversation. Clients and prospects may not know when or how to ask about Social Security. Proactively introduce the topic during retirement income planning conversations—ideally well before they reach eligibility age.

- Clear up misconceptions. Many people think they’ll spend less in retirement or receive more in Social Security benefits than they actually will. Help them see the full picture using tools like retirement income projections, benefit timing calculators, and tax-efficient withdrawal strategies.

- Coordinate income and tax strategies. Show clients how to combine Social Security with other income sources and apply smart retirement tax strategies to improve efficiency and reduce surprises.

- Tailor your approach by generation. With a longer runway to retirement, Millennials and Gen Z represent your best opportunity to frame conversations around long-term planning. Gen Xers who are in their peak earning years and actively seeking guidance as retirement approaches may want additional education, detailed data, and modeling. Boomers may need more help with Social Security filing logistics and benefits timing. Know your audience and guide them accordingly.

- Reinforce your value. Social Security is often the starting point for broader retirement income discussions. Use it to demonstrate your comprehensive planning approach and help clients understand how your guidance can lead to more confident decisions, fewer surprises, and a retirement income strategy they can feel good about.

Build confidence where it matters most

From Social Security concerns to inflation and taxes, Americans are facing more questions than ever about how to retire comfortably. By helping them understand how Social Security fits into the bigger picture—and how to plan around its limitations—you can position yourself as a valuable, long-term partner in their retirement planning journey. Your guidance can give them the clarity they need to prepare for a longer, more confident retirement armed with a strategy they can trust.

Nationwide offers a wide range of resources to help you turn client conversations into meaningful action, including our Social Security 360 Analyzer®, which can help you optimize clients’ filing decisions and better integrate benefits into their income planning strategy. Explore our other tools, insights, and client-ready materials to support smarter retirement planning.